5 Stocks With Recent Dividend Hike Amid August Volatility

Wall Street suffered setbacks in the past three weeks after a smooth sail in the first seven months of 2023. Market participants remain uncertain up to what level the Fed will continue to hike its interest rate. Fed’s July FOMC meeting minutes clearly indicated that a majority of officials were in favor of pursuing the rate hike cycle as the inflation rate remains well above the central bank’s target level supported by resiliency in the labor market and consumer spending.

On Aug 25, at the Jackson Hole Annual Policy Symposium of the Fed, Chairman Jerome Powell warned that the inflation rate is still high despite steady progress in the past year. Consequently, the central bank is open for more hikes in the near future.

According to Powell, “We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

Justifying chances of further interest rate hikes, Powell said, “The economy may not be cooling as expected. So far this year, GDP growth has come in above expectations and above its longer-run trend, and recent readings on consumer spending have been especially robust. In addition, after decelerating sharply over the past 18 months, the housing sector is showing signs of picking back up.”

Month to date, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — are down 2.3%, 3.% and 4.1%, respectively. The mid-cap benchmark S&P 400 and the small-cap benchmark Russell 2000 and the S&P 600 are also down 4.4%, 6.5% and 5.7%, respectively, in the same period.

Volatility is likely to continue in the near term as market participants remain cautious about the Fed FOMC meeting next month. Moreover, September is historically known as the worst-performing month on Wall Street.

Stocks to Watch

At this stage, dividend-paying stocks should be in demand as investors try to safeguard their portfolios. We believe that one should consider stocks that have recently raised their dividend payments.

Five such companies are — AAON Inc. AAON, First American Financial Corp. FAF, The Toronto-Dominion Bank TD, Royal Bank of Canada RY and NetEase Inc. NTES.

AAON is a manufacturer of air-conditioning and heating equipment consisting of rooftop units, chillers, air-handling units, condensing units and coils. AAON’s products serve the new construction and replacement markets. AAON has successfully gained market share through its semi-custom product lines, which offer the customer value, quality, function, serviceability and efficiency. AAON currently carries a Zacks Rank #2 (Buy).

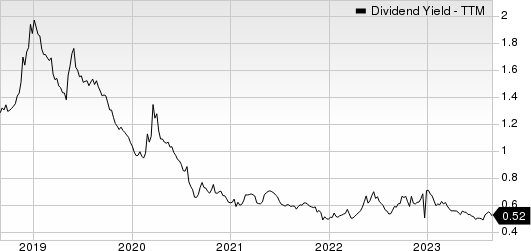

On Aug 18, 2023, AAON declared that its shareholders would receive a dividend of $0.08 per share on Sep 29, 2023. It has a dividend yield of 0.5%. Over the past five years, AAON has increased its dividend two times, and its payout ratio presently stays at 18% of earnings. Check AAON’s dividend history here.

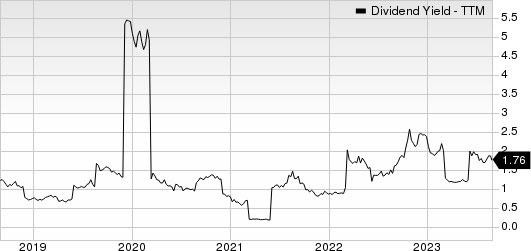

AAON, Inc. Dividend Yield (TTM)

AAON, Inc. dividend-yield-ttm | AAON, Inc. Quote

First American Financial should continue to benefit from strength in commercial business and increased demand among millennials for first-time home purchases. FAF has been actively pursuing acquisitions to strengthen its core business and expand its valuation and data businesses. First American Financial also expects increased demand among millennials for first-time home purchases. Growing direct premiums, escrow fees and agent premiums should drive revenues. FAF currently carries a Zacks Rank #3(Hold).

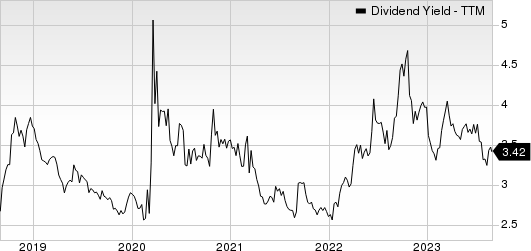

On Aug 22, 2023, First American Financial declared that its shareholders would receive a dividend of $0.53 per share on Sep 15, 2023. It has a dividend yield of 3.5%. Over the past five years, FAF has increased its dividend six times, and its payout ratio presently stays at 43% of earnings. Check FAF’s dividend history here.

First American Financial Corporation Dividend Yield (TTM)

First American Financial Corporation dividend-yield-ttm | First American Financial Corporation Quote

The Toronto-Dominion Bank is a Canadian chartered bank and offers a wide range of business and consumer services. TD’s services include checking and savings accounts, credit cards, mortgage and student loans, trusts, wills, estate planning, investment management services and financial and advisory services. TD currently carries a Zacks Rank #3.

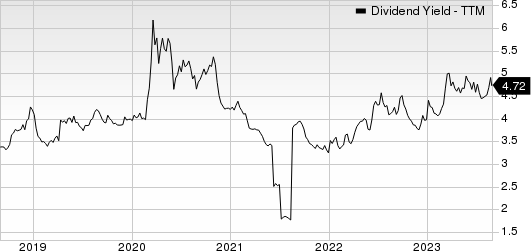

On Aug 24, 2023, The Toronto-Dominion Bank declared that its shareholders would receive a dividend of $0.725 per share on Oct 31, 2023. It has a dividend yield of 4.9%. Over the past five years, TD has increased its dividend 14 times, and its payout ratio presently stays at 47% of earnings. Check TD’s dividend history here.

Toronto Dominion Bank (The) Dividend Yield (TTM)

Toronto Dominion Bank (The) dividend-yield-ttm | Toronto Dominion Bank (The) Quote

Royal Bank of Canada operates as a diversified financial service company worldwide. RY has five segments — Personal & Commercial Banking, Wealth Management, Insurance, Investor & Treasury Services and Capital Markets. RY operate under the master brand name of RBC. RY currently carries a Zacks Rank #3.

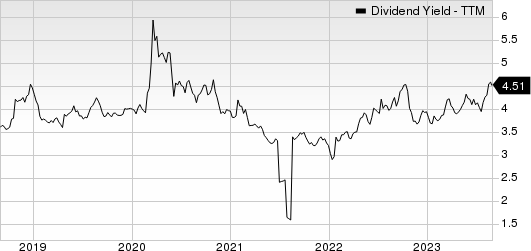

On Aug 24, 2023, Royal Bank of Canada declared that its shareholders would receive a dividend of $1.019 per share on Nov 24, 2023. It has a dividend yield of 4.5%. Over the past five years, RY has increased its dividend 16 times, and its payout ratio presently stays at 48% of earnings. Check RY’s dividend history here.

Royal Bank Of Canada Dividend Yield (TTM)

Royal Bank Of Canada dividend-yield-ttm | Royal Bank Of Canada Quote

NetEase is an Internet technology company engaged in the development of applications, services and other technologies for the Internet in China. NTES provides online gaming services that include in-house developed massively multi-player online role-playing games and licensed titles. NetEase also provides online advertising, community services, entertainment content, free e-mail services and micro-blogging services. NTES currently sports a Zacks #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

On Aug 24, 2023, NetEase declared that its shareholders would receive a dividend of $0.525 per share on Sep 22, 2023. It has a dividend yield of 2.1%. Over the past five years, NTES has increased its dividend 13 times, and its payout ratio presently stays at 33% of earnings. Check NTES’ dividend history here.

NetEase, Inc. Dividend Yield (TTM)

NetEase, Inc. dividend-yield-ttm | NetEase, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First American Financial Corporation (FAF) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Toronto Dominion Bank (The) (TD) : Free Stock Analysis Report

Royal Bank Of Canada (RY) : Free Stock Analysis Report

AAON, Inc. (AAON) : Free Stock Analysis Report