5 Restaurant Stocks to Buy Ahead of Thanksgiving Day

Wall Street rally has resumed in November after three consecutive months of decline. Month to date, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — have advanced 5.7%, 7% and 9.8%, respectively.

The last two months of the year are characterized as the holiday season. This year, Thanksgiving Day will be celebrated on Nov 23. This day is associated with feasting on turkey, sweet potato, wine and a lot more.

Given that good food is the theme of Thanksgiving, it should be prudent to invest in restaurant stocks with a favorable Zacks Rank. U.S. restaurant businesses continue to thrive in 2023 after an impressive turnaround last year. Sales at U.S. restaurants have not been impacted much despite severe inflationary pressure.

The headline retail sales declined 0.1% month over month in October, narrower than the consensus estimate of a drop of 0.2%. This indicates that consumer spending is still steady. Moreover, within retail sales, expenditure on food and beverage stores rose 0.6% over the prior month and 1% year over year.

Within the retail sector, the Zacks Defined Restaurant Industry is currently placed in the top 26% of all industries with a year-to-date return of 7%.

Our Top Picks

We have narrowed our search to five restaurant stocks that have strong growth potential for the rest of 2023. These stocks have seen positive earnings estimate revision in the last 30 days. Each of our picks carries either a Zacks Rank # 1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

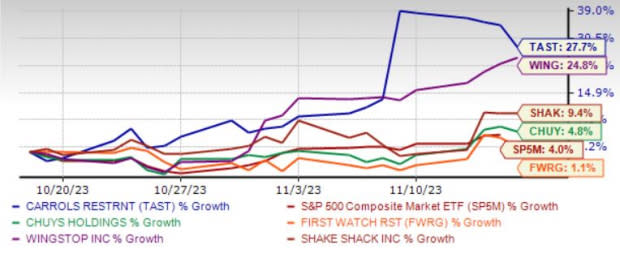

The chart below shows the price perormance of our five picks in the past month.

Image Source: Zacks Investment Research

Carrols Restaurant Group Inc. TAST is the largest BURGER KING franchisee in the United States with over 800 restaurants and has operated BURGER KING restaurants since 1976. TAST operates as a Burger King and Popeyes franchisee.

Zacks Rank #1 Carrols Restaurant Group has an expected revenue and earnings growth rate of 8.3% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 13.5% over the last seven days.

Wingstop Inc. WING franchises and operates restaurants. WING’s operating segment consists of the Franchise and Company segments. WING offers cooked-to-order, hand-sauced and tossed chicken wings.

Zacks Rank #1 Wingstop has an expected revenue and earnings growth rate of 26.3% and 29.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.7% over the last seven days.

First Watch Restaurant Group Inc. FWRG is a daytime dining restaurant concept serving made-to-order breakfast, brunch and lunch using fresh ingredients. FWRG offers pancakes, omelets, sandwiches and salads, alongside specialty items like the Quinoa Power Bowl, Avocado Toast and the Chickichanga.

Zacks Rank #2 First Watch Restaurant Group has an expected revenue and earnings growth rate of 21.1% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 16.7% over the last 30 days.

Shake Shack Inc. SHAK has been benefiting from various digital initiatives, strong same-shack sales and unit expansion efforts. SHAK’s digital retention continues to be strong. It has also been making more investments in digitization in an effort to sustain its digital guest enhancement strategies in the near term.

Zacks Rank #2 Shake Shack has an expected revenue and earnings growth rate of 20.1% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3% over the last seven days.

Chuy's Holdings Inc. CHUY owns and operates full-service restaurants serving a distinct menu of authentic Mexican food. CHUY offers a menu that includes appetizers, soups and salads, tacos, burritos, enchiladas, fajitas and combination platters. CHUY operates chains throughout Texas, Alabama, Indiana, Kentucky, and Tennessee.

Zacks Rank #2 Chuy's Holdings has an expected revenue and earnings growth rate of 9.3% and 37.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.2% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carrols Restaurant Group, Inc. (TAST) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Shake Shack, Inc. (SHAK) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

First Watch Restaurant Group, Inc. (FWRG) : Free Stock Analysis Report