5 Safe Stocks to Buy Amid Plummeting U.S. Consumer Confidence

Wall Street is suffering in September as volatility has become a daily phenomenon. The latest catalyst for volatile trading is the tumbling U.S. consumer confidence. On Sep 26, the Conference Board reported that the index for Consumer Confidence in September came in at 103, missing the consensus estimate of 105.5.

The metric for August was revised upward to 108.7 from 106.1 reported earlier. September marked the second consecutive month of the index’s decline and the largest monthly decline for the index since December 2020.

The Present Situation Index— based on consumers’ assessment of current business and labor market conditions— rose marginally to 147.1 in September from 146.7 in August. The Expectations Index— based on consumers’ short-term outlook for income, business, and labor market conditions— declined to 73.7 in September, after falling to 83.3 in August and 88 in July. Notably, any reading of the Expectations Index below 80, historically signals a recession within next year.

According to Dana Peterson, the chief economist at The Conference Board, “Expectations for the next six months tumbled back below the recession threshold of 80, reflecting less confidence about future business conditions, job availability, and incomes."

Peterson also said, "Consumers may be hearing more bad news about corporate earnings, while job openings are narrowing, and interest rates continue to rise — making big-ticket items more expensive."

In a similar kind of study, on Sep 15, the University of Michigan reported that the preliminary Index for U.S. Consumer Sentiment in September dropped to 67.7, missing the consensus estimate of 69.2. The final metric of the Index in August was 69.5.

At this stage, investment in low-beta stocks with a high dividend yield and a favorable Zacks Rank may be the best option. If the markets regain momentum, the favorable Zacks Rank of these stocks will capture the upside potential. However, if the downtrend continues, low-beta stocks will minimize portfolio losses and dividend payments will act as a regular income stream.

Our Top Picks

We have narrowed our search to five large-cap (market capital > $10 billion) low-beta (beta >0 <1) stocks with a solid dividend yield. These companies have strong growth potential for 2023 and have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

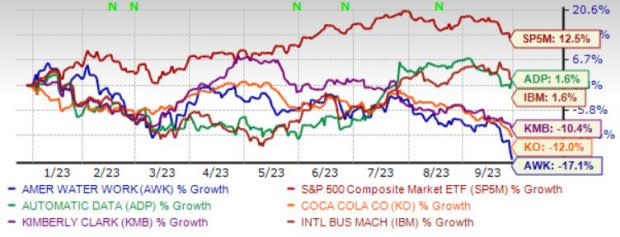

The chart below shows the priceperformance of our five picks year to date.

Image Source: Zacks Investment Research

American Water Works Co. Inc. AWK is gaining from the implementation of new water systems and contributions from military contracts. Investments to upgrade its infrastructure will allow AWK to provide quality services to its expanding customer base. AWK continues to expand operations through organic and inorganic initiatives. Cost management is boosting margins. Our model projects an increase in revenues for the 2023-2025 period.

American Water Works Co. has an expected revenue and earnings growth rate of 8.2% and 6.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last 30 days. AWK has a beta of 0.57 and a current dividend yield of 2.18%.

Automatic Data Processing Inc. ADP continues to enjoy a dominant position in the human capital management market through strategic buyouts like Celergo, WorkMarket, Global Cash Card and The Marcus Buckingham Company. ADP has a strong business model, high recurring revenues, good margins, robust client retention and low capital expenditure. Further, ADP continues to innovate, improve operations, and invest in its ongoing transformation efforts.

Automatic Data Processing has an expected revenue and earnings growth rate of 6.3% and 11.1%, respectively, for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 11.1% over the last 60 days. ADP has a beta of 0.81 and a current dividend yield of 2.11%.

Kimberly-Clark Corp. KMB has been benefiting from its three growth pillars. These include focusing on improving KMB’s core business in the developed markets, speeding up the growth of the Personal Care segment in developing and emerging markets and enhancing digital and e-commerce capacities. Apart from this, KMB’s pricing and saving initiatives have been aiding amid cost inflation.

Kimberly-Clark has an expected revenue and earnings growth rate of 1.5% and 14%, respectively, for the current year. The Zacks Consensus Estimate for next-year earnings has improved 3.4% over the last 60 days. KMB has a beta of 0.39 and a current dividend yield of 3.82%.

International Business Machines Corp. IBM is witnessing sales growth in the software segment driven by healthy hybrid cloud adoption and solid demand trends across RedHat, automation, data in AI and security. A strong foundation of research and innovation, a broad portfolio that caters to various industry requirements and a diverse global market presence set IBM apart from its competitors.

IBM is also poised to benefit from the Watsonx platform. The buyout of Apptio will likely bolster IBM’s IT automation capabilities, empowering enterprise leaders to generate incremental value across the technology domain.

International Business Machines has an expected revenue and earnings growth rate of 1.6% and 3.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last 60 days. IBM has a beta of 0.85 and a current dividend yield of 4.64%.

The Coca-Cola Co. KO has benefited from the continued momentum in its business. Sales have gained from revenue growth across its operating segments, aided by an improved price/mix and a rise in concentrate sales. KO is poised to gain from innovations and accelerating digital investments. KO provided an upbeat guidance for 2023. We anticipate organic revenue growth of 9% for 2023.

The Coca-Cola has an expected revenue and earnings growth rate of 4.7% and 6.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 38.3% over the last 60 days. KO has a beta of 0.56 and a current dividend yield of 3.25%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

CocaCola Company (The) (KO) : Free Stock Analysis Report

Kimberly-Clark Corporation (KMB) : Free Stock Analysis Report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report