5 Stocks to Buy From the Promising Building Products Industry

Higher government spending for infrastructural enhancement has been aiding the companies belonging to the Zacks Building Products - Miscellaneous industry. Although macroeconomic uncertainties, investments in new products and higher raw material costs might keep margins under pressure, companies like Otis Worldwide Corporation OTIS, Owens Corning OC, Arcosa, Inc. ACA, Construction Partners, Inc. ROAD and PGT Innovations, Inc. PGTI are set to benefit from higher repair and remodeling (R&R) activities, operational excellence, geographic and product diversification strategies, accretive buyouts and higher infrastructural spending.

Industry Description

The Zacks Building Products - Miscellaneous industry primarily comprises manufacturers, designers and distributors of home improvement and building products like ceiling systems, doors, windows, flooring and metal products. Some industry players provide solutions to rehabilitate the aging infrastructure, primarily pipelines in the wastewater, water, energy, mining and refining industries. The companies also manufacture expansion joints and structural bearings, ventilation products, ground-mounted solar racking and commercial greenhouses, as well as mail storage (solutions including mailboxes along with package delivery products). Companies in this industrial cohort also rent out equipment to a diverse customer base, including construction and industrial companies, manufacturers, utilities, municipalities, homeowners and government entities.

3 Trends Shaping the Future of the Building Products Industry

U.S. Administration’s Infrastructural Spending & Improving Residential Market: The industry players are expected to benefit from strong global trends in infrastructure modernization, energy transition, national security and a potential super-cycle in global supply-chain investments. The U.S. administration’s endeavor to rebuild the nation’s deteriorating roads and bridges and fund new climate-resilient and broadband initiatives is expected to aid the companies. Meanwhile, as the industry players’ business prospects are highly correlated with U.S. housing market conditions and the R&R activity, solid momentum in the R&R markets and improving residential construction markets are expected to drive growth. Builders are now cautiously optimistic for 2023 as the lack of existing inventory is shifting demand to the new home market, thereby driving the demand for companies’ products in the industry.

Operational Excellence, Product Innovation & Acquisitions: The industry participants have been undertaking strong cost-saving initiatives like business consolidation, system implementations, plant/branch closures, improvement in the global supply chain and headcount reductions to boost profitability. Industry participants have also been strategically investing in new products, sales and support services, digitally enabled solutions and advanced manufacturing capabilities to boost revenues. The companies are also following a systematic acquisition strategy to supplement organic growth and expand access to additional markets and products.

Inflationary Woes: Inflationary headwinds with respect to transportation costs, material costs and energy costs owing to supply-chain disruptions have been a pressing concern. Also, rising labor costs are compressing margins. These are dampening the companies’ operating performance. Rising costs related to steel, asphalt, resin and other input materials are also hurting margins. Although the industry participants have been working to recover higher costs through various price increases, they expect this ongoing volatility in material and transportation costs to persist in the near term. Meanwhile, the companies have been witnessing short-term project delays due to material and labor shortages that are impacting upstream building activity. This may result in a lower backlog in the near term.

Apart from higher raw material costs, the companies bear expenses related to product launches. If companies are unable to offset these costs through price increases or supply-chain initiatives, their profits may be affected.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Building Products – Miscellaneous industry is a 26-stock group within the broader Zacks Construction sector. The industry currently carries a Zacks Industry Rank #61, which places it in the top 24% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates positive near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a solid earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group’s earnings growth potential. Since March 2023, the industry’s earnings estimates for 2023 and 2024 have been revised upward to $3.84 and $4.24 per share from $3.78 and $4.14, respectively.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

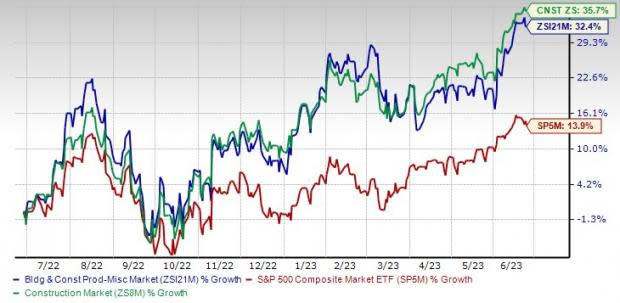

Industry Lags Sector, Outperforms S&P 500

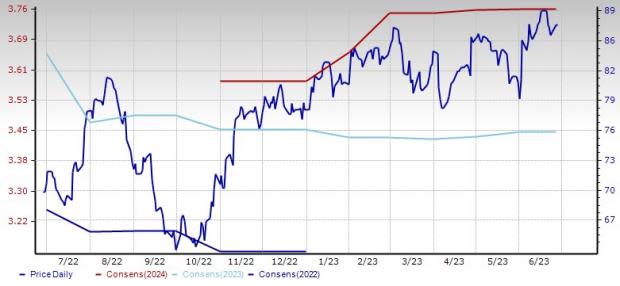

The Zacks Building Products – Miscellaneous industry has underperformed the broader Zacks Construction sector but outperformed the Zacks S&P 500 composite over the past year.

Over this period, the industry has rallied 32.4% compared with the broader sector’s 35.7% rise. Meanwhile, the Zacks S&P 500 composite has jumped 13.9% over the same period.

One-Year Price Performance

Industry's Current Valuation

On the basis of the forward 12-month price to earnings, which is a commonly used multiple for valuing building products’ stocks, the industry is trading at 14X versus the S&P 500’s 19.3X and the sector’s 15.7X.

Over the past five years, the industry has traded as high as 19.9X, as low as 6.9X and at a median of 13.5X, as the chart below shows.

Industry’s P/E Ratio (Forward 12-Month) Versus S&P 500

5 Building Product Stocks to Buy Now

We have selected five stocks from the Zacks universe of building products that currently carry a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Arcosa: This Dallas, TX-based company provides infrastructure-related products and solutions. The company remains focused on its long-term vision to lessen the complexity of Arcosa’s overall portfolio and shift its business mix toward less cyclical, higher-margin growth opportunities that leverage core strengths and drive long-term shareholder value creation. It has completed the previously announced sale of its storage tanks business and aims to invest the proceeds into its key growth businesses. Also, ACA’s inorganic drive to expand its portfolio and improved efficiencies in utility structures business, coupled with solid execution in cyclical businesses, should drive growth.

Arcosa, a Zacks Rank #1 stock, has gained 52.2% over the past year. ACA has seen an upward estimate revision of 13.1% and 11.3% for 2023 and 2024 earnings over the past 30 days to $2.77 per share and $3.26 per share, respectively. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 59.9%.

Price and Consensus: ACA

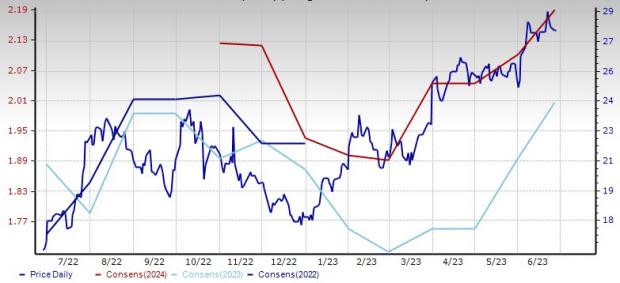

PGT Innovations: This North Venice, FL-based company is one of the nation's leading manufacturers and suppliers of residential impact-resistant windows and doors. A diversified product portfolio to capture profitable growth in new construction and R&R channels, customer-centric innovation, manufacturing improvements and a series of pricing actions in response to the rising cost pressure have been aiding the company. Also, strategic acquisitions have expanded its footprint into new regions, channels or products via advanced technologies, enhanced manufacturing or supply chain capabilities. These buyouts are aligned with growth priorities and are expected to boost shareholder value over the long term.

PGTI, a Zacks Rank #1 stock, has surged 72.4% over the past year. PGT Innovations has seen an upward estimate revision of 5.8% and 4.3% for 2023 and 2024 earnings over the past 30 days to $2.01 per share and $2.19 per share, respectively. Its earnings topped the consensus estimate in three of the trailing four quarters and missed on one occasion, with the average surprise being 19.1%. Again, it carries an impressive VGM Score of B. This helps to identify stocks with the most attractive value, growth and momentum.

Price and Consensus: PGTI

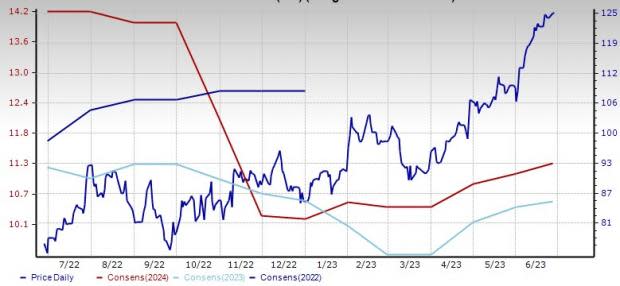

Owens Corning: Headquartered in Toledo, OH, Owens Corning produces and sells building material systems and composite solutions. It has been benefiting from market-leading businesses, innovative products, process technologies and capabilities. With positive momentum in residential end markets and the R&R market, particularly in the United States, improved manufacturing leverage and strong cost controls will likely help the company deliver solid results.

Owens Corning, a Zacks Rank #2 stock, has gained 63.9% over the past year. OC has seen an upward estimate revision of 9.1% and 6.8% for 2023 and 2024 earnings over the past 30 days to $10.52 per share and $11.25 per share, respectively. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 15.1%.

Price and Consensus: OC

Construction Partners: Headquartered in Dothan, AL, this civil infrastructure company engages in the construction and maintenance of roadways across Alabama, Florida, Georgia, North Carolina and South Carolina. The company has benefited from solid demand for infrastructure services throughout end markets in both the private and public sectors, consistent execution of its business model and a growth strategy that defies labor, inflation and supply-chain challenges. Its recent acquisitions and the sale of Daurity Springs Quarry will help the company to expand operations into fast-growing markets while maintaining its leverage ratio. Construction Partners’ organic and inorganic growth opportunities in the attractive Southeastern U.S. road construction/repair market are expected to help the company generate higher revenues.

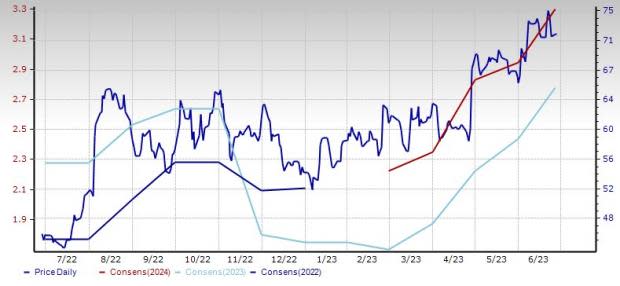

ROAD, a Zacks Rank #2 stock, has gained 59.1% over the past year. This company surpassed earnings estimates in three of the trailing four quarters and missed on one occasion, with the average surprise being 30.8%. ROAD has seen an upward estimate revision of 9.4% and 6.7% for 2023 and 2024 earnings over the past 60 days to 70 cents per share and 95 cents per share, respectively. Again, it carries an impressive VGM Score of A.

Price and Consensus: ROAD

Otis: Based in Farmington, CT, Otis is a leading elevator and escalator manufacturing, installation and service company. Otis’ primary focus on innovation is core to its strategy. The company connects global R&D efforts through an operating model that sets global and local priorities based on customer and segment needs. It focuses on innovation and expansion of the digital ecosystem and a suite of digital solutions for existing service portfolio customers and new equipment shipments from factories.

OTIS, a Zacks Rank #2 stock, has gained 24.8% over the past year. This company surpassed earnings estimates in all the trailing four quarters, with the average surprise being 5.9%. OC has seen an upward estimate revision of 0.5% and 0.3% for 2023 and 2024 earnings over the past 30 days to $3.45 per share and $3.76 per share, respectively. Again, it carries an impressive VGM Score of B.

Price and Consensus: OTIS

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

PGT, Inc. (PGTI) : Free Stock Analysis Report

Construction Partners, Inc. (ROAD) : Free Stock Analysis Report

Arcosa, Inc. (ACA) : Free Stock Analysis Report