5 Reasons to Invest in ICICI Bank (IBN) Stock Right Now

ICICI Bank Ltd IBN is well-poised to benefit from its efforts to digitize banking services and dependence on domestic loans (which represent a substantial part of its overall loans). Its steady capital deployment activities aimed at enhancing shareholder value are another positive. Amid this, the stock seems like a good investment option right now.

This July, the company posted robust first-quarter fiscal 2024 (ended Jun 30) results, aided by a rise in net interest income, non-interest income, growth in loans and deposits, and higher rates. However, higher operating expenses posed were an undermining factor.

The Zacks Consensus Estimate for ICICI bank's 2023 and 2024 earnings has been revised 8.3% and 5.8% upward over the past 30 days, respectively. This shows that analysts are optimistic regarding the company’s earnings growth prospects. IBN currently sports a Zacks Rank #1 (Strong Buy).

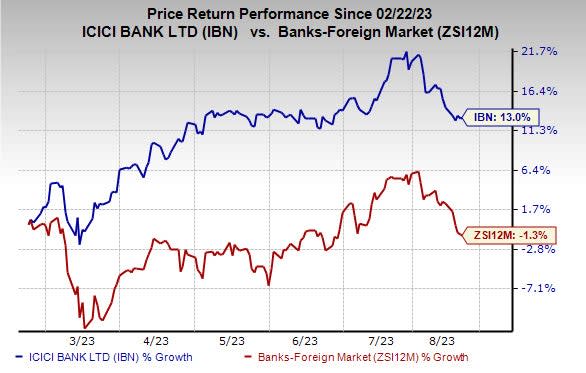

Over the past six months, shares of the company have gained 13% against the industry's decline of 1.3%.

Image Source: Zacks Investment Research

Mentioned below are a few factors that make IBN stock a rewarding investment pick now:

Digitization Efforts: ICICI Bank has been making significant progress in improving digital banking services for both its retail and corporate clients. The increasing adoption of the bank’s mobile banking app — iMobile Pay — is helping garner solid market share, with 10 million activations of iMobile Pay from non-ICICI Bank users as of Jun 30, 2023.

Also, IBN's digital platform for businesses, InstaBIZ, along with supply chain platforms, has witnessed significant growth in the past few quarters. These efforts are leading to a rapid increase in end-to-end digital sanctions and disbursements across various products. Notably, as of Jun 30, 2023, it reported about 2.3 million registrations on the InstaBIZ platform by non-ICICI Bank users. Capitalizing on these, the company remains well-positioned for growth in the upcoming period.

Earnings Growth: In the last three to five years, the company witnessed earnings per share (EPS) growth of 60.3% compared with the industry’s average of 5.8%. The uptrend is expected to continue in the near term, with the company’s EPS projected to rise 17% and 12% in fiscal 2024 and 2025, respectively.

Revenue Strength & High Domestic Loan Dependence: ICICI Bank's non-interest income, which is a key component of its revenues, increased 12% in the first three months of fiscal 2024, following a 13% rise in fiscal 2023 and 27% growth in fiscal 2022. The company's efforts to digitize operations and a rise in mobile banking transactions are likely to continue to help garner more fee income going forward. While sales estimates are expected to decline 3.8% for fiscal 2024, the same is anticipated to rise 14.5% for fiscal 2025.

In addition, ICICI Bank is likely to benefit from its high dependence on domestic loans, which form a substantial part of its overall loans. As of Jun 30, 2023, ICICI Bank's domestic loans represented 97% of the bank's overall loans. Moreover, during the first quarter of fiscal 2024, retail loans witnessed a 22% rise and at the end of fiscal 2023, retail loans grew 23%.

This secures the company with respect to loans and makes it less susceptible to global concerns.

Strong Leverage & Superior Return on Equity (ROE): ICICI Bank has a debt/equity ratio of 0.79 compared with the industry average of 0.90, indicating that it has a less debt burden relative to the industry. This highlights the financial stability of the company and is likely to enable it to navigate through periods of economic downturns.

Moreover, the company has a trailing 12-month ROE of 14.59%, which compares favorably with 11.46% of the industry. This reflects that it is more efficient in using shareholder funds than its peers.

Steady Capital Deployments: Given ICICI Bank's solid financial position, its capital deployments seem sustainable. The company has been consistent with its dividend payments. Recently in July 2023, IBN announced a dividend of 17 cents per share. Moreover, it has increased its quarterly dividend four times in the last five years and its five-year annualized dividend growth rate is 27.77%.

Other Foreign Banks Worth a Look

A couple of other top-ranked stocks from the foreign banking space are ING Group ING and Itau Unibanco ITUB.

The Zacks Consensus Estimate for ING Group’s current-year earnings has been revised 11.7% upward over the past 30 days. Its shares have gained 7.7% in the past three months. Currently, ING sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Itau Unibanco carries a Zacks Rank #2 (Buy) at present. Its earnings estimates for 2023 have been revised 1.4% upward over the past 30 days. In the past three months, ITUB shares have gained 2.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ICICI Bank Limited (IBN) : Free Stock Analysis Report

ING Group, N.V. (ING) : Free Stock Analysis Report

Itau Unibanco Holding S.A. (ITUB) : Free Stock Analysis Report