5 Must-Buy High-Flying Mid-Caps to Enhance Your Portfolio

Investment in mid-cap stocks is often recognized as a good portfolio diversification strategy. These stocks combine the attractive attributes of both small and large-cap stocks. Top-ranked mid-cap stocks have a high potential of enhancing their profitability, productivity and market share. These may also become large caps in due course of time.

If the economy faces any unforeseen internal or external disturbance, mid-cap stocks will be less susceptible to losses than their large-cap counterparts owing to their less international exposure. On the other hand, if the economy remains stable, these stocks will gain more than small caps due to established management teams, a broad distribution network, brand recognition and ready access to the capital markets.

In the first and second quarters of 2023, like the three major stock indexes, the mid-cap-centric S&P 400 Index ended in positive territory, advancing 3.4% and 4.4%, respectively. Year to date, the S&P 400 has rallied 10.7%.

At this stage, it will be prudent to invest in mid-cap stocks to tap the broad-based ongoing rally of 2023.

Our Top Picks

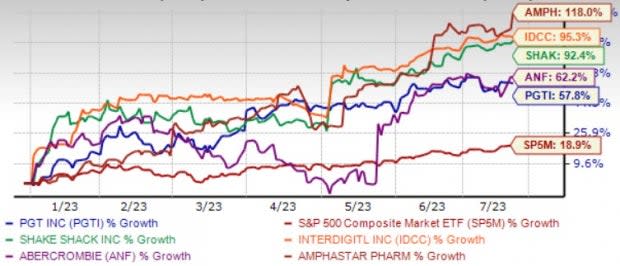

We have narrowed our search to five mid-cap (market capital > $1 billion < $10 billion) stocks with more than 50% returns year to date. These stocks have more upside left for the rest of 2023. These stocks have seen positive earnings estimate revisions in the last 60 days. Each of our picks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Abercrombie & Fitch Co. ANF has gained from the continued momentum in the Abercrombie brand and improvement in the Hollister brand. Lower freight costs and robust AUR growth aided ANF’s margins. Consequently, ANF expects fiscal 2023 sales growth of 1-3% from the year-ago period’s reported figure of $3.7 billion. ANF’s store optimization and the Always Forward plan bode well.

Abercrombie & Fitch has an expected revenue and earnings growth rate of 3.4% and more than 100%, respectively, for the current year (ending January 2024). The Zacks Consensus Estimate for current-year earnings has improved 45.6% over the last 60 days. The stock price of ANF has surged 62.2% year to date.

InterDigital Inc. IDCC is focused on strategic acquisitions in order to drive its product portfolio and boost organic growth. IDCC’s extensive portfolio of wireless technology patents provides a significant competitive advantage. IDCC is poised to gain from future growth opportunities fueled by the 5G rollout, while a strong emphasis on research & development helps it to stay at the forefront of wireless technology innovation.

InterDigital has an expected revenue and earnings growth rate of 17.4% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 60 days. The stock price of IDCC has jumped 95.3% year to date.

Shake Shack Inc. SHAK has been benefiting from various digital initiatives, strong same-shack sales and unit expansion efforts. SHAK’s digital retention continues to be strong. It has also been making more investments in digitization in an effort to sustain its digital guest enhancement strategies in the near term.

Shake Shack has an expected revenue and earnings growth rate of 21.5% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last 60 days. The stock price of SHAK has climbed 92.4% year to date.

Amphastar Pharmaceuticals Inc. AMPH is a specialty pharmaceutical company. AMPH focuses primarily on developing, manufacturing, marketing, and selling generic and proprietary injectable and inhalation products. AMPH’s products include Enoxaparin Sodium Injection, Amphadase, Cortrosyn for Injection, and prefilled disposable emergency syringes for crash cart use.

Amphastar Pharmaceuticals has an expected revenue and earnings growth rate of 17.4% and 30%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 5.8% over the last 60 days. The stock price of AMPH has soared 118% year to date.

PGT Innovations Inc. PGTI pioneered the U.S. impact-resistant window and door industry and today is the nation's leading manufacturer and supplier of residential impact-resistant windows and doors. PGTI is also one of the largest window and door manufacturers in the United States.

PGTI’s total line of custom windows and doors is now available throughout the eastern United States, the Gulf Coast and in a growing international market, which includes the Caribbean, South America, and Australia.

PGT Innovations has an expected revenue and earnings growth rate of 0.5% and 8.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.5% over the last seven days. The stock price of PGTI has advanced 57.8% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Amphastar Pharmaceuticals, Inc. (AMPH) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

PGT, Inc. (PGTI) : Free Stock Analysis Report

Shake Shack, Inc. (SHAK) : Free Stock Analysis Report