5 Stocks Set to Beat on Earnings Today After the Closing Bell

We are in the second half of the second-quarter 2023 earnings season. So far, the earnings results are not great but they are not bad either. Moreover, the outlook given by companies that have already reported is far better than expected.

As of Aug 4, 423 S&P 500 companies reported earnings results. Total earnings of these companies are down 9.7% year over year on 0.2% higher revenues. Of these, 79.4% surpassed EPS estimates while 65.5% outpaced revenue estimates.

At present, our estimate has shown that the total earnings of the S&P 500 Index will likely decline 9.2% year over year on 0.2% lower revenues. The second-quarter earnings decline would follow the 3.4% decline in the first quarter and a 5.4% drop in fourth-quarter 2022.

More than 1,000 companies will report this week. We have selected five such companies with a favorable Zacks Rank that are poised to beat earnings estimates. The combination of a possible earnings beat and a favorable Zacks Rank should drive their stocks in the near future.

Our Top Picks

We have narrowed our search to five stocks that are set to declare earnings results on Aug 7 after the closing bell. Each of our picks carries a Zacks Rank #2 (Buy) and has a positive Earnings ESP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings release. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

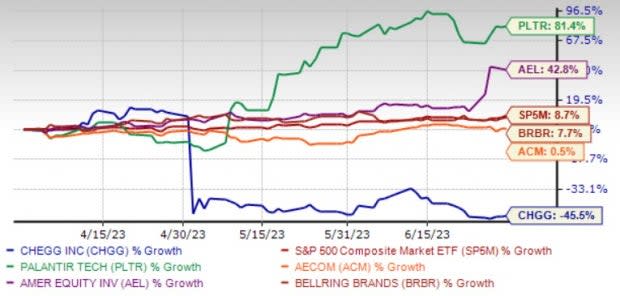

The chart below shows the price performance of our five picks in the last quarter.

Image Source: Zacks Investment Research

AECOM ACM is benefiting from robust contributions from the Americas and International segments. ACM’s solid backlog level of $41.98 billion, as of the fiscal second quarter of 2023, indicates significant opportunities in the forthcoming quarters.

Management remains focused on leveraging ACM’s scale and technical leadership. ACM plans to do so by simplifying the operating model to drive greater collaboration across the business segment and push digital innovation.

AECOM has an Earnings ESP of +1.05%. It has an expected earnings growth rate of 6.9% for the current year (ending September 2023). The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 30 days. ACM recorded earnings surprises in the last four reported quarters, with an average beat of 4.8%.

Palantir Technologies Inc. PLTR builds and deploys software platforms for the intelligence community in the United States to assist in counterterrorism investigations and operations. PLTR provides Palantir Gotham, a software platform that enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants.

Palantir Technologies has an Earnings ESP of +10%. It has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 5% over the last 90 days.

Chegg Inc. CHGG provides a social education platform. CHGG rents and sells print textbooks; and provides eTextbooks, supplemental materials, homework help, textbook buyback, courses, and college admissions and scholarship services, as well as offers enrollment marketing and brand advertising services.

Chegg has an Earnings ESP of +20.89%. CHGG recorded earnings surprises in the last four reported quarters, with an average beat of 10.3%.

American Equity Investment Life Holding Co.‘s AEL fixed index and fixed rate annuity products assure principal protection, competitive rates of credited interest, tax-deferred growth, guaranteed lifetime income and alternative payout options poise it well to benefit, given its targeted demography.

AEL remains focused on expanding into middle market credit, real estate, infrastructure debt and agricultural loans. Solid returns on partnerships and lower average cash balances should benefit average yields on invested assets.

American Equity Investment Life Holding has an Earnings ESP of +0.77%. It has an expected earnings growth rate of 76.6% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.2% over the last 30 days. AEL recorded earnings surprises in three out of the last four reported quarters, with an average beat of 13%.

BellRing Brands Inc. BRBR manufactures and sells nutrition products. BRBR offers protein shakes, other RTD beverages, powders and nutrition bars and supplements. BRBR offers products under the Premier Protein, Dymatize and PowerBar, as well as Joint Juice and Supreme Protein brands.

BellRing Brands has an Earnings ESP of +1.63%. It has an expected earnings growth rate of 9.5% for the current year (ending September 2023). The Zacks Consensus Estimate for current-year earnings has improved 8% over the last 90 days. BRBR recorded earnings surprises in the last four reported quarters, with an average beat of 11.7%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

American Equity Investment Life Holding Company (AEL) : Free Stock Analysis Report

Chegg, Inc. (CHGG) : Free Stock Analysis Report

BellRing Brands Inc. (BRBR) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report