5 Stocks to Add to Your Portfolio in a Challenging Scenario

Wall Street is suffering from severe volatility, although October generally remains favorable for investors. The impressive bull run in the first seven months of this year suffered major setbacks since August. Month to date, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — tumbled 1.4%, 2.4% and 3%, respectively.

Benchmarks are heading for the third consecutive month of decline. On Oct 25, the S&P 500 closed below its crucial support level of 4,200 for the first time since May. The Nasdaq Composite posted its worst day since Feb 21. The tech-heavy index closed at 12,821.22, slightly ahead of its 200 DMA of 12,766.69. Closing below that level will indicate more pain for the tech-laden index.

Volatility continues as the Fed warned of one more rate hike of 25 basis points by the end of this year and a higher interest rate regime for a longer period. The first rate cut is not expected before September 2024 and the inflation rate is unlikely to decline to the central bank’s target rate of 2% before 2026.

Consequently, the yield on the benchmark 10-Year U.S. Treasury Note spiked above 5% last week. This happened for the first time since the Great Recession of 2007. The 10-Year yield is crucial as it reflects investors sentiment on the economy and financial markets.

Moreover, the intensifying geopolitical conflicts in the Middle East between Israel and Hamas may result in a spike in crude oil prices. This will raise the cost of transportation thereby hiking the general price level.

Our Top Picks

We have narrowed our search to five U.S. corporate bigwigs that have popped in the past month. These stocks have strong potential for the rest of 2023 and have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

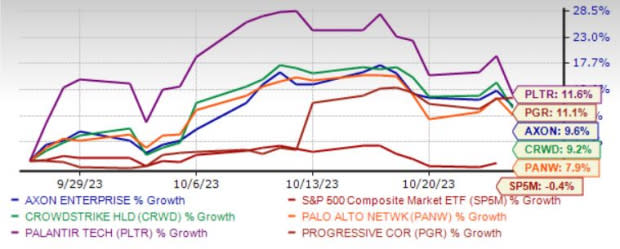

The chart below shows the price performance of our five picks n the past month.

Image Source: Zacks Investment Research

Palo Alto Networks Inc. PANW has been benefiting from continuous deal wins and the increasing adoption of PANW’s next-generation security platforms, attributable to the rise in the remote work environment and the need for stronger security.

Palo Alto Networks has an expected revenue and earnings growth rate of 18.7% and 20.3%, respectively, for the current year (ending July 2024). The Zacks Consensus Estimate for current-year earnings has improved 7.7% over the last 60 days. The stock price of PANW has advanced 7.9% in the past month.

Palantir Technologies Inc. PLTR builds and deploys software platforms for the intelligence community in the United States to assist in counterterrorism investigations and operations. PLTR provides Palantir Gotham, a software platform that enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants.

Palantir Technologies has an expected revenue and earnings growth rate of 16.3% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.5% over the last 60 days. The stock price of PANW has jumped 11.6% in the past month.

CrowdStrike Holdings Inc. CRWD is benefiting from the rising demand for cyber-security solutions owing to the slew of data breaches and the increasing necessity for security and networking products amid the growing hybrid working trend. Continued digital transformation and cloud-migration strategies adopted by organizations are the key growth drivers.

CRWD’s portfolio strength, mainly the Falcon platform’s 10 cloud modules, boosts its competitive edge and helps add users. Additionally, strategic acquisitions, like that of Humio and Preempt, are expected to drive growth for CRWD.

CrowdStrike has an expected revenue and earnings growth rate of 35.6% and 83.1%, respectively, for the current year (ending January 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last 30 days. The stock price of PANW has appreciated 9.2% in the past month.

Axon Enterprise Inc. AXON is thriving on the back of strength across its TASER segment, driven by solid demand for the TASER 7 device. Strong initial demand for the recently launched TASER 10 energy device sparks optimism about the growth of the TASER segment. Within the Software & Sensors segment, AXON is seeing strong demand for Axon Cloud SaaS solutions and Axon Fleet 3 systems.

Solid customer response for the newly introduced Axon Body 4 camera is encouraging. With the TASER 10 device and Axon Body 4 camera receiving solid customer responses, AXON raised its 2023 guidance.

Axon Enterprise has an expected revenue and earnings growth rate of 28% and 62.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 13.8% over the last 60 days. The stock price of PANW has surged 9.6% in the past month.

The Progressive Corp. PGR continues to gain on higher premiums, given its compelling product portfolio, leadership position and strength in both Vehicle and Property businesses. Focus on becoming a one-stop insurance destination, catering to customers opting for a combination of home and auto insurance, augurs well for PGR’s growth.

Policies in force and retention ratio should remain healthy for PGR. Competitive pricing to retain current customers and address customer needs with new offerings should continue to drive policy life expectancy.

The Progressive has an expected revenue and earnings growth rate of 18.3% and 29.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 20.8% over the last 30 days. The stock price of PGR has climbed 11.1% in the past month.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report