5 Must-Buy High-Flying, Small-Cap Stocks With Huge Potential

U.S. small businesses are still suffering from high inflation and interest rate. The NFIB (National Federation of Independent Business) Small Business Optimism Index decreased two points in January to 89.9, marking the 25th consecutive month below the 50-year average of 98.

On the other hand, a survey by Goldman Sachs 10,000 Small Business Voices — a policy advocate for small business owners — revealed a relatively rosy picture. According to the survey, which was conducted in January, 75% of small business owners are optimistic about their financial well-being in 2024, up from 68% a year earlier.

The survey also showed that 28% of small business owners rated the economy as good or excellent, up 9% from a quarter ago. More than half of the respondents said they expect to create jobs this year, and 62% expect their profits to grow in 2024.

Despite facing a 22-year high interest rate and elevated inflation, the fundamentals of the U.S. economy remain rock solid. Moreover, at present, the CME FedWatch shows a 78% chance that the Fed will reduce the benchmark interest rate by at least 25 basis points in the June FOMC meeting.

Small-cap companies have suffered from record-high inflation, a soaring interest rate and fear of an impending recession. Currently, the inflation rate is less than half of its peak in June 2022. Further, small businesses are predominantly dependent on the domestic economy. They generally have very little access to export markets. Better-than-expected consumer spending has reduced the risk of a near-term recession.

Our Top Picks

We have applied our VGM Style Score to narrow the search to select five small-cap (market capital < $1 billion) companies that have strong potential for 2024. These stocks have seen positive earnings estimate revisions in the last 30 days. Finally, each of our picks sports a Zacks Rank #1 (Strong Buy) and a VGM Score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

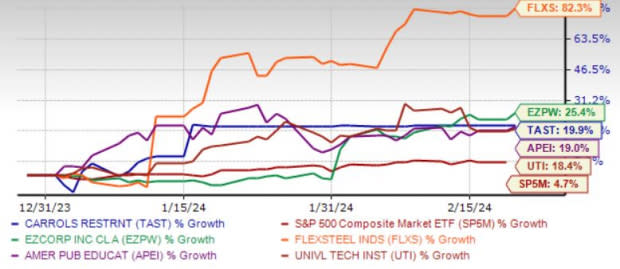

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Carrols Restaurant Group Inc. TAST is the largest BURGER KING franchisee in the United States with over 800 restaurants and has operated BURGER KING restaurants since 1976. TAST operates as a Burger King and Popeyes franchisee.

Carrols Restaurant Group has an expected revenue and earnings growth rate of 3.8% and 25.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 10.7% over the last 30 days. The stock price of TAST has climbed 19.9% year to date.

EZCORP Inc. EZPW is engaged in establishing, acquiring, and operating pawnshops that function as convenient sources of consumer credit and value-oriented specialty retailers of primarily previously owned merchandise. Through its lending function, EZPW makes relatively small, non-recourse loans secured by pledges of tangible personal property. EZPW contracts for a pawn service charge to compensate it for each pawn loan.

EZCORP has an expected revenue and earnings growth rate of 11.2% and 14.1%, respectively, for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved 12.9% over the last 30 days. The stock price of EZPW has jumped 25.4% year to date.

Flexsteel Industries Inc. FLXS is engaged in the design, manufacture and sale of a broad line of quality upholstered furniture for residential, commercial, and recreational vehicle seating use. FLXS primarily distributes its products throughout most of the United States through its sales force to furniture dealers, department stores, recreational vehicle manufacturers and van converters, and hospitality and healthcare facilities. FLXS’ products are also sold to several national chains, some of which sell on a private label basis.

Flexsteel Industries has an expected revenue and earnings growth rate of 3.3% and more than 100%, respectively, for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 30% over the last 60 days. The stock price of FLXS has soared 82.3% year to date.

American Public Education Inc. APEI provides online and campus-based postsecondary education and career learning. APEI operates through three segments: American Public University System, Rasmussen University, and Hondros College of Nursing.

APEI offers 136 degree programs and 115 certificate programs in various fields of study, including nursing, public health, public administration, and business administration. APEI also provides nursing-and health sciences-focused postsecondary education, a diploma in practical nursing, and an associate degree in nursing.

American Public Education has an expected revenue and earnings growth rate of 2.5% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.9% over the last 30 days. The stock price of APEI has surged 19% year to date.

Universal Technical Institute Inc. UTI provides transportation, skilled trades, and healthcare education programs in the United States. UTI operates in two segments, UTI and Concorde. UTI offers certificate, diploma, or degree programs under various brands, such as Universal Technical Institute, Motorcycle Mechanics Institute, Marine Mechanics Institute, NASCAR Technical Institute, and MIAT College of Technology.

UTI also provides manufacturer-specific advanced training programs, including student-paid electives at its campuses; and manufacturer or dealer-sponsored training at various campuses and dedicated training centers. UTI serves students, partners, and communities by providing education and support services in various fields.

Universal Technical Institute has an expected revenue and earnings growth rate of 18.2% and more than 100%, respectively, for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved 12.9% over the last 30 days. The stock price of UTI has rallied 18.4% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Public Education, Inc. (APEI) : Free Stock Analysis Report

Universal Technical Institute Inc (UTI) : Free Stock Analysis Report

EZCORP, Inc. (EZPW) : Free Stock Analysis Report

Flexsteel Industries, Inc. (FLXS) : Free Stock Analysis Report

Carrols Restaurant Group, Inc. (TAST) : Free Stock Analysis Report