5 Stocks to Watch as the Alcohol Industry Trends Turn Unfavorable

Players in the Zacks Beverages – Alcohol industry have been witnessing product shortages due to supply delays and other logistic issues. Escalated input, freight and packaging costs, along with higher advertising and marketing expenses, may continue to be headwinds for the industry participants. However, companies in the alcohol space are placed to benefit from the continued recovery across markets and channels, robust demand for premium and high-quality products, and innovative spirits. The diversification of product portfolios of alcohol companies has been helping boost their top lines. Companies are expected to benefit from the momentum in spirits and ready-to-drink (RTD) cocktails.

Investments in product innovations, premiumization and technology platforms bode well for players like Constellation Brands Inc. STZ, Brown-Forman (BF.B), Molson Coors TAP, The Boston Beer Company SAM and The Duckhorn Portfolio NAPA.

About the Industry

The Zacks Beverages – Alcohol industry mainly comprises producers, importers, exporters, marketers and sellers of alcoholic beverages like beer, craft beer, ciders, wine, rum, whiskey, liqueurs, vodka, tequila, champagnes, brandy, amaretto, RTD cocktails and malt. Some industry players also produce and sell non-alcoholic beverages like carbonated soft drinks, sparkling waters, bottled water, energy drinks, powdered and natural juices, and RTD teas. The companies sell products through wholesalers and retailers like supermarkets, warehouse clubs, grocery stores, convenience stores, package stores, drug stores and other retail outlets. The industry participants also sell beer directly to consumers in cans and bottles at restaurants, pubs, bars and liquor stores. Some brewers operate brewpubs or taste rooms at breweries, offering consumers the freshest beer.

What's Shaping the Future of Beverages - Alcohol Industry

Supply-Chain Disruptions & Higher Freight Costs: Players in the alcohol industry have been enduring pressures from the ongoing supply-chain constraints, and the impacts of inflationary labor, transportation and commodity costs. The industry players have been experiencing elevated ingredient and other input costs, including shipping and freight, labor, trucking, fuel, co-packing fees, secondary packaging materials, and increased outbound freight costs, leading to increased costs of sales and higher operating costs. These have been resulting in adverse gross and operating margins for beverage companies.

Elevated Costs: Apart from elevated input and packaging costs, players in the alcohol industry are anticipated to witness higher advertising and promotional expenses, as well as SG&A costs, further threatening profitability. Rising brand investments, particularly in media, advertising, production and local marketing, and increased freight to distributors due to higher volumes are resulting in elevated advertising, promotional and selling expenses. Growing external costs, increased compensation expenses and higher discretionary spending are expected to drive SG&A deleverage. Most industry players expect the trend to continue in the near term, impacting profitability to some extent.

Premiumization & Product Diversification: Premiumization has been a key growth driver for players in the alcohol space due to consumers’ continued desires for refreshing and newer tastes. Many beverage companies are diversifying their product offerings to capture more sales. Alcohol companies have also been witnessing robust demand trends for premium and high-end products. As a result, the companies focused on innovation and portfolio premiumization stand to gain from today’s market. Players have been exploring opportunities beyond the traditional beer, whiskey, spirits and wine categories. Some popular variations, which have gained traction, include RTD spirits like canned wine and cocktails, hard seltzers, cider, and flavored malt beverages. To capitalize on the priority and consumer trends, companies have been resorting to innovative products. Notably, RTD has emerged as the fastest-growing alcohol segment. Many companies in the industry have collaborated to grow their shares in the fast-growing RTD category.

E-Commerce Development & Pricing Gains: Alcohol companies have been benefiting from the rise of e-commerce, and the recovery across markets and channels, boosting volume. Investments in online and e-commerce portals have gained prominence. Companies have been investing in the latest capabilities, and leveraging technology to better connect with customers and consumers. With a recovery in markets and channels, and the expansion of digital capabilities, players in the alcohol space look well-poised for growth. Additionally, companies have been benefiting from price increases and supply productivity savings, offsetting the effects of cost inflation. Effective marketing and exceptional commercial execution have been boosting the sale of alcohol companies.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Beverages – Alcohol industry is an 18-stock group within the broader Zacks Consumer Staples sector. The industry currently carries a Zacks Industry Rank #163. The rank places it at the bottom 35% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Underperforms S&P 500

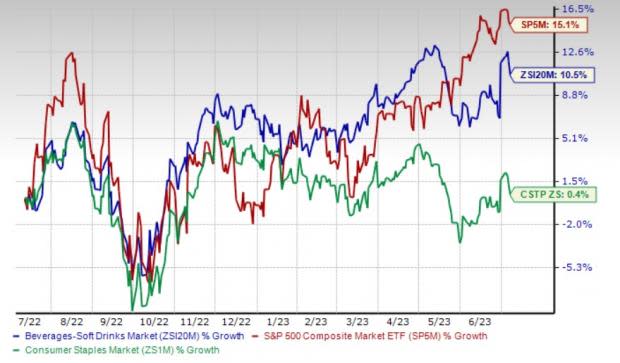

The Zacks Beverages – Alcohol industry has outperformed the broader sector and underperformed the S&P 500 in the past year.

While the stocks in the industry have collectively grown 10.5%, the Zacks S&P 500 composite and the Zacks Consumer Staples sector have soared 0.4% and 15.1%, respectively.

One-Year Price Performance

Beverages - Alcohol Industry's Valuation

Based on the forward 12-month price-to-earnings (P/E) ratio, commonly used for valuing Consumer Staples stocks, the industry is currently trading at 20.54X compared with the S&P 500’s 19.45X and the sector’s 18.07X.

Over the last five years, the industry traded as high as 23.97X, as low as 19.15X and at the median of 22.22X, as the chart below shows.

Price-to-Earnings Ratio (Past 5 Years)

5 Alcohol Beverages Stocks to Keep a Close Eye on

One stock in the Zacks Beverages – Alcohol space currently sports a Zacks Rank #1 (Strong Buy), while two stocks have a Zacks Rank #2 (Buy). Also, we have selected two Zacks Rank #3 (Hold) stocks to watch from the same industry. You can see the complete list of today’s Zacks #1 Rank stocks here.

Let’s have a look at the companies.

Duckhorn: The company, formerly known as Mallard Intermediate, Inc., produces and sells wines in North America. Duckhorn’s brand equity, diversified omni-channel platform and highly flexible supply chain position it to capitalize on the heightened interest and demand for high-quality wine. These have also been aiding NAPA’s sales and volume growth.

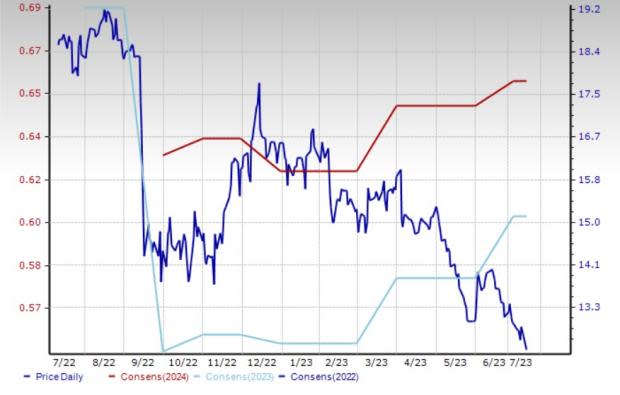

The Saint Helena, CA-based company sells wines to distributors. NAPA also sells the same directly to retail accounts and consumers. The Zacks Consensus Estimate for Duckhorn’s fiscal 2023 sales and earnings suggests growth of 8.3% and 4.8%, respectively, from the year-ago period’s reported figures. The consensus mark for fiscal 2023 earnings has moved up 3.2% in the past 30 days. NAPA has declined 33.2% in the past year. The company flaunts a Zacks Rank #1 at present.

Price and Consensus: NAPA

Molson Coors: The stock of this Chicago, IL-based leading beverage company has gained 14.1% in the past year. TAP is on track with its revitalization plan focused on achieving sustainable top-line growth by streamlining its organization and reinvesting resources into its brands and capabilities. Investments, partnerships and product launches, which are part of its revitalization plan, have been aiding the company. Molson Coors has been committed to growing its market share through innovation and premiumization. Intending to accelerate portfolio premiumization, TAP has been aggressively growing its above-premium portfolio in the past few years.

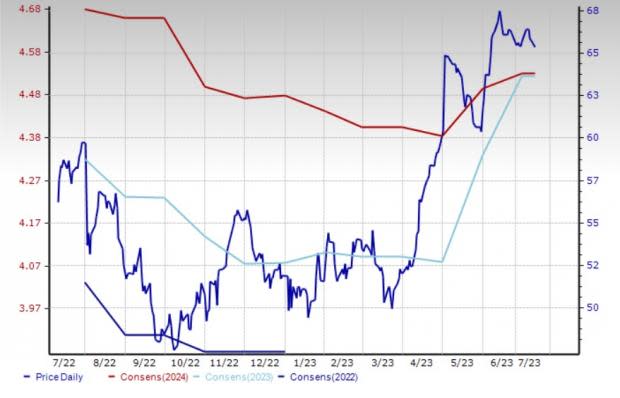

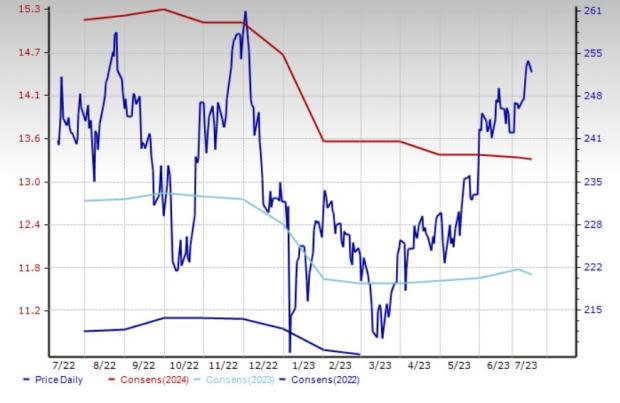

The consensus estimate for Molson Coors’ 2023 EPS has moved up 2.5% in the past 30 days. The consensus estimate for 2023 sales and earnings suggests growth of 5.3% and 10.2%, respectively, from the year-ago period’s reported figures. TAP currently has a Zacks Rank #2.

Price and Consensus: TAP

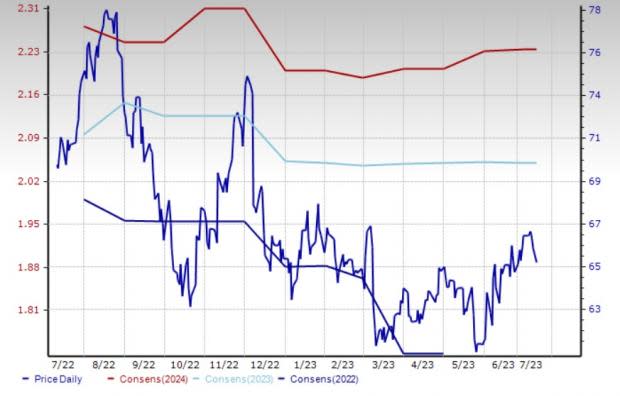

Boston Beer: Boston Beer is the largest premium craft brewer in the United States and commands a strong portfolio of globally recognized brands. The company produces beer, malt beverages and cider products at company-owned breweries and under contract. We expect its continued focus on pricing, product innovation, growth of non-beer categories and brand development to boost its operational performance and position in the market. SAM is on track with growth of its Beyond Beer category. Beyond Beer is growing faster than the traditional beer market, and the company expects this trend to continue for several years.

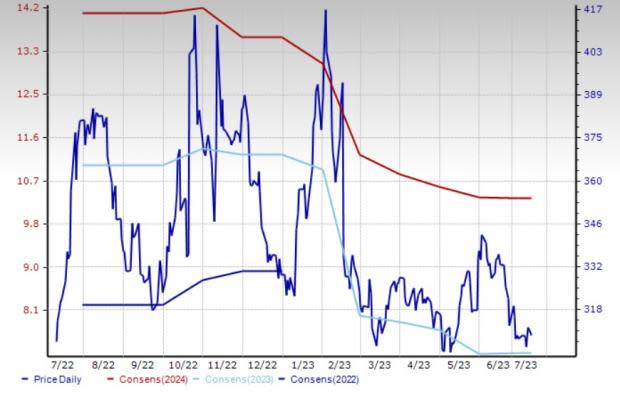

SAM has been committed to the three-point growth plan focused on the revival of its Samuel Adams and Angry Orchard brands, cost-saving initiatives, and long-term innovation. The company is focused on accelerated cost savings and efficiency projects, with savings directed toward further brand development. The Zacks Consensus Estimate for Boston Beer’s 2023 earnings suggests growth of 1.8% from the year-ago period’s reported figure. The consensus mark for the company’s 2023 earnings has moved up by a penny in the past 30 days. SAM has declined 1.5% in the past year. It carries a Zacks Rank #2 at present.

Price and Consensus: SAM

Constellation Brands: The Victor, NY-based third-largest beer company and a leading, high-end wine company in the United States has been benefiting from the constant focus on brand building and initiatives to include the latest products. STZ is poised to benefit from its premiumization strategy, driven by the continued strength in the Modelo and Corona Brand Family, as well as growth in the Power Brands. The beer segment has been gaining from premiumization, driven by growth in the traditional beer and flavors category, including seltzers, flavored beer, RTD spirits and flavored malt beverages. The company has been making investments to fuel growth of its power brands through innovation, capitalizing on priority and consumer trends, with successful product introductions. STZ is also on track to invest in the next phase of capacity expansion in Mexico.

Constellation Brands has been benefiting from consumers’ shift to e-commerce for buying alcoholic beverages. Its digital business has been gaining from platforms like Instacart, Drizly and other retailer online sites, as consumers look for the convenience offered by the channels, which is likely to continue. The Zacks Consensus Estimate for Constellation Brands’ fiscal 2024 earnings per share (EPS) has moved up 0.7% in the past seven days. The consensus estimate for fiscal 2024 earnings suggests growth of 9.8% from the year-ago period’s reported figure. The STZ stock has gained 4.6% in the past year. It has a Zacks Rank #3 at present.

Price and Consensus: STZ

Brown-Forman: The Louisville, KY-based leading alcoholic beverages company has been benefiting from increased demand for its brands, mainly Jack Daniel’s Tennessee Whiskey, and growth across all regions and the Travel Retail channel. The company is focused on investing in the diversification of its brand portfolio to drive growth. For more than a decade, Jack Daniel's Tennessee Whiskey has been the key contributor to the company’s growth in the United States. The company is investing in organically accelerating growth of two fast-growing spirits categories, bourbon and tequila. The balanced portfolio investments are likely to support its record of consistent growth.

The consensus estimate for Brown-Forman’s fiscal 2023 EPS has moved down by a penny in the past 30 days. The Zacks Consensus Estimate for fiscal 2023 sales and earnings suggests growth of 6.6% and 8.5%, respectively, from the year-ago period’s reported figures. BF.B has declined 6.5% in the past year. It currently has a Zacks Rank #3.

Price and Consensus: BF.B

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Constellation Brands Inc (STZ) : Free Stock Analysis Report

Brown-Forman Corporation (BF.B) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

The Duckhorn Portfolio, Inc. (NAPA) : Free Stock Analysis Report