5 Stocks in Focus on Their Recent Dividend Hike

U.S. stock markets have retreated in January after a sharp rally in 2023. The euphoria surrounding technology stocks evaporated as the yield on the benchmark 10-Year U.S. Treasury Note returned northward, trading above 4%.

This was primarily owing to the uncertainty regarding the time when the Fed would initiate the first cut in the benchmark interest rate. Recently, a few key Fed FOMC members said that although they believe that the rate hike regime is over, they are yet to be convinced that the economic condition is conducive enough for an immediate rate cut.

The Department of Labor reported that the consumer price index (CPI) — a key measure of inflation — rose 0.3% month-over-month in December, beating the consensus estimate of 0.2%. In November, CPI rose 0.1% month over month. CPI was up 3.4% in 2023 compared with the consensus estimate of 3.2%. However, in 2022, the inflation gauge was up around 6.4%.

Core CPI (excluding the volatile food and energy items) increased 0.3% in December, in line with the consensus estimate and the metric for November. Year over year, core CPI was up 3.9% in December, beating the consensus estimate of 3.8%. However, the year-over-year core CPI reading in December was the lowest since May 2021.

This triggered an alarm among market participants and resulted in volatile trading at the beginning of 2024. At present, the CME FedWatch tool is showing 73% probability that the central bank will initiate a 25-basis point rate cut in its March FOMC meeting. Last week, the probability of the first rate cut was more than 90%.

Stocks to Watch

At this stage, dividend-paying stocks should be in demand as investors try to safeguard their portfolios. We believe one should consider stocks that have recently raised their dividend payments.

Five such companies are — TD SYNNEX Corp. SNX, Alamo Group Inc. ALG, Lennar Corp. LEN, Immersion Corp. IMMR and Bank OZK OZK.

TD SYNNEX has been benefiting from the growing hybrid working trend, which is driving demand for offsite-working and learning hardware and software. Strong growth in product areas, such as networking and cloud and software-related solutions, is contributing to revenue acceleration at SNX’s technology solutions business.

A steady IT spending environment on the back of rapid digital transformation is a positive. Acquisitions and partnerships are helping SNX expand its product portfolio. SNX currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

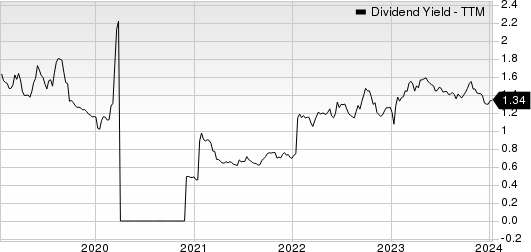

On Jan 9, 2024, TD SYNNEX declared that its shareholders would receive a dividend of $0.40 per share on Jan 26, 2024. It has a dividend yield of 1.5%. Over the past five years, SNX has increased its dividend six times, and its payout ratio presently stays at 13% of earnings. Check SNX’s dividend history here.

TD SYNNEX Corporation Dividend Yield (TTM)

TD SYNNEX Corporation dividend-yield-ttm | TD SYNNEX Corporation Quote

Alamo Group designs, manufactures, distributes, and services vegetation management and infrastructure maintenance equipment for governmental, industrial, and agricultural uses worldwide. ALG operates through two segments, Vegetation Management and Industrial Equipment.

ALG’s products include truck and tractor mounted mowing and other vegetation maintenance equipment, street sweepers, snow removal equipment, excavators, vacuum trucks, other industrial equipment, agricultural implements and related after-market parts and services. ALG currently carries a Zacks Rank #3 (Hold).

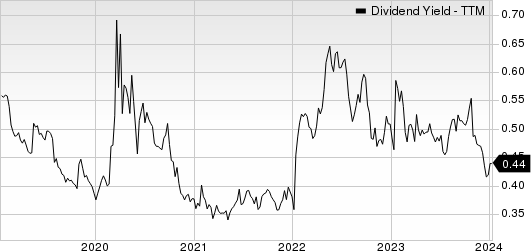

On Jan 2, 2024, Alamo Group declared that its shareholders would receive a dividend of $0.26 per share on Jan 29, 2024. It has a dividend yield of 0.4%. Over the past five years, ALG has increased its dividend six times, and its payout ratio presently stays at 8% of earnings. Check ALG’s dividend history here.

Alamo Group, Inc. Dividend Yield (TTM)

Alamo Group, Inc. dividend-yield-ttm | Alamo Group, Inc. Quote

Lennar has been benefiting from its solid operating strategy of focusing on production and sales pace over price, the land-light strategy and favorable pricing and product mix. Also, focusing on generating strong cash flow and increasing returns on equity and assets bode well for LEN. These tailwinds resulted in increased home deliveries and new orders. LEN currently carries a Zacks Rank #3.

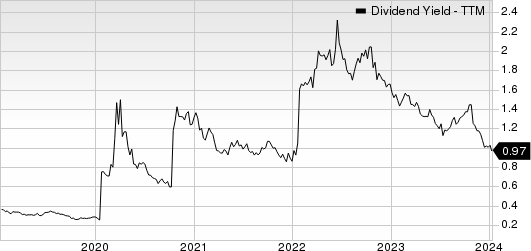

On Jan 9, 2024, Lennar declared that its shareholders would receive a dividend of $0.50 per share on Feb 7, 2024. It has a dividend yield of 1.3%. Over the past five years, LEN has increased its dividend four times, and its payout ratio presently stays at 11% of earnings. Check LEN’s dividend history here.

Lennar Corporation Dividend Yield (TTM)

Lennar Corporation dividend-yield-ttm | Lennar Corporation Quote

Immersion develops hardware and software technologies that enable users to interact with computers using their sense of touch. IMMR’s patented technologies, which are branded TouchSense, enable devices such as mice, joysticks, knobs, and medical simulation products to deliver tactile sensations that correspond to on-screen events.

IMMR focus on four application areas: computing and entertainment, medical simulation, professional and industrial, and three-dimensional capture and interaction. IMMR currently carries a Zacks Rank #3.

On Jan 11, 2024, Immersion declared that its shareholders would receive a dividend of $0.045 per share on Jan 25, 2024. It has a dividend yield of 2.9%. Over the past five years, IMMR has increased its dividend two times, and its payout ratio presently stays at 12% of earnings. Check IMMR’s dividend history here.

Immersion Corporation Dividend Yield (TTM)

Immersion Corporation dividend-yield-ttm | Immersion Corporation Quote

Bank OZK provides various retail and commercial banking services. OZK accepts various deposit products, including non-interest-bearing checking, interest bearing transaction, business sweep, savings, money market, individual retirement, and other accounts, as well as time deposits.

2OZK also offers real estate, consumer and business purposes, indirect recreational vehicle and marine, commercial and industrial, government-guaranteed, agricultural equipment, small business, lines of credit, homebuilder, and affordable housing loans, business aviation and subscription financing services, and mortgage and other lending products. OZK currently carries a Zacks Rank #3.

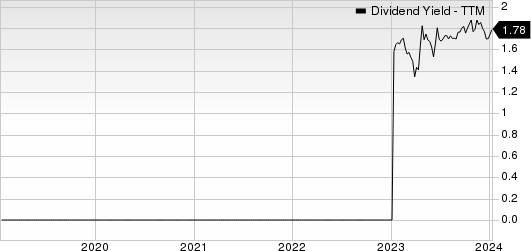

On Jan 2, 2024, Bank OZK declared that its shareholders would receive a dividend of $0.38 per share on Jan 23, 2024. It has a dividend yield of 3.2%. Over the past five years, OZK has increased its dividend 21 times, and its payout ratio presently stays at 25% of earnings. Check OZK’s dividend history here.

Bank OZK Dividend Yield (TTM)

Bank OZK dividend-yield-ttm | Bank OZK Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lennar Corporation (LEN) : Free Stock Analysis Report

TD SYNNEX Corporation (SNX) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

Immersion Corporation (IMMR) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report