5 Stocks in Focus on Their Recent Dividend Hike

U.S. stock markets have witnessed an impressive rally in the first seven months of this year after a highly disappointing 2022. After that volatility returned on Wall Street, which ended in negative territory in the last three successive months. However, Wall Street bounced back with more pace in November.

Most of the market participants are confident that the Fed is through with its current rate hike cycle buoyed by a steadily declining inflation rate, cooling down of several key economic data and a slowdown in the resilient labor market.

Despite these positives, we should remain watchful since any external disturbances like geopolitical conflict or oil price fluctuation may create volatility in markets. Moreover, we are not out of the woods, as inflation is still highly elevated.

Stocks to Watch

At this stage, dividend-paying stocks should be in demand as investors try to safeguard their portfolios. We believe one should consider stocks that have recently raised their dividend payments.

Five such companies are — Dillard's Inc. DDS, CDW Corp. CDW, TransAlta Corp. TAC, TotalEnergies SE TTE and Churchill Downs Inc. CHDN. Each of these stocks currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dillard's is a large departmental store chain featuring fashion apparel and home furnishing. As of Jul 29, Dillard's operated 274 full-line Dillard’s stores and 27 clearance stores in 29 states. DDS also sells its merchandize through the Internet at www.dillards.com. Stores are mainly located in the Southwest, Southeast, and Midwest regions of the United States.

DDS’ primary product categories comprise women’s and children’s apparel, shoes, accessories and lingerie, men’s clothing and accessories, cosmetics, home, and children’s clothing. Its merchandise mix consists of both branded and private-label items.

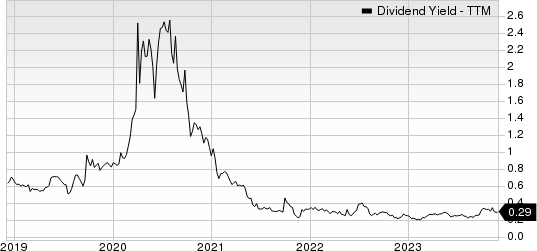

On Nov 16, 2023, Dillard's declared that its shareholders would receive a dividend of $20 per share on Jan 8, 2024. It has a dividend yield of 0.3%. Over the past five years, DDS has increased its dividend six times, and its payout ratio presently stays at 2% of earnings. Check DDS’ dividend history here.

Dillard's, Inc. Dividend Yield (TTM)

Dillard's, Inc. dividend-yield-ttm | Dillard's, Inc. Quote

CDW’s performance is affected due to weakness across the Corporate and Small Business segments. The Corporate business is affected due to a significant decline in client device demand coupled with the postponement of upgrades and utilization of existing products. Owing to the above-mentioned factors, CDW continues to expect its 2023 non-GAAP earnings to be flat to slightly down year over year. Stiff competition is a concern.

On Nov 22, 2023, CDW declared that its shareholders would receive a dividend of $0.62 per share on Dec 12, 2023. It has a dividend yield of 1.2%. Over the past five years, CDW has increased its dividend five times, and its payout ratio presently stays at 25% of earnings. Check CDW’s dividend history here.

CDW Corporation Dividend Yield (TTM)

CDW Corporation dividend-yield-ttm | CDW Corporation Quote

TransAlta is engaged in the development, production, and sale of electric energy. TAC is Canada's largest non-regulated electric generation and marketing company. TAC operates through Hydro, Wind and Solar, Gas, Energy Transition, and Energy Marketing segments.

On Nov 22, 2023, TransAlta declared that its shareholders would receive a dividend of $0.0437 per share on Apr 1, 2024. It has a dividend yield of 2%. Over the past five years, TAC has increased its dividend 14 times, and its payout ratio presently stays at 11% of earnings. Check TAC’s dividend history here.

TransAlta Corporation Dividend Yield (TTM)

TransAlta Corporation dividend-yield-ttm | TransAlta Corporation Quote

TotalEnergies is among the top five publicly traded global integrated oil and gas companies based on production volumes, proved reserves and market capitalization. TTE operates in more than 130 countries across five continents.

TTE’s operations are divided into four main segments: Exploration & Production, Integrated Gas, Renewables & Power, which spearheads TotalEnergies’ ambitions in low-carbon businesses by expanding in downstream gas and renewable energies as well as in energy efficiency businesse, Refining and Chemicals, which includes all of its bioenergies activities and a new Biofuels division and Marketing & Services, which deals with the supply and sale of petroleum products. TTE also has interests in coal mining and power generation.

On Nov 28, 2023, TotalEnergies declared that its shareholders would receive a dividend of $0.8092 per share on Jan 25, 2024. It has a dividend yield of 3.3%. Over the past five years, TTE has increased its dividend nine times, and its payout ratio presently stays at 23% of earnings. Check TTE’s dividend history here.

TotalEnergies SE Sponsored ADR Dividend Yield (TTM)

TotalEnergies SE Sponsored ADR dividend-yield-ttm | TotalEnergies SE Sponsored ADR Quote

Churchill Downs operates as a racing, online wagering, and gaming entertainment company in the United States. CHDN operates through Live and Historical Racing, TwinSpires, and Gaming segments. CHDN operates pari-mutuel gaming entertainment venues, TwinSpires, an online wagering platform for horse racing, sports, and iGaming, retail sportsbooks; and casino gaming.

CHDN also offers streaming video of live horse races, replays, and an assortment of racing and handicapping information, and provides the Bloodstock Research Information Services platform for horse racing statistical data. In addition, CHDN manufactures and operates pari-mutuel wagering systems for racetracks, off-track betting facilities, and other pari-mutuel wagering businesses.

On Nov 29, 2023, Churchill Downs declared that its shareholders would receive a dividend of $0.382 per share on Jan 5, 2024. It has a dividend yield of 0.4%. Over the past five years, CHDN has increased its dividend six times, and its payout ratio presently stays at 7% of earnings. Check CHDN’s dividend history here.

Churchill Downs, Incorporated Dividend Yield (TTM)

Churchill Downs, Incorporated dividend-yield-ttm | Churchill Downs, Incorporated Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

TransAlta Corporation (TAC) : Free Stock Analysis Report

Churchill Downs, Incorporated (CHDN) : Free Stock Analysis Report

CDW Corporation (CDW) : Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE) : Free Stock Analysis Report