5 P&C Insurance Stocks With Modest Dividend Yield to Watch

The Zacks Property and Casualty Insurance industry’s performance is affected by catastrophe events, both natural and manufactured. Notably, underwriting profitability is inversely related to the number of catastrophe occurrences.

Colorado State University predicted 2023 hurricane activity to be about 130% of the average hurricane season. The team also predicted 18 named storms for 2023.

Aon plc had estimated global economic losses from natural disasters to be $194 billion in the first half of 2023, the fifth-highest on record. Per Aon, global insured losses from natural disaster events were 46% in the first half of 2023, above the 21st-century average.

Despite these challenges, the P&C insurance industry has jumped 14.4% in the past year, outperforming the Zacks S&P 500 composite’s growth of 6.3% and the Finance sector’s 0.3% growth.

Image Source: Zacks Investment Research

High-quality dividend stocks such as Axis Capital Holdings Limited AXS, American Financial Group AFG, First American Financial FAF, The Travelers Companies, Inc. TRV and CNA Financial Corporation CNA look poised to deliver better results and reward shareholders simultaneously.

Global commercial insurance prices rose 3% in the second quarter of 2023, per Marsh Global Insurance Market Index. This marked the 23rd consecutive quarter of a composite price increase. The improvement in pricing drives premiums and claims payment.

With four rate hikes already in 2023, investment income is likely to have improved, as insurers are beneficiaries of a rising rate environment. The Fed had raised its key interest rate by 0.25% and reached a target of 5.25-5.5%, which marked the highest level in 22 years. An improving rate environment is a boon for insurers, especially long-tail insurers. Also, investment income is an important component of insurers’ top lines.

Players are investing heavily in technology to improve scale and efficiencies. While a solid policyholders’ surplus will help the property and casualty insurance industry absorb losses, a sturdy capital level continues to aid the P&C insurers in pursuing strategic mergers and acquisitions, investing in growth initiatives, engaging in share buybacks, and increasing dividends or paying out special dividends.

How to Pick the Right Dividend Stocks

To choose some of the best dividend stocks from the aforementioned industry, we have run the Zacks Stock Screener to identify stocks with a dividend yield in excess of 2% and a sustainable dividend payout ratio of less than 60%, reflecting enough room for future dividend increases. These stocks also have a five-year historical dividend growth rate of more than 2% and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our Choices

Axis Capital, with a market capitalization of $4.62 billion, provides various specialty insurance and reinsurance products worldwide. The P&C insurer is poised to gain from the repositioning of its portfolio and markets, offering profitable growth, lower volatility, strong market presence, better pricing and margin expansion. AXS sports a Zacks Rank #1 at present.

The insurer’s payout ratio is 27, with a five-year annualized dividend growth rate of 2.3%. Its current dividend yield of 3.2% betters the industry average of 0.3%. The insurer’s quarterly dividend payment witnessed an eight-year CAGR (2016-2023) of 2.9%. (Check Axis Capital’s dividend history here.)

Axis Capital Holdings Limited Dividend Yield (TTM)

Axis Capital Holdings Limited dividend-yield-ttm | Axis Capital Holdings Limited Quote

AXIS Capital has been building on the Specialty Insurance, Reinsurance plus Accident and Health portfolio, exiting underperforming lines, investing in more attractive markets, and entering new markets, thus improving the portfolio mix and underwriting profitability. AXIS Capital has been boosting shareholder value through stock buybacks and dividend hikes. It boasts one of the highest dividend yields among its peers. As of Jun 30, 2023, AXIS Capital had $100 million of remaining authorization under the board-authorized share repurchase program for common share repurchases through Dec 31, 2023.

American Financial, with a market capitalization of $9.65 billion, is an insurance holding company that provides specialty property and casualty insurance products in the United States. This Zacks Rank #3 insurer is set to benefit from business opportunities, growth in the surplus lines and excess liability businesses, and higher retentions in renewal business, which boost premium growth.

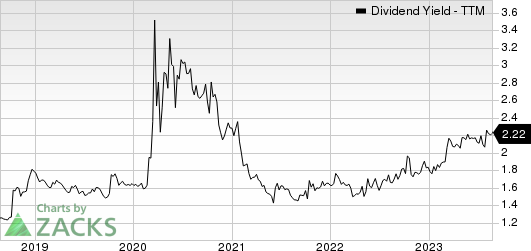

The insurer’s payout ratio is 27, with a five-year annualized dividend growth rate of 12.1%. Its current dividend yield of 2.2% betters the industry average of 0.3%. The insurer’s quarterly dividend payment witnessed an eight-year CAGR (2016-2023) of 12.3%. (Check American Financial’s dividend history here.)

American Financial Group, Inc. Dividend Yield (TTM)

American Financial Group, Inc. dividend-yield-ttm | American Financial Group, Inc. Quote

American Financial has traditionally maintained a moderate adjusted financial leverage of around 20%, with a good cash flow and an interest coverage ratio. In February 2023, the company declared a special cash dividend of $4 per share. The aggregate amount of this special dividend will be around $341 million. In August 2023, it raised the quarterly dividend by 12.7%, marking the 18th consecutive year of a dividend hike. The company expects its operations to continue to generate significant excess capital throughout the remainder of 2023 to the point that it can deploy $500 million of excess capital for share repurchases or additional special dividends through the end of 2023, which is in addition to the capital returned to shareholders in the first half of 2023.

First American Financial, with a market capitalization of $6.23 billion, provides financial services, and operates through the Title Insurance and Services, and Specialty Insurance segments. The insurer is well-poised to gain from improved agent premiums, higher direct premiums and escrow fees, and increased domestic residential purchase and commercial transactions. FAF also relies on inorganic growth initiatives to grow its business. The title insurer carries a Zacks Rank #3 at present.

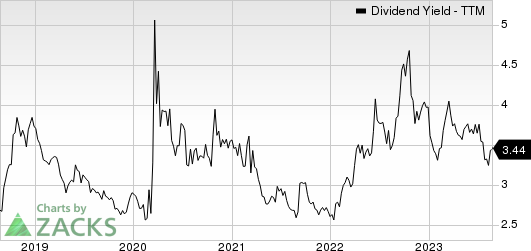

The insurer’s payout ratio is 43, with a five-year annualized dividend growth rate of 6%. Its current dividend yield of 3.4% betters the industry average of 0.3%. These make the stock an attractive pick for yield-seeking investors. (First American Financial’s dividend history here.)

First American Financial Corporation Dividend Yield (TTM)

First American Financial Corporation dividend-yield-ttm | First American Financial Corporation Quote

In August 2023, the insurer raised its dividend by 2%, in turn seeing a seven-year (2016-2023) CAGR of 9.3%. The company also engages in share buybacks. The board has increased the size of its share repurchase plan from $300 million to $600 million. The company bought back shares worth $45 million in the first half of 2023. It maintains a stock repurchase plan with an authorization of up to $400 million, of which $241.2 million remained as of Jun 30, 2023.

Travelers, with a market capitalization of $36.9 billion, is one of the leading writers of auto and homeowners’ insurance plus commercial U.S. property-casualty insurance. TRV currently carries a Zacks Rank #3.

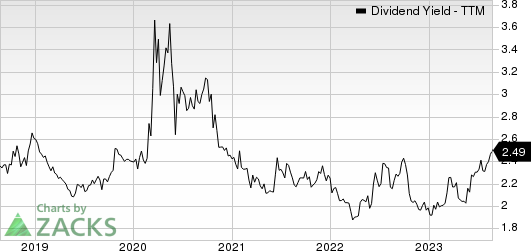

TRV’s current dividend of $3.72 per share yields 2.4%, better than the industry average of 0.3%. The insurer’s payout ratio is 41, with a five-year dividend growth rate of 4.75%. (Check Travelers’ dividend history here).

The Travelers Companies, Inc. Dividend Yield (TTM)

The Travelers Companies, Inc. dividend-yield-ttm | The Travelers Companies, Inc. Quote

Travelers’ comprehensive portfolio of coverages across nine lines of business is likely to help it maintain high levels of retention, improve pricing and increase new businesses, while achieving a positive renewal premium change. TRV maintains a conservative balance sheet among its peers. At the end of the second quarter of 2023, statutory capital and surplus were $22.9 billion. The company declared an 8% increase in the quarterly cash dividend in the first quarter of 2023, with a compound annual growth rate of 8%. This marked the 19th consecutive year of a dividend increase. It aims to generate increased earnings and capital in excess of growth needs, and maintain a balanced approach to rightsizing capital and growing book value per share over time as part of its long-term financial strategy.

CNA Financial, with a market capitalization of $10.5 billion, offers commercial P&C insurance products mainly across the United States. The insurer’s focus on better pricing and increased exposure, and higher new business and retention across its Specialty, Commercial and International segments poise it well for growth. CNA presently carries a Zacks Rank #3.

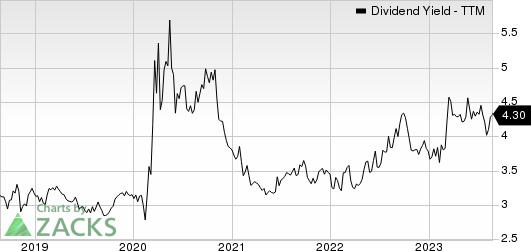

The insurer’s payout ratio is 41, with a five-year annualized dividend growth rate of 4.1%. Its current dividend yield of 4.3% betters the industry average of 0.3%. The insurer’s quarterly dividend payment has witnessed a 10-year CAGR (2013-2023) of 7.7%. (Check CNA Financial’s dividend history here.)

CNA Financial Corporation Dividend Yield (TTM)

CNA Financial Corporation dividend-yield-ttm | CNA Financial Corporation Quote

A strong balance sheet and cash flows enable CNA Financial to engage in shareholder-friendly moves like dividend hikes. In February 2023, the company’s board approved a 5% hike in the quarterly dividend. Simultaneously, CNA announced a special dividend of $1.20 per share, which was paid out in the first half of 2023. On the back of a disciplined execution denoted by strong underwriting results and confidence in future earnings performances, the company hiked its dividends over the past couple of years. Thus, the company is committed to returning more value to shareholders.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

First American Financial Corporation (FAF) : Free Stock Analysis Report

CNA Financial Corporation (CNA) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report