5 Must-Buy Momentum Stocks for June After a Mixed May

Wall Street ended May mixed after finishing April on a positive note The Nasdaq had a solid last month, ending 5.8% higher, driven by a rally in mega-cap tech stocks. The S&P 500 also finished the month 0.2% higher. However, the Dow suffered throughout May, ending the month 3.5% lower.

Meanwhile, U.S. stock markets gather pace in June. Last week, the market’s benchmark – the S&P 500 Index – exited from a bear market since October 2022 and formed a new bull market. The broad-market index recorded fourth straight winning week, for the first time since august 2022.

The tech-heavy Nasdaq Composite closed in positive territory to register seven consecutive winning weeks, for the first time since November 2029. The Dow also ended two successive winning weeks.

The momentum of the U.S. stock markets is likely to sustain in rest of June as market participants seem less worried about a near-term recession. The major driver of this month will be the Fed’s FOMC meeting.

Fed’s Upcoming June FOMC Meeting

The Fed is scheduled to meet its FOMC meeting on Jun 13 and 14. In the post-FOMC statement in May, Fed Chairman Jerome Powell hinted that the central bank may already reached the end of the interest rate hike regime. The current Fed fund rate is 5-5.25%, meaning terminal rate could be at 5.125%.

At present, the CME FedWatch tool is showing there exists 70% probability that the central bank will keep the benchmark lending rate unchanged. However, 30% respondents are expecting a 25 basis-point hike in June.

On Jun 8, The Department of Labor reported that weekly jobless claims increased by 28,000 to 261,000 for the week ended Jun 3, beating the consensus estimate of 236,000. This was the highest level of initial claims since the week ended Oct 30, 2021.

A section of economists and financial researchers have highlighted this data as a sign that the resilient labor market has started showing weakness. This may restrain the Fed for more rate hike.

Our Top Picks

We have narrowed our search to five U.S. corporate bigwigs that have strong momentum for the rest of June. These stocks have seen positive earnings estimate revisions in the last 30 days. Each of our picks carries a Zacks Rank #1 (Strong Buy) and has a Momentum Score of A or B. You can see the complete list of today’s Zacks #1 Rank stocks here.

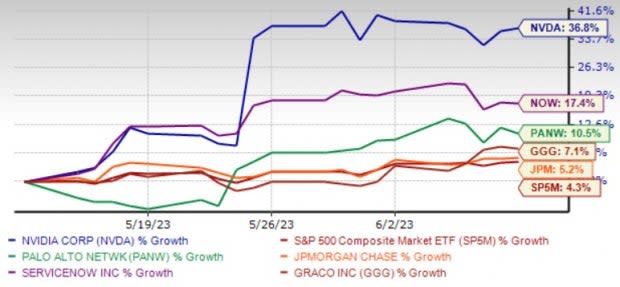

The chart below shows the price performance of our five picks in the past month.

Image Source: Zacks Investment Research

NVIDIA Corp. NVDA is gaining from the strong growth of artificial intelligence, high-performance computing and accelerated computing, which is boosting its Compute & Networking revenues. A surge in Hyperscale demand and a solid uptake of artificial intelligence-based smart cockpit infotainment solutions are acting as tailwinds for NVDA.

Collaboration with Mercedes-Benz and Audi is likely to advance NVDA’s presence in autonomous vehicles and other automotive electronics space. We expect its Automotive segment’s revenues to witness a CAGR of 29% through fiscal 2023-2025.

NVIDIA has an expected revenue and earnings growth rate of 58.1% and more than 100%, respectively, for the current year (ending January 2024). The Zacks Consensus Estimate for current-year earnings has improved 2.4% over the last seven days.

Palo Alto Networks Inc. PANW has been benefiting from continuous deal wins and the increasing adoption of PANW’s next-generation security platforms, attributable to the rise in the remote work environment and the need for stronger security.

Growing traction in Prisma and Cortex offerings is acting as a tailwind. PANW continues to acquire new customers and increase wallet share with existing customers. Our estimates suggests that Palo Alto’s revenues will witness a CAGR of 21.1% through fiscal 2023-2025.

Palo Alto Networks has an expected revenue and earnings growth rate of 25.3% and 67.9%, respectively, for the current year (ending July 2023). The Zacks Consensus Estimate for current-year earnings has improved 5.5% over the last 30 days.

ServiceNow Inc. NOW has been benefiting from the rising adoption of its workflows by enterprises undergoing digital transformation. As businesses, government agencies and others continue to shift their infrastructure to cloud, NOW is poised to boost uptake of its Now platform.

ServiceNow had 1,682 total customers with more than $1 million in annual contract value at the end of the first quarter. NOW’s new solutions — Automated service suggestions, Service Request Playbook and Workplace Scenario Planning — is helping it win new customers. This is driving subscription revenues. Strategic alliances with the likes of Microsoft remain tailwinds.

ServiceNow has an expected revenue and earnings growth rate of 21.6% and 26.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 30 days.

JPMorgan Chase & Co. JPM acquired failed First Republic Bank for $10.6 billion, which is expected to be accretive to its earnings. The deal adds almost $173 billion in loans and will increase market share of JPM among wealthy clients. Higher rates, global expansion initiatives and a steady loan demand will support net interest income (NII). Our estimates for NII (managed) imply a CAGR of 6.1% by 2025.

Yet, the volatile nature of the capital markets business and higher mortgage rates are likely to make fee income growth challenging. We expect non-interest income (managed) to fall 2.5% in 2023. Mounting expenses pose a major headwind, and we anticipate the same to rise 6.8% in 2023. Nevertheless, supported by solid earnings strength, JPM will be able to sustain enhanced capital deployments.

JPMorgan Chase has an expected revenue and earnings growth rate of 14.5% and 18.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last seven days.

Graco Inc. GGG is benefiting from strength in its Industrial segment due to a robust product portfolio of liquid finishing and sealant and adhesive equipment. In the quarters ahead, GGG will likely benefit from strong demand trends for new and existing products. For 2023, GGG predicts organic sales growth (on a constant-currency basis) in low single digits.

Graco has an expected revenue and earnings growth rate of 5.3% and 16.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.3% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report