5 Large-Cap Stocks Set to Beat on Earnings Next Week

We are in the initial stage of the fourth-quarter 2024 earnings season. The earnings results and management guidance will be crucial for market participants to gauge the health of the U.S. economy.

As of Jan 17, 36 companies on the S&P 500 Index have reported their financial numbers. Total earnings for these 29 index members are up 4.2% from the same period last year on 5.4% higher revenues, with 86.1% beating EPS estimates and 55.6% beating revenue estimates.

At present, total earnings of the S&P 500 Index in fourth-quarter 2024 are expected to be up 0.2% on 2.2% higher revenues. This follows the 3.8% earnings growth on 2% higher revenues in the third quarter and three back-to-back quarters of declining earnings before that.

Meanwhile, several large-cap stocks are set to beat on earnings next week. A handful of them currently carries a favorable Zacks Rank. The combination of a favorable Zacks Rank and an earnings beat should drive their stock prices in the near-term.

Our Top Picks

We have narrowed our search to five large-cap stocks that are poised to beat on earnings results next week. Each of these stocks carries a Zacks Rank #2 (Buy) and has a positive Earnings ESP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings releases. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

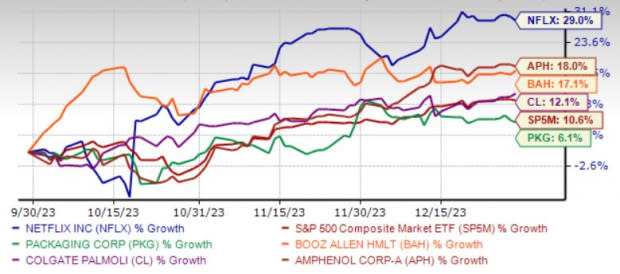

The chart below shows the price performance of our five picks in the last quarter.

Image Source: Zacks Investment Research

Netflix Inc. NFLX is benefiting from growing subscriber base thanks to a robust portfolio. Crackdown on password-sharing and the introduction of paid sharing in more than 100 countries, which represents more than 80% of NFLX’s revenue base, is also expected to aid growth.

NFLX’s diversified content portfolio, which is attributable to heavy investments in the production and distribution of localized, foreign-language content, has been driving its growth prospects. We expect 2023 net sales to rise 6.2% from 2022.

Netflix has an Earnings ESP of +2.26%. It has an expected earnings growth rate of 32.5% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 30 days. The company is set to release earnings results on Jan 23, after the closing bell.

Packaging Corporation of America PKG has been benefiting as customers’ order patterns resumed normal levels. Shipments in the packaging segment are expected to improve in the fourth quarter of 2023. Growth in e-commerce activities of PKG will however continue to support demand for packaging.

Stable demand for food, beverages, medication and other consumer products bodes well for the Packaging segment. The conversion of the No. 3 paper machine at PKG’s Jackson, AL-based mill to liner board in a phased manner will aid growth. PKG’s cost-management and process-optimization efforts will help offset the impact of high labor and other costs on its earnings.

Packaging Corporation of America has an Earnings ESP of +1.89%. The Zacks Consensus Estimate for current-year earnings has improved 1.4% over the last 30 days. PKG recorded earnings surprises in three out of the last four reported quarters, with an average beat of 6.8%. The company is set to release earnings results on Jan 24, after the closing bell.

Amphenol Corp. APH is benefiting from robust growth across commercial air, military, industrial and automotive end-markets as well as solid contribution from acquisitions, which is expected to drive top-line growth as witnessed in the third quarter of 2023.

Acquisitions are helping APH expand its position across a broad array of technologies and markets. APH’S wide array of interconnect and sensor products boosts long-term prospects. Further, APH’s diversified business model lowers the volatility of individual end markets and geographies. Strong cash flow generating ability is noteworthy.

Amphenol has an Earnings ESP of +1.74%. It has an expected earnings growth rate of 8.9% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.9% over the last 30 days.

Amphenol recorded earnings surprises in the last four reported quarters, with an average beat of 5%. The company is set to release earnings results on Jan 24, before the opening bell.

Booz Allen Hamilton Holding Corp. BAH is benefiting from the Vision 2020 strategy, which has accelerated its organic revenue growth, strengthened its profitability and fetched significant headcount and backlog growth.

BAH’s VoLT strategy focuses on integrating velocity, leadership and technology in the process of transformation. BAH is focusing on areas such as Artificial Intelligence, advanced engineering, directed energy and modern digital platforms. We expect revenue growth of 12.4% in fiscal 2024.

Booz Allen Hamilton has an Earnings ESP of +7.65%. It has an expected earnings growth rate of 10.3% for the current year (ending March 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.9% over the last seven days.

Booz Allen Hamilton recorded earnings surprises in three out of the last four reported quarters, with an average beat of 7.7%. The company is set to release earnings results on Jan 26, before the opening bell.

Colgate-Palmolive Co. CL has been gaining from strong pricing, and the benefits of funding growth and other productivity efforts. Also, accelerated revenue growth management plans aided CL’s organic sales.

Last reported quarter was the 18th successive quarter of organic sales growth at or above CL’s long-term target of 3-5% growth. Consequently, management anticipates net sales growth of 6-8% compared with the prior mentioned 5-8% and in line with our estimate of 7.5%.

Colgate-Palmolive has an Earnings ESP of +0.78%. It has an expected earnings growth rate of 7.7% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last seven days.

Colgate-Palmolive recorded earnings surprises in the last four reported quarters, with an average beat of 3.6%. The company is set to release earnings results on Jan 26, before the opening bell.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Amphenol Corporation (APH) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Packaging Corporation of America (PKG) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report