5 Reasons to Add LPL Financial (LPLA) Stock to Your Portfolio

It seems to be a wise idea to add LPL Financial Holdings LPLA stock to your portfolio now, given its strong fundamentals and strategic expansion efforts. Further, the company’s steady capital-deployment activities reflect a solid balance-sheet position.

The company has been witnessing upward earnings estimate revisions lately, reflecting analysts’ optimism regarding its earnings growth potential. Over the past 60 days, the Zacks Consensus Estimate for earnings has moved 4.6% and 6.4% upward for 2021 and 2022, respectively. The stock currently carries a Zacks Rank #2 (Buy).

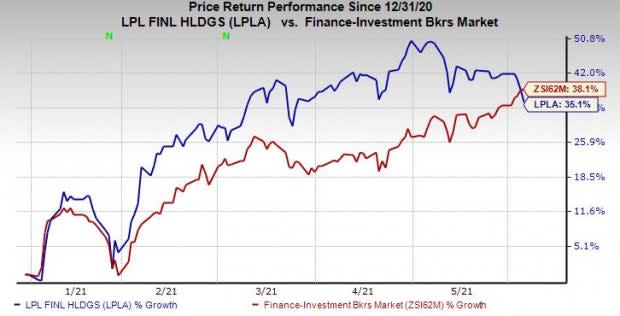

Shares of LPL Financial have risen 35.1% so far this year, underperforming the industry's 38.1% jump.

Image Source: Zacks Investment Research

Here are the major factors that make LPL Financial stock an attractive investment option.

Earnings Growth: Over the past three to five years, LPL Financial recorded earnings growth of 37.6%, substantially above the industry average of 15.9%. The momentum is likely to continue in the near term. The company’s earnings are projected to rise 13.5% for 2021 and 22.5% for 2022.

Moreover, LPL Financial has an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 13.92%.

Also, the stock has a Growth Score of A. Our research shows that stocks with a Value Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best upside potential.

Revenue Strength: LPL Financial has been witnessing steady improvement in revenues. Over the last three years (ended 2020), total net revenues witnessed a compound annual growth rate (CAGR) of 6.4%, mainly on rise in advisory revenues.

The momentum is expected to continue in 2021 and 2022, with sales projected to grow at a rate of 23.3% and 18.9%, respectively.

Strategic Buyouts: LPL Financial has concluded several strategic deals over the past few years. In April, the company acquired Waddell & Reed’s wealth management business for $300 million. In 2020, it acquired Blaze Portfolio, the assets of E.K. Riley Investments, LLC and Lucia Securities. These, along with other deals over the years, are expected to keep supporting the company’s financials.

Solid Balance Sheet: As of Mar 31, 2021, LPL Financial had net long-term and other borrowings worth $2.33 billion, and cash and cash equivalents and due from banks, along with restricted cash balance of $1.75 billion. Yet, its times interest earned ratio of 6.7 at the end of first-quarter 2021 improved sequentially. Also, the company's revolving credit facility will mature in 2024. Thus, the company’s current liquidity position suggests that it will able to be continue meeting debt obligations in the near term even if the economic situation worsens.

Superior Return on Equity (ROE): LPL Financial’s trailing 12-month ROE supports its growth potential. The company’s ROE of 39.31% compares favorably with the industry’s 17.67%, reflecting that it is more efficient in using shareholders’ funds than peers.

Other Brokerage Stocks to Consider

Charles Schwab SCHW witnessed an upward earnings estimate revision of 9.3% for 2021 over the past two months. Its shares have gained 42.8% so far this year. At present, it carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Interactive Brokers Group, Inc. IBKR has witnessed a 6.7% upward earnings estimate revisions for the current year over the past 60 days. This Zacks Rank #2 stock has rallied 12% year to date.

Raymond James RJF has recorded 16.9% upward earnings estimate revision for the ongoing year in the past 60 days. So far this year, this Zacks Rank #2 stock has appreciated 38.4%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Raymond James Financial, Inc. (RJF) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research