5 Stocks With Recent Dividend Hike to Watch Amid Volatility

The U.S. stock market has been fluctuating since the beginning of the year after a sharp rally in 2023. The euphoria surrounding technology stocks evaporated as the yield on the benchmark 10-Year U.S. Treasury Note returned northward, trading well above 4%.

This was primarily owing to the uncertainty regarding the timing of the Fed’s first cut in the benchmark interest rate. Recently, several key Fed FOMC members said that although they believe that the rate hike regime is over, they are yet to be convinced that the economic condition is conducive enough for an immediate rate cut.

At present, the CME FedWatch tool shows a mere 8.5% probability that the central bank will initiate a 25-basis-point rate cut in its March FOMC meeting. The probability of the first rate cut was more than 90% at the beginning of 2024. Moreover, 63.3% of market respondents currently expect the central bank to maintain the status quo of the benchmark lending rate at 5.25-5.5% even in the May FOMC meeting.

We should remain watchful since any external disturbances like geopolitical conflict or oil price fluctuation may create volatility in markets. We are not out of the woods yet as inflation is still highly elevated.

Stocks to Watch

At this stage, dividend-paying stocks are in demand as investors try to safeguard their portfolios. We believe one should consider stocks that have recently raised their dividend payments. Five such companies are — Ardmore Shipping Corp. ASC, Murphy USA Inc. MUSA, Harley-Davidson Inc. HOG, HealthStream Inc. HSTM and Analog Devices Inc. ADI.

Ardmore Shipping is engaged in the ownership and operation of product and chemical tankers. ASC provides shipping services to customers through voyage charters, commercial pools, and time charters.

ASC provides seaborne transportation of petroleum products and chemicals worldwide to oil majors, national oil companies, oil and chemical traders, and chemical companies. ASC currently carries a Zacks Rank #3 (Hold).

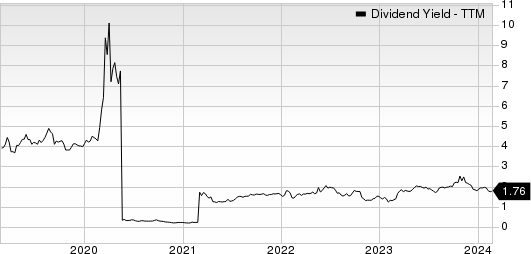

On Feb 15, 2024, Ardmore Shipping declared that its shareholders would receive a dividend of $0.21 per share on Mar 15, 2024. It has a dividend yield of 5.2%. Over the past five years, ASC has increased its dividend three times, and its payout ratio presently stays at 23% of earnings. Check ASC’s dividend history here.

Ardmore Shipping Corporation Dividend Yield (TTM)

Ardmore Shipping Corporation dividend-yield-ttm | Ardmore Shipping Corporation Quote

Murphy USA is a low-cost, high-volume fuel seller, whose stations are located near Walmart supercenters. This enables MUSA to attract significantly more transactions than its peers. MUSA’s access to pipelines and product distribution terminals is another key competitive advantage in the fiercely competitive retail environment.

The QuickChek acquisition has helped MUSA in improving its offerings. MUSA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

On Feb 15, 2024, Murphy USA declared that its shareholders would receive a dividend of $0.42 per share on Mar 7, 2024. It has a dividend yield of 0.4%. Over the past five years, MUSA has increased its dividend nine times, and its payout ratio presently stays at 6% of earnings. Check MUSA’s dividend history here.

Murphy USA Inc. Dividend Yield (TTM)

Murphy USA Inc. dividend-yield-ttm | Murphy USA Inc. Quote

Harley-Davidson is focusing on motorcycle models and technologies that better align with market trends. This strategy is in sync with long-term growth objectives to optimize HOG’s product portfolio and expand its customer base.

HOG’s Hardwire plans are intended to improve effectiveness and contribute to revenue growth. HOG remains focused on bolstering its market position by putting more emphasis on sportier bikes and a modern marketing strategy. HOG currently carries a Zacks Rank #3.

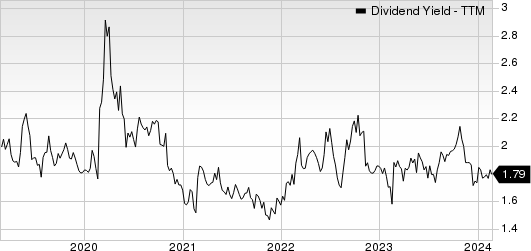

On Feb 16, 2024, Harley-Davidson declared that its shareholders would receive a dividend of $0.1725 per share on Mar 20, 2024. It has a dividend yield of 1.8%. Over the past five years, HOG has increased its dividend six times, and its payout ratio presently stays at 14% of earnings. Check HOG’s dividend history here.

Harley-Davidson, Inc. Dividend Yield (TTM)

Harley-Davidson, Inc. dividend-yield-ttm | Harley-Davidson, Inc. Quote

HealthStream provides Software-as-a-Service (SaaS) based applications for healthcare organizations in the United States. HSTM’s solutions help healthcare organizations meet their ongoing clinical development, talent management, training, education, assessment, competency management, safety and compliance, and scheduling, as well as provider credentialing, privileging, and enrollment needs.

HSTM offers hStream, a technology platform that powers a range of healthcare workforce solutions. HSTM provides its solutions to customers across a range of entities within the healthcare industry, including private, not-for-profit, and government entities, as well as pharmaceutical and medical device companies through its direct sales teams. HSTM currently carries a Zacks Rank #2 (Buy).

On Feb 19, 2024, HealthStream declared that its shareholders would receive a dividend of $0.028 per share on Mar 22, 2024. It has a dividend yield of 0.4%. Over the past five years, HSTM has increased its dividend two times, and its payout ratio presently stays at 22% of earnings. Check HSTM’s dividend history here.

HealthStream, Inc. Dividend Yield (TTM)

HealthStream, Inc. dividend-yield-ttm | HealthStream, Inc. Quote

Analog Devices has benefited from strength in the automotive market. Strong momentum across the electric vehicle space on the back of its robust Battery Management System solutions remains a tailwind for ADI.

Massive investments in technology and business innovation are contributing well. Increasing power design wins is another positive for ADI. The solid momentum of ADI’s HEV platform across the cabin electronics ecosystem is a positive too. ADI currently carries a Zacks Rank #3.

On Feb 20, 2024, Analog Devices declared that its shareholders would receive a dividend of $0.92 per share on Mar 15, 2024. It has a dividend yield of 1.9%. Over the past five years, ADI has increased its dividend six times, and its payout ratio presently stays at 34% of earnings. Check ADI’s dividend history here.

Analog Devices, Inc. Dividend Yield (TTM)

Analog Devices, Inc. dividend-yield-ttm | Analog Devices, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Harley-Davidson, Inc. (HOG) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

HealthStream, Inc. (HSTM) : Free Stock Analysis Report

Ardmore Shipping Corporation (ASC) : Free Stock Analysis Report