5 Small-Cap Stocks That Soared in 1H & Have More Upside

Small -cap stocks have lately shown promise. Amid an impressive first-half rally, the small-cap-centric Russell 2000 Index lagged its large-cap peers like the S&P 500 and the Nasdaq Composite. However, June onward, small-cap stocks have started to gather pace. The momentum is expected to continue.

Small business operators are most susceptible to recession. The major issue for U.S. small businesses is galloping inflation, which is currently well above the Fed’s target rate of 2%. The global breakdown of supply-chain systems due to the pandemic and the shortage of manpower has hurt these companies the most. Small businesses are unable to pass on the total hike in input costs to their final products deteriorating their financial conditions.

Small businesses are major sufferers of a higher interest rate regime. These companies operate on a thin profit margin and most new businesses take time to achieve profitability. Moreover, small businesses, have no geographical diversification and depend on U.S. consumers. Therefore, a slowdown in U.S. consumer spending is likely to hurt the small businesses.

Meanwhile, the inflation rate has steadily fallen from its peak in June 2022. Consequently, the Fed has reduced the magnitude of interest rate hike and is approaching the end of this rate hike cycle. At the same time, recently released several economic data have shown that the fundamentals of the U.S. economy remain strong. As a result, concerns of a near-term recession evaporated.

Our Top Picks

We have narrowed our search to five small-cap (market capital < $1 billion) stocks that have provided more than 50% returns year to date with more upside left. These stocks have strong growth potential for the rest of 2023 and have seen positive earnings estimate revisions in the last 60 days. Finally, each of our picks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

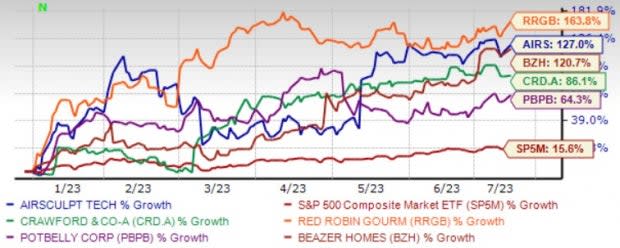

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Crawford & Co. (CRD.A) is the world's largest independent provider of diversified services to insurance companies, self-insured corporations, and governmental entities. CRD.A provides claims management and outsourcing solutions for carriers, brokers, and corporations in the United States, the United Kingdom, Europe, Canada, Australia, Asia, and Latin America. Crawford operates through four segments: North America Loss Adjusting, International Operations, Broadspire, and Platform Solutions.

CRD.A has expected revenue and earnings growth rates of 7.1% and 61.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 29.9% over the last 60 days. The stock price of CRD.A has surged 87% year to date.

Potbelly Corp. PBPB owns, operates, and franchises Potbelly sandwich shops. PBPB manages establishments for consuming food on premises. Its offerings include sandwiches, salads, soups, chili, chips, cookies, ice cream, and smoothies. Potbelly serves customers throughout the United States.

Potbelly has expected revenue and earnings growth rates of 7.8% and 36.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 10% over the last 60 days. The stock price of PBPB has advanced 60.5% year to date.

Red Robin Gourmet Burgers Inc. RRGB is a full-service casual dining restaurant chain that serves an assorted range of burgers. RRGB develops, operates and franchises full-service restaurants in North America. RRGB also runs limited service non-traditional prototype restaurants, named Red Robin's Burger

Red Robin Gourmet Burgers has expected revenue and earnings growth rates of 3.4% and 57.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 21.1% over the last 60 days. The stock price of RRGB has soared 160.3% year to date.

Beazer Homes USA Inc. BZH designs, builds, and sells single-family homes. BZH designs homes to appeal primarily to entry-level and first-move-up home buyers. BZH’s objective is to provide customers with homes that incorporate quality and value. Its subsidiary, Beazer Mortgage, originates the mortgages for the company's home buyers.

Beazer Homes USA has expected revenue and earnings growth rates of 7.8% and 12.9%, respectively, for the next year (ending September 2024). The Zacks Consensus Estimate for next-year earnings has improved 4.9% over the last 30 days. The stock price of BZH has climbed 118.3% year to date.

AirSculpt Technologies Inc. AIRS is a provider of body contouring procedures delivering a premium consumer experience under its brand, Elite Body Sculpture. At Elite Body Sculpture, AIRS provides custom body contouring using their proprietary AirSculpt method which removes unwanted fat in a minimally invasive procedure.

AirSculpt Technologies has expected revenue and earnings growth rates of 13.22% and 29.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.1% over the last 60 days. The stock price of AIRS has jumped 122.4% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Red Robin Gourmet Burgers, Inc. (RRGB) : Free Stock Analysis Report

Beazer Homes USA, Inc. (BZH) : Free Stock Analysis Report

Potbelly Corporation (PBPB) : Free Stock Analysis Report

Crawford & Company (CRD.A) : Free Stock Analysis Report

AirSculpt Technologies, Inc. (AIRS) : Free Stock Analysis Report