5 Profitable Companies With a Margin of Safety

- By Tiziano Frateschi

According to the GuruFocus discounted cash flow calculator as of Dec. 9, the following companies have a high margin of safety and have grown their margins over a 10-year period.

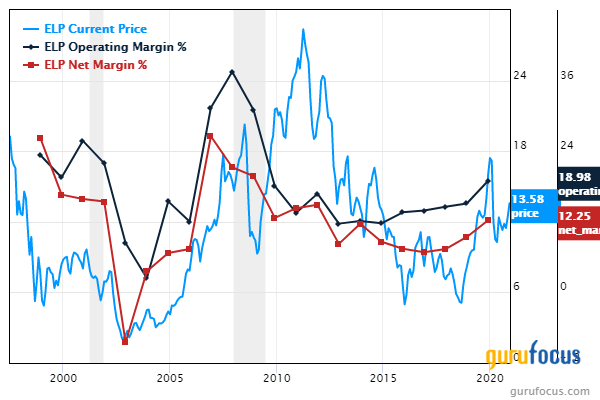

Cia Paranaense De Energia

Cia Paranaense De Energia Copel's (ELP) net margin and operating margin have grown 9.02% and 13.76% per annum, respectively, over the past 10 years.

According to the DCF calculator, the stock is undervalued with a 51.42% margin of safety at $13.47 per share. The price-earnings ratio is 5.37. The share price has been as high as $18.15 and as low as $8.28 in the last 52 weeks; it is currently 25.79% below its 52-week high and 62.68% above its 52-week low.

The generator of power in the country of Panama has a market cap of $3.6 billion and an enterprise value of $5.08 billion.

The company's largest guru shareholder is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.16% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.04%.

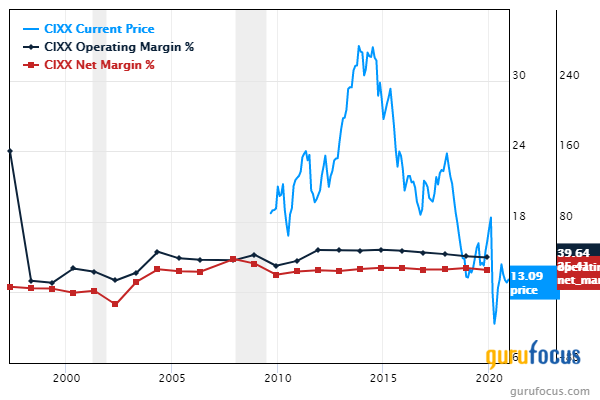

CI Financial

The net margin of CI Financial Corp. (CIXX) has grown 25.92% per annum over the past decade. The operating margin has grown 46.20% per annum over the past decade.

According to the DCF calculator, the stock is undervalued with a 46.15% margin of safety at $13.09 per share. The price-earnings ratio is 7.14. The share price has been as high as $19.22 and as low as $7.5 in the last 52 weeks; it is currently 31.89% below its 52-week high and 74.53% above its 52-week low.

The provider of wealth management products and services has a market cap of $2.7 billion and an enterprise value of $4.12 billion.

Kimco

Kimco Realty Corp. (KIM) has grown its net margin and operating margin by 34.49% and 33.50%, respectively, per year over the past decade.

According to the DCF calculator, the stock is undervalued with a 31.45% margin of safety at $14.82 per share. The price-earnings ratio is 7.34. The share price has been as high as $21.32 and as low as $7.45 in the last 52 weeks; it is currently 30.49% below its 52-week high and 98.93% above its 52-week low.

The real estate investment trust has a market cap of $6.4 billion and an enterprise value of $11.4 billion.

The company's largest guru shareholder is Renaissance Technologies with 0.26% of outstanding shares, followed by Chuck Royce (Trades, Portfolio) with 0.08%.

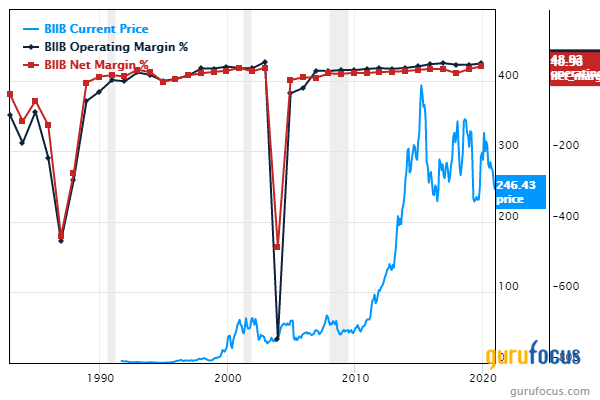

Biogen

The net margin of Biogen Inc. (BIIB) has grown 28.56% per annum over the past decade. The operating margin has grown 42.49% annually over the same 10-year period.

According to the DCF calculator, the stock is undervalued with a 71.35% margin of safety at $246 per share. The price-earnings ratio is 8.16. The share price has been as high as $375 and as low as $223.25 in the last 52 weeks; it is currently 34.28% below its 52-week high and 10.38% above its 52-week low.

The drug manufacturer has a market cap of $37.9 billion and an enterprise value of $42.16 billion.

The company's largest guru shareholder is PRIMECAP Management (Trades, Portfolio) with 10.20% of outstanding shares, followed by Simons' firm with 2.48% and the Vanguard Health Care Fund (Trades, Portfolio) with 2.41%.

Grupo Televisa

Grupo Televisa SAB's (TV) net margin and operating margin have grown 8.61% and 22.35%, respectively, per year over the past 10 years.

According to the DCF calculator, the stock is undervalued with a 760% margin of safety at $8.25 per share. The price-book ratio is 1.32. The share price has been as high as $12.61 and as low as $4.65 in the last 52 weeks; it is currently 34.58% below its 52-week high and 77.42% above its 52-week low.

The media company has a market cap of $4.6 billion and an enterprise value of $3.61 billion.

With 11.98% of outstanding shares, Dodge & Cox is the company's largest guru shareholder, followed by David Herro (Trades, Portfolio) with 4.80% and Bill Gates (Trades, Portfolio)' foundation with 2.99%.

Disclosure: I do not own any stocks mentioned.

Read more here:

6 Banks Trading With Low Price-Sales Ratios

5 Retailers Popular Among Gurus

5 Guru-Owned Utilities Outperforming the S&P 500

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.