5 Property & Casualty Insurers to Buy as Pricing Improves

The Zacks Property and Casualty Insurance (P&C) industry is likely to benefit from better pricing, prudent underwriting and exposure growth. Industry players like Berkshire Hathaway Inc. (BRK.B), The Progressive Corporation PGR, Chubb Limited CB, The Travelers Companies TRV and AXIS Capital Holdings AXS are poised to grow despite a rise in catastrophic activities. Given an active catastrophe environment, the policy renewal rate should accelerate. Also, the increasing adoption of technology and the emergence of insurtech will help the industry players function smoothly.

Though the industry is witnessing an increase in premium pricing, the magnitude has decreased in the last 12 quarters. Nonetheless, an improvement in surplus and accelerated economic activities set the stage for a better M&A environment. Per a report in Carrier Management, AM Best expects profitable commercial lines and improving personal lines, coupled with higher investment returns on increased yields and strong cash flow, to drive the industry’s performance in 2024.

About the Industry

The Zacks Property and Casualty Insurance industry comprises companies that provide commercial and personal property insurance, and casualty insurance products and services. Such insurance helps to safeguard property in case of any natural or man-made disasters. Liability coverages are also provided by some industry players. The insurance coverage offered also includes automobiles, professional risk, marine, excess casualty, aviation, personal accident, commercial multi-peril, and professional indemnity and surety. Premiums are the primary source of revenues. Better pricing and increased exposure drive premiums. These companies invest a portion of premiums to meet their commitments to policyholders. The Fed made four hikes in 2023, taking the tally to 11 since March 2022. An improving rate environment is a boon for insurers, especially long-tail insurers.

4 Trends Shaping the Future of the Property and Casualty Insurance Industry

Improved pricing to help navigate claims: Catastrophes are a concern for insurers due to the high degree of losses incurred. Insurers implement price hikes to ensure uninterrupted claims payment. Global commercial insurance prices rose for 25 straight quarters, per Marsh Global Insurance Market Index. Better pricing will help insurers write higher premiums and address claims payment prudently. Per Fitch Ratings, personal auto is likely to deliver better performance in 2024. This, coupled with better investment results and lower claims, should fuel insurers' performance per Fitch Ratings. Per Deloitte Insights, gross premiums are estimated to increase sixfold to $722 billion by 2030. Analysts at Swiss Re Institute predict premiums to grow 5.5% in 2024.

Catastrophe loss induces volatility in underwriting profits: The P&C insurance industry is susceptible to catastrophe events, which drag down underwriting profits. Per reports in Aon, total economic losses were $380 billion in 2023, while insured losses were $118 million. According to AM Best, total net underwriting loss was $38 billion in 2023, a 10-year high, largely attributable to weather-related losses, high inflation as well as reinsurance pricing pressure. The combined ratio was 103.7 for the same time frame per the credit rating giant, to which catastrophe losses added 780 basis points. The credit rating giant also estimates cat loss to contribute 680 basis points to the expected combined ratio of 100.7 in 2024. Underwriting losses are expected to be primarily due to soft performance in personal lines, which are expected to witness higher catastrophe losses per Insurance Information Institute and Milliman. However, exposure growth, better pricing, prudent underwriting and favorable reserve development will help withstand the blow. Also, frequent occurrences of natural disasters should accelerate the policy renewal rate.

Merger and acquisitions: Consolidation in the property and casualty industry is likely to continue as players look to diversify their operations into new business lines and geography. Buying businesses along the same lines will also continue as players look to gain market share and grow in their niche areas. With a sturdy capital level, the industry is witnessing a number of mergers, acquisitions and consolidations. Deloitte estimates more mergers and acquisitions in the reinsurance space in 2024.

Increased adoption of technology: The industry is witnessing increased use of technology like blockchain, artificial intelligence, advanced analytics, telematics, cloud computing and robotic process automation that expedite business operations and save costs. The industry has also witnessed the emergence of insurtech — technology-led insurers — which creates competition for incumbent players. Insurers continue to invest heavily in technology to improve scale and efficiencies. However, with insurtechs using the latest technologies and concepts that the incumbents are just beginning to experiment with, there remains a huge market risk. The use of technology also poses cyber threats.

Zacks Industry Rank Indicates Bright Prospects

The group's Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates rosy prospects in the near term. The Zacks Property and Casualty Insurance industry, which is housed within the broader Zacks Finance sector, currently carries a Zacks Industry Rank #34, which places it in the top 13% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Earnings estimates have increased 0.8% in a year.

Before we present a few property and casualty stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Outperforms S&P 500 and Sector

The Property and Casualty Insurance industry has outperformed both the Zacks S&P 500 composite as well as its sector over the past year. The stocks in this industry have collectively risen 26.6% in a year compared with the Finance sector and the Zacks S&P 500 composite’s increases of 17.1% and 25.7%, respectively.

One-Year Price Performance

Current Valuation

On the basis of the trailing 12-month price-to-book (P/B), which is commonly used for valuing insurance stocks, the industry is currently trading at 1.44X compared with the S&P 500’s 6.25X and the sector’s 3.51X.

Over the past five years, the industry has traded as high as 1.55X, as low as 0.97X and at the median of 1.39X.

Price-to-Book (P/B) Ratio (TTM)

Price-to-Book (P/B) Ratio (TTM)

5 Property and Casualty Insurance Stocks to Add to Your Portfolio

We are recommending two Zacks Rank #1 (Strong Buy) stocks and three Zacks Rank #2 (Buy) stocks from the P&C Insurance industry. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Progressive Corporation: Based in Mayfield Village, OH, Progressive is one of the major auto insurers in the country. Better pricing, a compelling portfolio, leadership position, strength in Vehicle and Property businesses, healthy policies in force, retention and solid capital position poise this Zacks Rank #1 insurer well for growth.

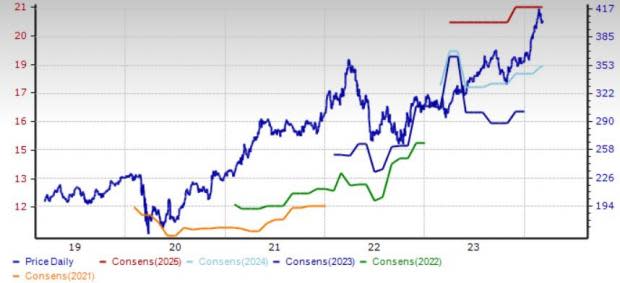

The Zacks Consensus Estimate for PGR’s 2024 and 2025 earnings suggests 50.7% and 14.1%, year-over-year growth respectively. The consensus estimate for 2024 and 2025 has moved up 4.1% and 0.3%, respectively, in the past seven days. The expected long-term earnings growth rate is pegged at 21.7%, better than the industry average of 11.9%.

Price and Consensus: PGR

AXIS Capital Holdings Limited: Bermuda-based AXIS Capital provides a broad range of specialty insurance and reinsurance solutions on a worldwide basis. Its compelling and diversified product portfolio, underwriting excellence, digital capabilities and solid capital position poise this Zacks Rank #1 insurer well for growth. This insurer boasts one of the highest dividend yields among its peers and has raised its dividend for 18 consecutive years.

The Zacks Consensus Estimate for AXIS Capital’s 2024 and 2025 earnings suggests 3.1% and 10.1% respective year-over-year growth. The consensus estimate for 2024 and 2025 has moved up 0.1% and 10.9%, respectively, in the past 30 days. AXIS Capital’s earnings surpassed estimates in each of the last four quarters, the average surprise being 102.57%. The expected long-term earnings growth rate is pegged at 5%.

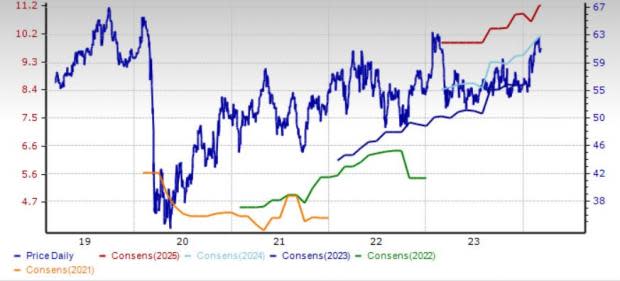

Price and Consensus: AXS

Berkshire Hathaway: Omaha, NE-based Berkshire Hathaway owns more than 90 subsidiaries in insurance, railroads, utilities, manufacturing services, retail and homebuilding. BRK.B is one of the largest property and casualty insurance companies measured by premium volume. BRK.B, carrying a Zacks Rank #2, should continue to benefit from its growing Insurance business as well as Manufacturing, Service and Retailing, and Finance and Financial Products segments. Continued insurance business growth fuels an increase in float, drives earnings and generates maximum return on equity. With Warren Buffett at its helm, Berkshire continues to create tremendous value for shareholders.

The Zacks Consensus Estimate for 2024 and 2025 bottom line suggests a year-over-year increase of 7.7% and 15.3%, respectively. The consensus estimate for 2024 has moved up 1.8% in the past 30 days. The expected long-term earnings growth rate is 7%.

Price and Consensus: BRK.B

The Travelers Companies: Based in New York, this Zacks Rank #2 insurer provides a wide variety of property and casualty insurance and surety products and services to businesses, organizations and individuals in the United States. and select international markets. Strong renewal rate change, retention, increase in new business supported by a compelling portfolio and a solid capital position poise TRV well for growth. The company raised its dividend for the 19th consecutive year at a compound annual growth rate of 8% over that period.

The Zacks Consensus Estimate for 2024 and 2025 earnings has moved 0.4% and 0.1% north respectively in the past 30 days. The consensus estimate for 2024 and 2025 earnings indicates a year-over-year improvement of 34.7% and 13.8%, respectively. The expected long-term earnings growth rate is 11.5%.

Price and Consensus: TRV

Chubb: Based in Zurich, Switzerland, Chubb is one of the world’s largest providers of P&C insurance and reinsurance. It has diversified through acquisitions into many specialty lines and also provides specialized insurance products. This Zacks Rank #2 insurer is poised to benefit from its focus on capitalizing on the potential of middle-market businesses and strategic initiatives, which pave the way for long-term growth. Chubb has hiked dividends for the last 30 straight years.

The Zacks Consensus Estimate for 2025 bottom line has moved 3 cents north in the past 30 days. The Zacks Consensus Estimate for 2025 earnings indicates an improvement of 10.5% year over year. The expected long-term earnings growth rate is 10%.

Price and Consensus: CB

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Chubb Limited (CB) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report