These 5 Small-Cap Stocks Could Be Worth Picking Up

Investors with lower risk appetite often run far from small-cap stocks. And you can’t blame them because its true that these really are riskier than large-cap or even mid-cap stocks.

Small-cap stocks are generally considered to be those of companies with a market capitalization of less than a billion dollars. They are typically newer and smaller companies that often grow very fast off a small base, or possess compelling intellectual property or other asset that promises growth in the future. If the promise is great, investors could even bid up their prices till they can no longer be considered small.

The risk in small-cap stocks could be of various kinds:

It could be related to the market because small-cap companies are often more sensitive to changes in the market and the economy. This makes their share prices more volatile, meaning that their prices can fluctuate more dramatically. This can make it difficult to time your investments and can lead to losses.

Small-cap stocks are less liquid than large-cap stocks, meaning that it can be more difficult to buy and sell them. This can make it difficult to exit your investment if you need to.

They are also more likely to go bankrupt than large-cap companies. This is because they are newer and have less resources to weather a downturn.

Another risk is that a fewer number of analysts are likely to be covering them, so there may be a dearth of useful information on these stocks.

However, small-cap stocks also have the potential to generate higher returns than large-caps. This is because they are still growing and have the potential to become large, successful companies. If you are willing to take on the risk, small-cap stocks can be a good investment for your portfolio although it’s best to only invest money that you can afford to lose.

It is important to balance the risk in these stocks with some solid large caps, in order to take advantage of the growth prospects without upsetting the overall risk profile of the portfolio. And it goes without saying that you should be doing your homework, studying the stocks and making sure you understand what you’re getting into.

In addition, Zacks proprietary methodology has produced a ranking system for stocks (#1 denotes Strong Buy, #2 Buy, #3 Hold, #4 Sell and #5 Strong Sell), as well as a Style Score system (Value, Growth or Momentum where an A or B grade is considered good). When you match these with growth rates that analysts are projecting and check the valuation, it’s hard to go wrong. Making these the criteria for stock selection, let’s take a look at a few examples:

Commercial Vehicle Group, Inc. (CVGI)

New Albany, OH-based Commercial Vehicle Group and its subsidiaries are involved in the design, manufacturing and sale of components and assemblies for vehicles. Its operations span across North America, Europe and the Asia-Pacific. CVG operates in four segments: Vehicle Solutions, Electrical Systems, Aftermarket & Accessories, and Industrial Automation.

It offers a wide range of products, including electrical wire harness assemblies, panel assemblies, electro-mechanical assemblies, vinyl or cloth-covered appliqués, armrests, instrument panels, cab structures, mirrors, seats and seating systems. Its products cater to the commercial vehicle market, serving various industries such as trucks, buses, construction, mining, agriculture, military, industrial, and specialty vehicles.

#2 ranked Commercial Vehicle carries a Growth score of A.

In the last quarter, the company reported a 100%earnings beat versus estimates. Importantly, revenues grew 7.8%.

2023 estimates increased by 29 cents (43.9%) in the last 30 days. 2024 estimates increased 19 cents. Earnings are now expected to increase 86.3% and 15.4%, respectively in 2023 and 2024. The estimated long-term growth is 21.0%.

CVGI trades at a significant discount to both the industry and the S&P 500, although the current valuation is a premium to its median value over the past year.

Kimball International, Inc. (KBAL)

Jasper, IN-based Kimball is a furniture manufacturing and sales company. It produces and sells furniture products under various brands, including Kimball, National, Etc., Interwoven, Kimball Hospitality, D'style and Poppin. Its product range includes desks, workstations, seating, storage and tables for offices, conference rooms, training rooms and so forth.

It also offers furniture and other products for hotels, as well as commercial and residential developments. Products are sold through sales representatives, office furniture dealers, wholesalers, designers and online platforms.

The shares carry a Zacks Rank #1 and Growth Score A.

In the last quarter, Kimball posted very strong results. Earnings of 30 cents were 1600% better than the 2-cent loss projected. Revenue also increased, by 4.2%.

Estimates for the year ending June 2023 jumped from 44 cents to 86 cents (95.5%). 2024 estimates also jumped from 75 cents to $1.04 (38.7%). Analysts expect 145.7% growth in 2023, 20.9% growth in 2024 and 12.0% long-term growth.

The shares are trading at a significant discount to their median value over the past year, as well as a discount to the industry and the S&P 500.

2U, Inc. (TWOU)

Lanham, MD-based 2U is an online education platform company operating mainly in the U.S. through two segments: Degree Program and Alternative Credential. In the Degree Program segment, 2U provides technology and services to nonprofit colleges and universities, enabling them to offer online degree programs.

This segment caters to students pursuing undergraduate or graduate degrees. The Alternative Credential segment offers online open courses, executive education programs, skills-based boot camps, and micro-credential programs through nonprofit colleges and universities. This segment targets students seeking shorter and more affordable options for career advancement or personal development.

Despite missing on the top line, 2U was able to deliver a 17.7% earnings surprise in the last quarter.

In the last 60 days, I’m seeing a 3-cent reduction in the 2023 estimate and a 2-cent reduction in the 2024 estimate. At the current level, the Zacks Consensus Estimates represent a 292.9% increase in 2023 earnings and a 95.6% increase in 2024 earnings. For the long-term, analysts expect 20% growth.

2U shares are trading at 0.32X P/S, a discount to its median value over the past year. It is also a discount to the industry and the S&P 500.

M-tron Industries, Inc. (MPTI)

Orlando, FL-based M-tron Industries engages in the design, manufacture and marketing of frequency and spectrum control products such as radio frequency, microwave and millimeter wave filters; cavity, crystal, ceramic, lumped element and switched filters; high frequency and performance OCXOs, integrated PLL OCXOs, TCXOs, VCXOs, and low jitter and harsh environment oscillators; crystal resonators, integrated microwave assemblies; and solid-state power amplifier products. Its products are used in applications in the commercial and military aerospace, defense, space and other commercial markets.

The shares carry a Zacks Rank #1 and Growth Score of A.

In the last quarter, the company met earnings estimates while beating on revenue by 4.1%. In the last 60 days, the 2023 estimate increased 24 cents (32%) while the 2024 estimate increased 13 cents (14.0%). Analysts are currently looking for 47.7% growth in 2023, 7.1% growth in 2024 and 17.0% growth in the long term.

MPTI shares are trading at a very low multiple, making them undervalued, both from the perspective of the industry and the S&P 500.

Diversified Healthcare Trust (DHC)

DHC is a real estate investment trust (REIT) that specializes in owning high-quality healthcare properties across the United States. They aim for diversification in terms of care delivery, practice type, scientific research disciplines, property type and location. As of December 31, 2022, DHC's portfolio was valued at approximately $7.1 billion and consisted of 379 properties across 36 states and Washington, D.C.

These properties encompassed around 9 million square feet of life science and medical office spaces, as well as over 27,000 senior living units. DHC is managed by The RMR Group, a prominent alternative asset management company with extensive experience in commercial real estate operations and more than $37 billion in assets under management at the end of 2022.

The Zacks Rank #1 stock has a Growth score of A.

In the last quarter, the company reported a slight miss on sales while meeting earnings expectations. The last 30 days have seen a 4-cent increase in the 2023 estimate and a penny increase in the 2024 estimate. But at these levels, earnings are expected to grow 337.5% in 2023 (from a loss last year) and 68.4% in 2024. Long-term growth is expected to be 10%.

The shares are trading at a huge discount to both the industry and the S&P 500. Additionally, they’re trading at a huge discount to their median value over the past year.

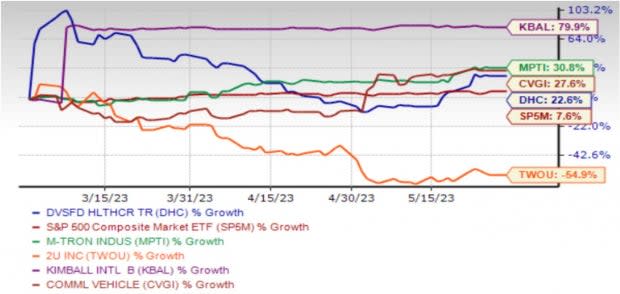

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Commercial Vehicle Group, Inc. (CVGI) : Free Stock Analysis Report

2U, Inc. (TWOU) : Free Stock Analysis Report

Kimball International, Inc. (KBAL) : Free Stock Analysis Report

Diversified Healthcare Trust (DHC) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report