Here are 5 Reasons to Bet on Byline Bancorp (BY) Stock Now

Currently, the banking industry is facing a challenging operating environment amid high interest rates and gradually waning loan demand. Despite this, one can bet on fundamentally solid lenders like Byline Bancorp, Inc. BY. The company is well-placed to benefit from solid loan and deposit balances, high interest rates, strategic buyouts and a strong balance sheet.

Analysts seem optimistic regarding the company’s earnings growth potential. Over the past month, the Zacks Consensus Estimate for BY’s earnings has been revised 2.3% and 3.6% upward for 2023 and 2024, respectively. The stock presently sports a Zacks Rank #1 (Strong Buy).

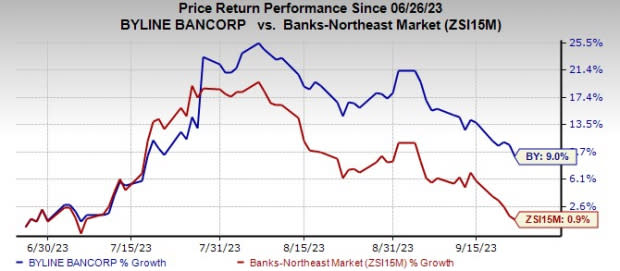

Shares of BY have rallied 9% over the past three months, significantly outperforming the industry’s 0.9% rise.

Image Source: Zacks Investment Research

Some factors that make Byline Bancorp stock a must-buy right now.

Earnings Growth: In the last three to five years, BY witnessed earnings growth of 18.7%, higher than the industry average of 12.3%. The trend is expected to continue in the near term, with earnings anticipated to rise 13.1% this year.

Also, the company has an impressive earnings surprise history. BY’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an average beat of 10.02%.

Revenue Strength: The company’s revenues witnessed a CAGR of 13.3% over the five years ended 2022. The improvement was driven by solid loan and deposit balance and efforts to bolster fee income. Further, since 2022, higher interest rates have aided Byline Bancorp’s top line.

In July, BY acquired Inland Bancorp, Inc. and thus solidified its position in the Chicago region. The stock-cum-cash deal, announced in November 2022, was valued at approximately $129 million. Under the terms of the agreement, each share of Inland Bancorp’s common stock was converted into the right to receive 0.19 shares of Byline shares and 68 cents in cash. This, along with past acquisitions, will keep supporting the company’s financials.

Given the modest loan demand and rise in fee income, the company’s revenues will likely trend upward, while rising funding costs will weigh on it. The top line is expected to rise 20.2% in 2023 and 5.5% next year.

Steady Capital Distributions: Byline Bancorp has been paying quarterly dividends regularly. Further, over the last five years, the company has hiked dividends twice, with payout growing 50.6% over the same time frame. BY's payout ratio currently stands at 14% of earnings.

Additionally, the company has a share repurchase program in place. In December 2022, the company announced a new buyback plan to repurchase up to 1.25 million shares in 2023. As of Jun 30, 2023, this whole authorization remained available. Given the solid balance sheet, the company’s capital distributions seem sustainable.

Strong Leverage: Byline Bancorp’s debt/equity ratio is nil compared with the industry average of 0.38, displaying no debt burden relative to the industry. It highlights the company's financial stability, even in an unstable economic environment.

Favorable Valuation: BY stock has a Value Score of A. Our research shows that stocks with a Value Score of A or B, when combined with a Zacks Rank #1 or 2 (Buy), offer the best upside potential.

Other Banks Worth a Look

A couple of other top-ranked stocks from the banking space are Northeast Community Bancorp, Inc. NECB and First Internet Bancorp INBK.

Northeast Community Bancorp currently sports a Zacks Rank #1. Earnings estimates for 2023 have been revised 10% north in the past 60 days. In the past three months, NECB’s shares have rallied 6.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings estimates for First Internet Bancorp have been revised 14.3% north for 2023 over the past 60 days. Shares of INBK have risen 9.1% in the past three months. Currently, the company carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Internet Bancorp (INBK) : Free Stock Analysis Report

Northeast Community Bancorp Inc. (NECB) : Free Stock Analysis Report

Byline Bancorp, Inc. (BY) : Free Stock Analysis Report