5 Momentum Stock Bargains Hunters Would Love Chasing

Wall Street's main indices ended lower on Wednesday after the latest 0.5% interest rates hike and policy announcement by the Federal Reserve, stating its economic projections see higher rates for a longer period.

The Dow Jones Industrial fell 0.42%, while the S&P 500 and NASDAQ moved down 0.61% and 0.76%, respectively. All these major stock indices are in negative territory year to date. The Dow Industrial, Nasdaq and S&P 500 plunged 6.5%, 28.6% and 16.2%, respectively, in the year to date.

With the turn of the year approaching, the global economy continues to grapple with several macroeconomic challenges. The obstacles include supply-chain issues due to acute shortage of chips and other input components, labor shortages, currency fluctuations, Russia-Ukraine invasion led energy price hikes and a constant fear of recessionary uncertainty.

Also, the Fed’s aggressive interest rate hikes to combat the raging inflation further intensify the vulnerability of interest-sensitive stocks.

Despite these headwinds, we believe that stocks with strong momentum in the near term with a favorable Zacks Rank are likely to be the ideal combination of investments. Five such stocks are Sanofi SNY, GSK plc GSK, Ulta Beauty Inc. ULTA, United Airlines UAL and United Therapeutics UTHR.

Momentum investing calls for a continued appraisal of stocks, which ensures that an investor does not pick a beaten-down name or overlook a thriving one. Momentum investors buy high on the anticipation that the stock will only ascend in the short-to-intermediate term.

Picking the Right Momentum Stocks

We have run the Zacks Stocks Screener to identify stocks with a market capital of > $1 billion. Each of our picks carries a Zacks Rank #2 (Buy) and has a Momentum Score of A. To further cut short the list, we have considered stocks with a Value Score of A or B. This combination offers an excellent opportunity for momentum players to get their favorite stocks at a low price.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Our Picks

Sanofi manufactures and markets prescription drugs in Europe, the United States and other countries. Headquartered in Paris, the company focuses on major therapeutic areas such as multiple sclerosis, cardiovascular, immunology, neurology, oncology, rare disease, rare blood disorders and diabetes, among others.

This Zacks Rank #2 company has a Value Score and Momentum Score of A each. Shares of SNY lost 4.3% in the year to date. However, the stock has made a strong rebound in the past three months, with its share price improving 17.5% during the time frame.

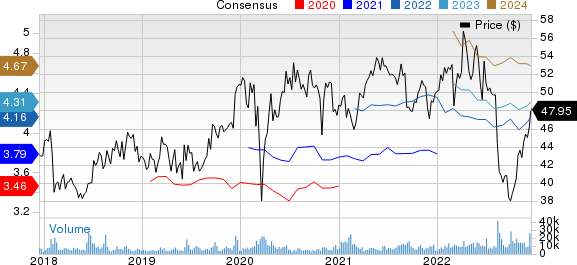

Sanofi Price and Consensus

Sanofi price-consensus-chart | Sanofi Quote

Sanofi’s immunology drug Dupixent is currently annualizing at close to €9.0 billion in sales after around five years on the market. It expects Dupixent to achieve more than €13 billion in peak sales. Our estimates for Dupixent suggest a CAGR growth of around 20.0% over the next three years. Besides, the company possesses a leading vaccine portfolio with total annual sales of more than €5 billion in the past five years. SNY expects Vaccine unit sales to grow at a mid-to-high single digit CAGR from 2018 to 2025. Our estimates for Sanofi’s total vaccine sales suggest a CAGR growth of around 4.8% over the next three years.

The Zacks Consensus Estimate for this $119.2-billion market cap worth company’s 2022 earnings stands at $4.16 per share, up 1.2% in the past seven days, suggesting a 7.2% surge year over year. For 2023, the consensus mark for SNY earnings expanded to $4.31 per share from $4.25 over the past seven days. This suggests a 3.6% year-over-year rise.

GSK is a London-based pharmaceutical and biotechnology company with three commercial operation segments — Specialty Medicines, which include HIV, Oncology, Immuno inflammation, respiratory and other; Vaccines, including Meningitis, Influenza, Shingles and Established Vaccines; and General Medicines comprising Respiratory and Other. The company’s diversified base and presence in different geographical areas help support its revenue growth.

Currently, GSK carries a Zacks Rank of 2 and a Value and Momentum Score of A each. Shares of GSK dropped 34.8% in the year to date. However, the stock has soared 16.5% in the past three months.

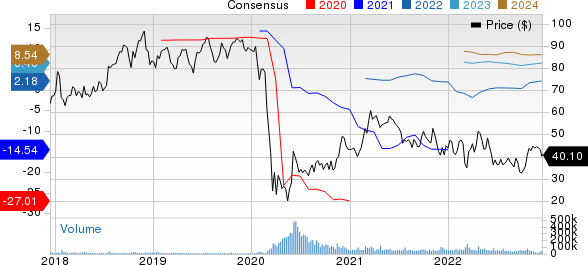

GSK PLC Sponsored ADR Price and Consensus

GSK PLC Sponsored ADR price-consensus-chart | GSK PLC Sponsored ADR Quote

GSK has made significant progress in expanding its presence in emerging markets by acquiring product portfolios from companies like Bristol-Myers and UCB. Its specialty products like Nucala for severe eosinophilic asthma, Bexsero (meningitis vaccine), Shingrix (shingles vaccines), Trelegy Ellipta (three medicines in a single inhaler to treat COPD) and Juluca (dolutegravir+ rilpivirine once-daily, single pill for HIV) have witnessed considerable success and have become key drivers of top-line growth. The $73.52 billion firm expects its new medicines and vaccines to contribute around 60% of the new GSK’s (after CHC demerger) sales growth for the period 2022-2026. Our estimates for Shingrix and Dovato sales suggest a CAGR of more than 8% over the next three years.

The Zacks Consensus Estimate for GSK’s 2022 earnings is pegged at $3.28 per share, moving northward by 3.5% in the past 30 days. The consensus for 2023 earnings, which stands at $3.41 per share, has inched up by 3.6% over the past 30 days.

Ulta Beauty is a leading beauty retailer based in Illinois. The company offers a wide range of products, including cosmetics, fragrance, skincare, hair care, bath and body products and salon styling tools in stores. It sells more than 25,000 products from about 500 well-established and emerging beauty brands across all categories and price points.

With a Zacks Rank #2 and a market capital of $23.6 billion, Ulta Beauty has been benefiting from its omnichannel strength, especially buy online, pick up in store. ULTA’s skincare category has been gaining from consumers’ rising interest in self-care. In its latest quarterly results, the company generated double-digit comparable sales growth in all major categories while improving profitability. It witnessed an increased market share in prestige beauty. In the latest, the company opened 59 Ulta Beauty at Target shops and ended the quarter with 186 locations. Apart from this, Ulta Beauty is benefiting from its Wellness Shop, which is a cross-category platform providing guests self-care for the mind, body and spirit across several stores as well as online.

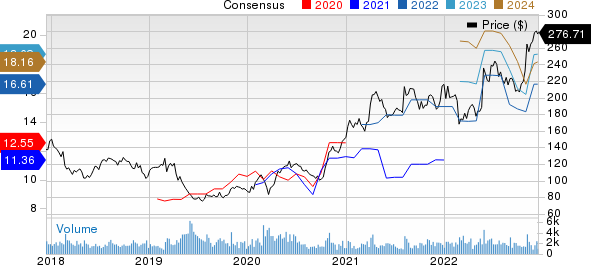

Ulta Beauty Inc. Price and Consensus

Ulta Beauty Inc. price-consensus-chart | Ulta Beauty Inc. Quote

Ulta Beauty has a Value Score of B and a Momentum Score of A. Shares of ULTA have gained 12.3% in the year and increased 10.5% in the past three months.

The Zacks Consensus Estimate for ULTA’s fiscal 2023 earnings is pegged at $22.77 per share, up from $22.66 per share in the past seven days. Fiscal 2024’s Consensus Estimate stands at $24.08 per share, moving northward by 3 cents in the past seven days.

United Airlines is a Chicago-headquartered company that transports people and cargo throughout North America and destinations in Asia, Europe, the Middle East and Latin America. The carrier's hubs are at Newark Liberty International Airport, Chicago O’Hare International Airport, Denver International Airport, George Bush Intercontinental Airport, Los Angeles International Airport, A.B. Won Pat International Airport, San Francisco International Airport and Washington Dulles International Airport.

UAL has a Zacks Rank #2 and a Value and Momentum Score of A each. Shares of UAL have declined 8.4% year to date and increased 7% in the past three months.

United Airlines Holdings Inc Price and Consensus

United Airlines Holdings Inc price-consensus-chart | United Airlines Holdings Inc Quote

United Airlines posted a significant year-over-year increase (about 75%) in its latest third-quarter 2022 passenger revenues. The company expects the adjusted operating margin in the December quarter to be around 10%, rising above the 2019 levels (pre-coronavirus) for the first time. Driven by solid demand, UAL’s management expects total revenue per available seat mile (TRASM) to increase in the 24%-25% band in the December quarter from fourth-quarter 2019 actuals. Besides, its focus on cargo operations is boosting its cargo revenues, partly offsetting the weakness in passenger revenues from the 2019 levels. In the first nine months of 2022, the carrier’s cargo revenues jumped 5% year over year.

United Airlines’ Zacks Consensus Estimate for 2022 earnings is pegged at $2.18 per share, which suggests a whopping 115.6% surge on a year-over-year basis. The figure has been revised upward by 11.8% in the past 30 days. For 2023, the consensus figure stands at $6.48, expanding by 10 cents from $6.38 per share 30 days ago. This indicates a 197.4% increase year over year.

United Therapeutics Corporation is a Silver Spring, MD-based company that markets four medicines in the United States to treat pulmonary arterial hypertension. Its medicine portfolio includes Remodulin, an injectable formulation of treprostinil, Orenitram, an oral version of treprostinil, Tyvaso, an inhaled version of treprostinil and Adcirca tablets. Additionally, the company engages in research and development efforts to increase the supply of transplantable organs and tissues through regenerative medicine and organ manufacturing.

United Therapeutics has a Zacks Rank #2 with a Value Score of B and a Momentum Score of A. Shares of UTHR have climbed 28.1% in the year till date and 26.9% over the past three months.

United Therapeutics Corporation Price and Consensus

United Therapeutics Corporation price-consensus-chart | United Therapeutics Corporation Quote

Currently, United Therapeutics is working on expanded indications for some of its marketed products, like Orenitram and Tyvaso, outside of WHO Group 1 PAH. In September, the company launched a patient-filled version of the Remunity pump, a semi-disposable pump system for subcutaneous delivery of Remodulin. As a result of this launch, the company now offers Remunity in both pre-filled and patient-filled options, which is expected to broaden and accelerate the uptake of Remunity pump. The company said the re-launch of the pump is proceeding well and Remunity initiations and total patients on Remunity are expected to grow through 2022 and into 2023. UTHR is helping 12,000 patients at present with its medicines and expects to have 25,000 patients on its medicines by 2025.

For 2022 earnings, UTHR’s Zacks Consensus Estimate is pegged at $16.62 per share, suggesting a 65.2% year-over-year surge. This estimate has been revised upward by 3 cents over the past 30 days. For 2023 also, the consensus mark has been revised upward by 3 cents at $18.69, estimating a 12.5% surge from the year-ago quarter’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

United Therapeutics Corporation (UTHR) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report