5 Reasons Why Investors Should Bet on Ryder (R) Stock Now

Ryder System, Inc. R is benefiting from its shareholder-friendly initiatives. The full-year 2023 earnings guidance looks encouraging.

Against this backdrop, let’s look at the factors that make this stock an attractive pick.

What Makes Ryder an Attractive Pick?

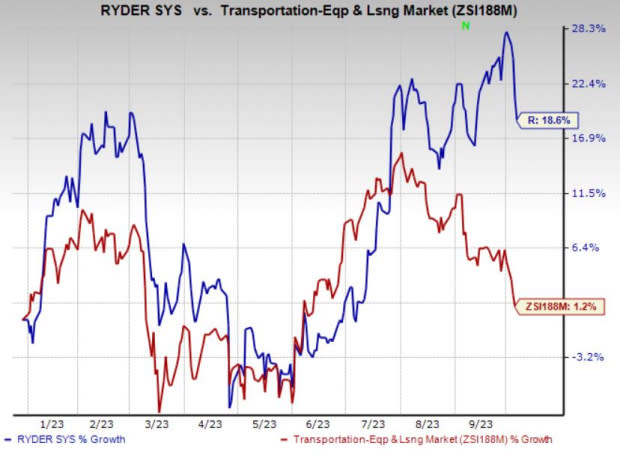

An Outperformer: A glimpse at the company’s price trend reveals that the stock has had an impressive run on the bourse year to date. Shares of Ryder have gained 18.6% so far this year compared with the 1.2% rise of the industry it belongs to.

Image Source: Zacks Investment Research

Solid Rank & VGM Score: Ryder currently carries a Zacks Rank #2 (Buy) and has a VGM Score of A. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities. Thus, the company seems to be an appropriate investment proposition at the moment.

Northward Estimate Revisions:The direction of estimate revisions serves as an important pointer when it comes to the price of a stock. Over the past 90 days, the Zacks Consensus Estimate for Ryder’s third-quarter 2023 earnings has moved up 7.3% year over year. For 2023 and 2024, the company’s earnings are expected to increase 8.1% and 4.9%, year over year, respectively.

Positive Earnings Surprise History: Ryder has an impressive earnings surprise history. The company has surpassed the Zacks Consensus Estimate in three of the last four quarters (missing the mark once). The average beat is 11.2%.

Growth Factors:Ryder’s 2023 outlook is encouraging. Adjusted earnings per share for the year is now estimated to be between $12.20 and $12.70 (prior view: $11.30-$12.05). For 2023, management anticipates operating revenues to increase 2%. Net cash from operating activities is projected to be $2.5 billion (prior view: $2.4 billion). Adjusted ROE (return on equity) is still suggested in the band of 17-19% (prior view: 16-18%).

Ryder’s measures to reward its shareholders through dividends and share buybacks are appreciative. In July 2023, Ryder announced a 14.5% hike in its quarterly dividend, taking the total to 71 cents per share (annualized $2.84). The company is also active on the buyback front. In February 2023, Ryder’s board approved a new 2-million share discretionary repurchase program. The management is now authorized to buyback up to 2 million shares of common stock at its discretion from Feb 10, 2023 through Feb 10, 2025 (two years).

Other Stocks to Consider

Some other top-ranked stocks from the Zacks Transportation sector are GATX Corporation (GATX), Westinghouse Air Brake Technologies Corporation, operating as Wabtec Corporation (WAB) and SkyWest, Inc. (SKYW). Each of these companies presently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

GATX has an expected earnings growth rate of 14.33% for the current year. GATX delivered a trailing four-quarter earnings surprise of 17.30%, on average.

The Zacks Consensus Estimate for GATX’s current-year earnings has improved 2.1% over the past 90 days. Shares of GATX have gained 6% year to date.

Wabtec has an expected earnings growth rate of 16.87% for the current year. WAB delivered a trailing four-quarter earnings surprise of 3.42%, on average.

The Zacks Consensus Estimate for WAB’s current-year earnings has improved 4.9% over the past 90 days. Shares of WAB have gained 5.9% year to date.

SkyWest's fleet-modernization efforts are commendable.A fall in operating expenses is a tailwind for SkyWest. In second-quarter 2023, the metric dipped 2.4% to $693.8 million due to a decline in operating costs. Low operating expenses boost bottom-line results. Shares of SKYW have surged 163.6% year to date.

SKYW delivered a trailing four-quarter earnings surprise of 31.51%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryder System, Inc. (R) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report