5 Must-Buy Homebuilders Defying High Mortgage Rate

The U.S. homebuilding market has rebounded this year after a disappointing 2022. Consequently, stock prices of most of the homebuilding stocks have seen an upsurge this year. Importantly, this turnaround has happened despite a high mortgage rate.

As of Sep 12, the average 30-year fixed mortgage rate is hovering around 7.56%, up 3 basis points from a week ago. Similarly, average 30-year fixed mortgage refinance rate is around 7.75%, up 3 basis points from a week ago.

Homebuilders, all through this year, have applied innovative strategies to attract potential buyers of new homes. They have kept affordable prices on the properties and offered mortgage rate buydowns. Shortage of existing homes in the housing market has also increased the requirement for newly constructed homes, eventually enhancing the sales figures for housebuilders.

Solid Housing Sector Data

The U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly reported that the privately-owned housing starts in July were at a seasonally adjusted annual rate of 1.452 million units, up 3.9% month over month and 5.9% year over year.

Single-family housing starts, which mostly constitute the bulk of the construction, jumped 6.7% in July from the prior month to a seasonally adjusted annual rate of 983,000 units. Likewise building permits in July were at a seasonally adjusted annual rate of 1.442 million units, up 0.1% month over month. Single-family building permits increased 0.6% month over month in July to 930,000 units.

Sales of new single???family houses in July 2023 were at a seasonally adjusted annual rate of 714,000, up 4.4% month over month and jumped 31.5% year over year. The National Association of Realtors reported that pending home sales increased 0.9% in July — rising for the second consecutive month.

Moreover, the Department of Commerce reported that the spending on construction projects were up 0.7% month over month in July. This was primarily driven by a 1.4% rise month over month in spending on residential construction projects.

Our Top Picks

We have narrowed our search to five homebuilders with strong upside left. These stocks have seen positive earnings estimate revisions in the last 60 days. Each of our picks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

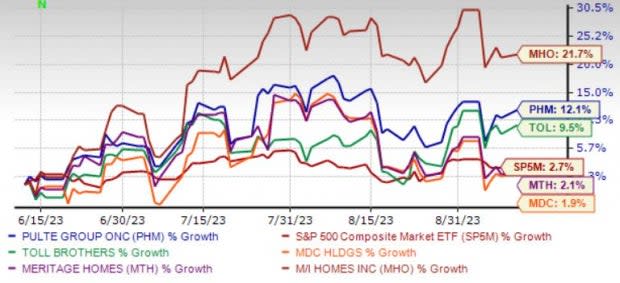

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

PulteGroup Inc. PHM has benefited from solid operating model, which strategically aligns the production of build-to-order and quick-move-in homes with applicable demand across consumer groups. PHM expects to close 7,000-7,400 homes in the third quarter and 29,500 homes this year. PHM also expects its community count to grow by 5-10% in the third and fourth quarters.

PulteGroup has an expected revenue and earnings growth rate of 1.6% and 7.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 10.9% over the last 60 days.

Toll Brothers Inc. TOL has benefited from improved market demand, favorable long-term demographic trends and the persistent underproduction of homes for more than a decade. Moreover, the policy of boosting its supply of spec homes and focus on operational efficiency bode well for TOL. Considering this solid upward trend, TOL raised its fiscal 2023 guidance, highlighting its growth prospects.

Toll Brothers has an expected revenue and earnings growth rate of 4% and 1.5%, respectively, for next year (ending October 2024). The Zacks Consensus Estimate for next-year earnings has improved 15.6% over the last 30 days.

M.D.C. Holdings Inc. MDC has been benefiting from the Build-to-Order process, which gives it a competitive edge over its peers. This approach helps reduce inventory risk, enhances efficiencies in construction and provides predictability on future deliveries.

Moreover, MDC is offering great opportunities for build-to-order buyers, such as long-term interest rate lock programs and other special incentives. MDC’s land acquisition strategies and high liquidity add to its growth.

M.D.C. Holdings has an expected revenue and earnings growth rate of 11% and 11.9%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 5.5% over the last 30 days.

Meritage Homes Corp. MTH has benefited from improved cycle times, spec strategy implementation and a normalizing housing demand environment. About 90% of MTH’s backlog conversion was stimulated by the spec strategy resulting in the highest second-quarter of home closings units and revenues in any year historically. Also, MTH’s focus on first-time/entry-level buyers bodes well.

Meritage Homes has an expected revenue and earnings growth rate of 5.2% and 5%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 22.6% over the last 60 days.

M/I Homes Inc. MHO operates as a builder of single-family homes in the United States. MHO operates through the Northern Homebuilding, Southern Homebuilding, and Financial Services segments. MHO designs, constructs, markets, and sells single-family homes and attached townhomes to first-time, millennial, move-up, empty-nester, and luxury buyers under the M/I Homes brand name.

In addition, MHO purchases undeveloped land to develop into developed lots for the construction of single-family homes, as well as for sale to others. Further, MHO originates and sells mortgages, and serves as a title insurance agent by providing title insurance policies, examination, and closing services to purchasers of its homes.

M/I Homes has an expected revenue and earnings growth rate of 8.7% and 7.9%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 38.3% over the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC) : Free Stock Analysis Report

M/I Homes, Inc. (MHO) : Free Stock Analysis Report