5 Stocks in Focus on Their Recent Dividend Hike

Wall Street started October with a volatile trading pattern like the last two months. The Fed kept the benchmark lending rate unchanged at the existing 5.25-5.5% range at its September FOMC meeting. Market participants were widely expecting a status quo. However, the post-FOMC statement of Fed Chairman Jerome Powell created uncertainty among investors.

Although the Fed paused its rate hike in the September FOMC meeting, the current dot plot has shown a strong likelihood of one more hike of 25 basis points in 2023. That will take the terminal interest rate of this hiking cycle to 5.6%, well above the 5.1% forecast in June. Notably, the current range of the Fed fund rate is the highest level since March 2001.

More importantly, the central bank said it would keep interest rates higher for a longer time. The new projection has shown two rate cuts in 2024 instead of four projected in June. The first cut in interest rate is not expected before September 2024.

Moreover, the unresolved war between Russia and Ukraine and the recent geopolitical conflict between Israel and the Palestine-based terrorist group Hamas may inject more volatility in the near future.

Stocks to Watch

At this stage, dividend-paying stocks should be in demand as investors try to safeguard their portfolios. We believe one should consider stocks that have recently raised their dividend payments.

Five such companies are — Bank OZK OZK, McDonald's Corp. MCD, RPM International Inc. RPM, Lockheed Martin Corp. LMT and A. O. Smith Corp. AOS. Each of these stocks currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bank OZK provides various retail and commercial banking services. OZK accepts different deposit products, including non-interest-bearing checking, interest-bearing transactions, business sweep, savings, money market, individual retirement, and other accounts, and time deposits. OZK is expected to benefit from branch consolidation efforts and robust loan balances along with strengthening non-interest income.

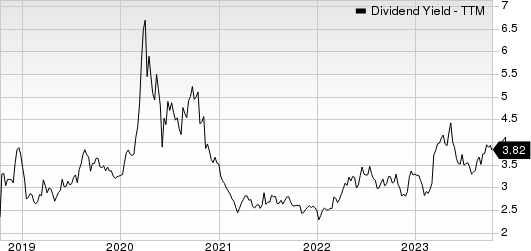

On Oct 2, 2023, Bank OZK declared that its shareholders would receive a dividend of $0.37 per share on Oct 20, 2023. It has a dividend yield of 4.2%. Over the past five years, OZK has increased its dividend 20 times, and its payout ratio presently stays at 26% of earnings. Check OZK’s dividend history here.

Bank OZK Dividend Yield (TTM)

Bank OZK dividend-yield-ttm | Bank OZK Quote

McDonald's continues to impress investors with robust comps growth. MCD’s increased focus on menu innovation and loyalty program expansion is commendable. MCD is also making every effort to drive growth in international markets. Robust digitalization is likely to boost McDonald's long-term growth and capture market share. MCD plans to open more than 1,900 restaurants globally in 2023.

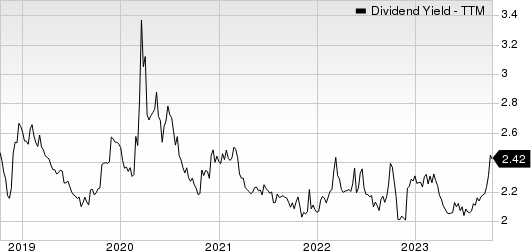

On Oct 4, 2023, McDonald's declared that its shareholders would receive a dividend of $1.67 per share on Dec 15, 2023. It has a dividend yield of 2.6%. Over the past five years, MCD has increased its dividend six times, and its payout ratio presently stays at 55% of earnings. Check MCD’s dividend history here.

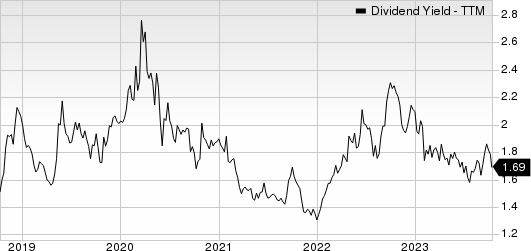

McDonald's Corporation Dividend Yield (TTM)

McDonald's Corporation dividend-yield-ttm | McDonald's Corporation Quote

RPM International has been benefitting from the solid execution of the MAP 2025 initiative, effectively utilizing its competitive advantages along with increased infrastructure spending and reshoring projects. This resulted in an all-time high in adjusted EBIT and record-breaking sales in three out of RPM’s four segments. Acquisitions, net of divestitures, also contributed to RPM’s top-line growth.

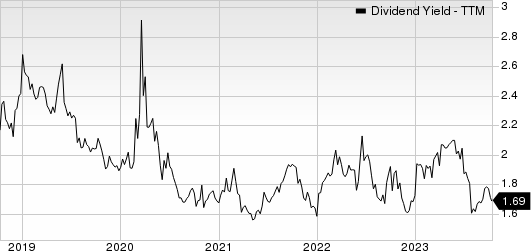

On Oct 5, 2023, RPM International declared that its shareholders would receive a dividend of $0.46 per share on Oct 31, 2023. It has a dividend yield of 1.7%. Over the past five years, RPM has increased its dividend six times, and its payout ratio presently stays at 38% of earnings. Check RPM’s dividend history here.

RPM International Inc. Dividend Yield (TTM)

RPM International Inc. dividend-yield-ttm | RPM International Inc. Quote

Lockheed Martin keeps securing big defense contracts from the Pentagon and other U.S. allies, which add up to a solid backlog count. LMT’s strong backlog boosts long-term growth. Lockheed Martin is the largest U.S. defense contractor with a steady order flow from its leveraged presence in the Army, Air Force, Navy and IT programs. The solid U.S. defense budgetary provisions should boost LMT’s businesses. LMT boasts strength in the international defense market.

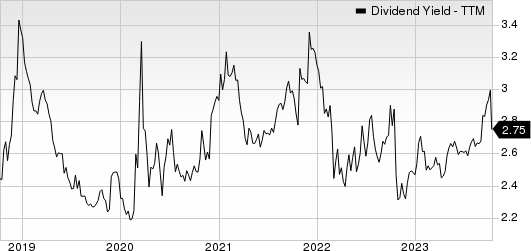

On Oct 6, 2023, Lockheed Martin declared that its shareholders would receive a dividend of $3.15 per share on Dec 29, 2023. It has a dividend yield of 3.1%. Over the past five years, LMT has increased its dividend six times, and its payout ratio presently stays at 43% of earnings. Check LMT’s dividend history here.

Lockheed Martin Corporation Dividend Yield (TTM)

Lockheed Martin Corporation dividend-yield-ttm | Lockheed Martin Corporation Quote

A. O. Smith is one of the leading manufacturers of commercial and residential water heating equipment, and water treatment products of the world. AOS specializes in offering innovative, as well as energy-efficient solutions and products, which are developed and sold on a global platform.

Improving supply chains and robust demand for commercial and residential boilers and water treatment products in North America have benefitted AOS. Higher sales from India support the Rest of the World unit’s performance amid weakness in China.

On Oct 9, 2023, A. O. Smith declared that its shareholders would receive a dividend of $0.32 per share on Nov 15, 2023. It has a dividend yield of 1.9%. Over the past five years, AOS has increased its dividend six times, and its payout ratio presently stays at 34% of earnings. Check AOS’ dividend history here.

A. O. Smith Corporation Dividend Yield (TTM)

A. O. Smith Corporation dividend-yield-ttm | A. O. Smith Corporation Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

McDonald's Corporation (MCD) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

RPM International Inc. (RPM) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report