5 Stocks to Watch on Recent Dividend Hikes Amid Volatility

The U.S. stock markets are in a selloff mode due to domestic and geopolitical risks. Rising bond yield is spreading panic among investors. The U.S. 10-Treasury bond yield is trading near 5%, the highest since 2006-07. Bond yields continued to surge after the Federal Reserve decided to keep a higher high-interest rate for a prolonged period to meet its 2% inflation target. The Dow, the S&P 500 and the Nasdaq lost 7.1%, 8.8% and 10.4%, respectively, in the past three months.

Federal Reserve Chairman Jerome Powell continues to stress for a stable inflation rate. However, the consumer price index for August rose 3.7% year on year from 3.2% in July. The inflation level saw a favorable decline till June at 3%. To achieve its target, the Fed has keptthe overnight interest rate at 5.25-5.5%, which is the highest in 22 years. This has pushed the cost of borrowing to a range that average Americans and corporations are not used to. Despite witnessing high borrowing costs for the past 18 months, the question remains whether the tight monetary policy was able to slow the momentum of economic growth.

An advance estimate of third-quarter U.S. gross domestic product (GDP) released by The Bureau of Economic Analysis showed the economy grew at an annualized pace of 4.9%, the fastest in nearly two years. The labor market remains strong and is still fueling inflation. The nonfarm payroll employment for the month of September rose by 336,000, and the unemployment rate remained unchanged at 3.8%. This resilience of the economy has left investors worried about how the hawkish Federal Reserve will react if the economy heats up further.

Internationally escalating geopolitical tension in the Middle East due to the war between Israel and the Palestine-based militant group Hamas has yet again shattered investors’ confidence. The recent conflict has impacted the global supply chain and will also hurt corporate performance.

Keeping such a critical situation in mind, prudent investors who wish to park their money for regular income and capital preservation can invest in dividend stocks. These companies, due to their well-established businesses, pay out regular dividends and remain profitable due to their proven business models. Companies that tend to reward investors with a high dividend payout outperform non-dividend-paying stocks in a highly volatile market.

On that note, let us look at companies like West Pharmaceutical Services WST, Standex International SXI, Waste Connections WCN, Marathon Petroleum MPC and Equinix EQIX that have lately hiked their dividend payouts.

West Pharmaceutical Services is headquartered in Exton, PA. This Zacks Rank #2 (Buy) company is a leading global manufacturer with respect to the design and production of technologically advanced, high-quality, integrated containment and delivery systems for injectable drugs and healthcare products. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

On Oct 26, WST declared that its shareholders would receive a dividend of 20 cents a share on Nov 15, 2023. WST has a dividend yield of 0.2%.

Over the past five years, WST has increased its dividend four times, and its payout ratio presently sits at 10% of earnings. Check West Pharmaceutical Services’ dividend history here.

West Pharmaceutical Services, Inc. Dividend Yield (TTM)

West Pharmaceutical Services, Inc. dividend-yield-ttm | West Pharmaceutical Services, Inc. Quote

Standex International is headquartered in Salem, NH. This Zacks Rank #3 (Hold) company is a diversified manufacturer producing and marketing various useful, quality products.

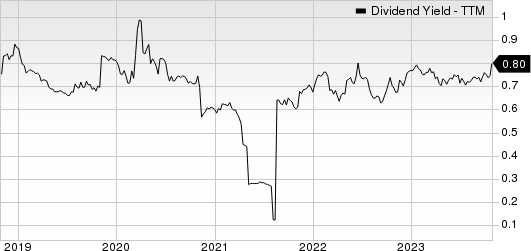

On Oct 26, SXI declared that its shareholders would receive a dividend of 30 cents a share on Nov 22, 2023. SXI has a dividend yield of 0.8%.

In the past five years, SXI has increased its dividend five times. Its payout ratio at present sits at 17% of earnings. Check Standex International’s dividend history here.

Standex International Corporation Dividend Yield (TTM)

Standex International Corporation dividend-yield-ttm | Standex International Corporation Quote

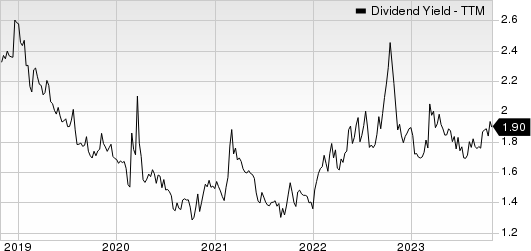

Waste Connections is headquartered in Woodbridge, Canada. This Zacks Rank #3 integrated solid waste services company provides non-hazardous waste collection, transfer, disposal and recycling services across the United States and Canada.

On Oct 25, WCN declared that its shareholders would receive a dividend of 29 cents a share on Nov 28, 2023. WCN has a dividend yield of 0.7%.

In the past five years, WCN has increased its dividend five times. Its payout ratio at present sits at 26% of earnings. Check Waste Connections’ dividend history here.

Waste Connections, Inc. Dividend Yield (TTM)

Waste Connections, Inc. dividend-yield-ttm | Waste Connections, Inc. Quote

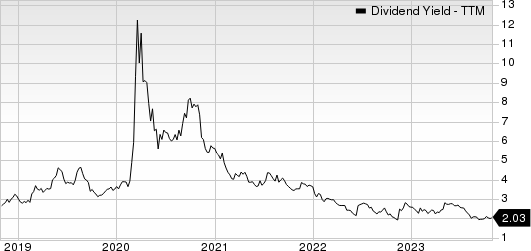

Marathon Petroleum is headquartered in Findlay, OH. This Zacks Rank #2 company is a leading independent refiner, transporter and marketer of petroleum products.

On Oct 25, MPC declared that its shareholders would receive a dividend of 83 cents a share on Nov 12, 2023. MPC has a dividend yield of 2%.

In the past five years, MPC has increased its dividend three times. Its payout ratio at present sits at 12% of earnings. Check Marathon Petroleum’s dividend history here.

Marathon Petroleum Corporation Dividend Yield (TTM)

Marathon Petroleum Corporation dividend-yield-ttm | Marathon Petroleum Corporation Quote

Equinix is a global digital infrastructure company. This Zacks Rank #1 (Strong Buy) company combines a global footprint of International Business Exchange or IBX data centers, interconnection solutions and edge services for deploying networks.

On Oct 25, EQIX announced that its shareholders would receive a dividend of $4.26 a share on Dec 13, 2023. EQIX has a dividend yield of 2%.

Over the past five years, EQIX has increased its dividend five times. Its payout ratio now sits at 43% of earnings. Check Equinix's dividend history here.

Equinix, Inc. Dividend Yield (TTM)

Equinix, Inc. dividend-yield-ttm | Equinix, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equinix, Inc. (EQIX) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

Waste Connections, Inc. (WCN) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Standex International Corporation (SXI) : Free Stock Analysis Report