5 Reasons to Invest in Bank OZK (OZK) Stock Right Now

Bank OZK OZK is well-positioned for top-line growth, supported by its business restructuring and branch consolidation initiatives. The company’s solid loan balance, along with higher interest rates, will keep aiding growth.

Analysts also seem bullish on the stock. Over the past 30 days, the Zacks Consensus Estimate for OZK’s earnings has been revised 1.4% and 3% upward for 2023 and 2024, respectively. The stock currently carries a Zacks Rank #2 (Buy).

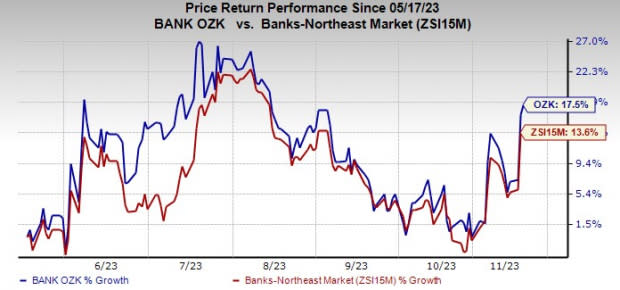

Bank OZK’s shares have gained 17.5% over the past six months, outperforming a rally of 13.6% for the industry.

Image Source: Zacks Investment Research

What Makes Bank OZK a Solid Bet Right Now

Earnings Strength: Bank OZK’s earnings witnessed growth of 15.6% over the last three to five years, driven by a solid top-line performance and strategic buyouts. The number is also impressive compared with the industry’s average of 10.9%.

The company’s earnings are projected to grow 28.4% in 2023 and 1.6% in 2024, suggesting the continuation of the upward trend in earnings.

Revenue Growth: Bank OZK has grown substantially through de novo branching strategy and inorganically. Its revenues witnessed a compound annual growth rate of 8.2% over the last three years (2019-2022), mainly driven by steady loan growth and a rise in fee income. The uptrend continued for revenues and total loans in the first nine months of 2023.

Given a strong balance sheet, OZK is expected to keep expanding through acquisitions as well. On the back of decent loan demand and efforts to bolster fee income, the positive trend in revenues is expected to continue in the near term.

For 2023, the company’s revenues are expected to rise 23.1%, and for 2024, it is projected to grow 3.5%.

Manageable Debt Level: As of Sep 30, 2023, the company had a total debt of $1.90 billion and cash and cash equivalents of $1.86 billion. Thus, given a robust liquidity position and decent earnings strength, Bank OZK is expected to continue to meet debt obligations in the near term, even if the economic situation worsens.

Impressive Capital Distributions: Bank OZK has been regularly increasing its quarterly dividend. In October 2023, it hiked its dividend for the 53rd consecutive quarter. The company has a share repurchase plan. In November 2022, it announced a new buyback program under which it is authorized to repurchase up to $300 million worth of shares. As of Sep 30, 2023, the plan (set to expire on Nov 9, 2023) had $133.5 million authorization remaining.

Given a robust capital position and lower debt-equity and dividend payout ratios than peers, the company is expected to sustain its capital distribution activities.

Superior Return on Equity (ROE): Bank OZK’s trailing 12-month ROE reflects its superiority in terms of utilizing shareholder funds compared with its peers. The company has an ROE of 15.23%, higher than the industry average of 10.90%.

Other Bank Stocks Worth a Look

A couple of other top-ranked stocks from the banking space are Hilltop Holdings HTH and First BanCorp. FBP. At present, HTH sports a Zacks Rank #1 (Strong Buy) and FBP has a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

HTH’s 2023 earnings estimates have been revised 7.3% north over the past 30 days. Over the past six months, Hilltop Holdings’ shares have lost 2.1%.

The Zacks Consensus Estimate for FBP’s current-year earnings has increased 5.2% over the past 30 days. First BanCorp’s share price has jumped 31.4% over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hilltop Holdings Inc. (HTH) : Free Stock Analysis Report

First BanCorp. (FBP) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report