5 Stocks to Watch on Recent Dividend Hikes Amid Volatility

A continuous selloff in the U.S. stock market is spreading panic among investors. The CBOE Volatility Index, which generally measures the fear gauge, touched 19.78 on Oct 3, the highest level since May 2023. Also, the U.S. Treasury 10-year and 30-year bond yield touched 4.75% and 4.93%, respectively, hitting the highest level since 2007. The bond yields continued to surge after the Federal Reserve decided to keep a higher high interest rate for a prolonged period to meet its 2% inflation target.

The consumer price index for the month of August rose 3.7% year on year from 3.2% in July. The inflation level saw a favorable decline till June at 3%. The recent increase in prices is mostly due to a rise in oil prices. Depleting U.S. oil reserves and an increase in oil demand amid tighter supply due to OPEC+ members' decision to cut oil production by 1.3 million barrels per day till the end of 2023 have pushed oil prices over $95/barrel.

The Fed kept the overnight interest rates unchanged at the 5.25-5.5% range in its last policy meeting, providing an interim relief to investors. The current interest is the highest in more than 22 years. Such high interest rates have pushed the cost of borrowing higher, which average Americans and corporates are not used to. However, it has left the doors open for another rate hike till the end of this year to counter further spike in inflation levels. Prolonged high interest rates may push various industries and the overall economy into a recession.

The recent catalyst that added to the fear of further rate hikes among investors was the release of August job openings data that surpassed street expectations by adding 690,000 positions, signaling a tight labor market. A still-strong labor market is fueling inflation. However, the Fed expects easing of the labor market.

Keeping such a critical situation in mind, prudent investors who wish to park their money for regular income and capital preservation can invest in dividend stocks. These companies, due to their well-established businesses, pay out regular dividends and remain profitable due to their proven business models. Companies that tend to reward investors with a high dividend payout outperform non-dividend-paying stocks in a highly volatile market.

On that note, let us look at companies like Honeywell International HON, Howmet Aerospace HWM, CenterPoint Energy CNP, Accenture ACN and Glacier Bancorp GBCI that have lately hiked their dividend payouts.

Honeywell International is a diversified technology and manufacturing company. This Zacks Rank #3 (Hold) company has a solid footprint in the aerospace industry, with commercial aviation and defense being two major business sources. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

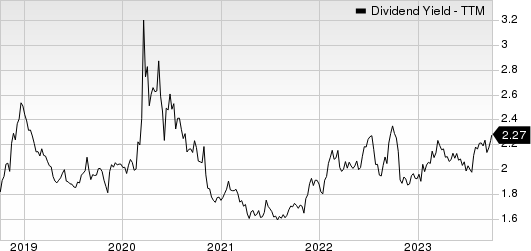

On Sep 29, HON declared that its shareholders would receive a dividend of $1.08 a share on Dec 1, 2023. HON has a dividend yield of 2.3%.

Over the past five years, HON has increased its dividend six times, and its payout ratio presently sits at 45% of earnings. Check Honeywell International’s dividend history here.

Honeywell International Inc. Dividend Yield (TTM)

Honeywell International Inc. dividend-yield-ttm | Honeywell International Inc. Quote

Howmet Aerospace is headquartered in Pittsburgh, PA. This Zacks Rank #2 (Buy) company is engaged in providing engineered solutions for customers in the transportation and aerospace (both defense and commercial) industries.

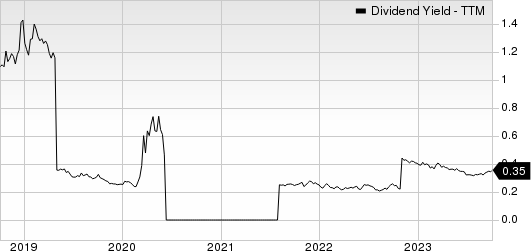

On Sep 28, HWM declared that its shareholders would receive a dividend of 5 cents a share on Nov 27, 2023. HWM has a dividend yield of 0.4%.

In the past five years, HWM has increased its dividend three times. Its payout ratio at present sits at 10% of earnings. Check Howmet Aerospace’s dividend history here.

Howmet Aerospace Inc. Dividend Yield (TTM)

Howmet Aerospace Inc. dividend-yield-ttm | Howmet Aerospace Inc. Quote

CenterPoint Energy is a domestic energy delivery company. This Zacks Rank #3 company provides electric transmission & distribution, natural gas distribution and competitive natural gas sales and services operations.

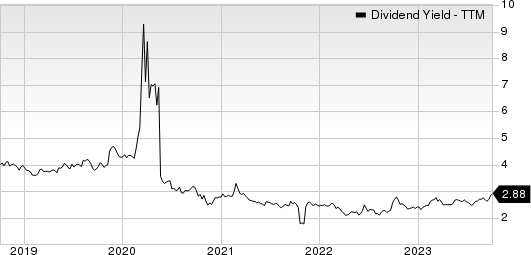

On Sep 28, CNP declared that its shareholders would receive a dividend of 20 cents a share on Dec 14, 2023. CNP has a dividend yield of 3.0%.

In the past five years, CNP has increased its dividend seven times. Its payout ratio at present sits at 55% of earnings. Check CenterPoint Energy’s dividend history here.

CenterPoint Energy, Inc. Dividend Yield (TTM)

CenterPoint Energy, Inc. dividend-yield-ttm | CenterPoint Energy, Inc. Quote

Accenture is headquartered in Dublin, Ireland. This Zacks Rank #3 professional services company provides strategy and consulting, interactive, industry X, song, and technology and operation services worldwide.

On Sep 28, ACN declared that its shareholders would receive a dividend of $1.29 a share on Nov 15, 2023. ACN has a dividend yield of 1.5%.

In the past five years, ACN has increased its dividend five times. Its payout ratio at present sits at 38% of earnings. Check Accenture’s dividend history here.

Accenture PLC Dividend Yield (TTM)

Accenture PLC dividend-yield-ttm | Accenture PLC Quote

Glacier Bancorp is a bank holding company. This Zacks Rank #3 company provides commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities in the United States.

On Sep 27, GBCI announced that its shareholders would receive a dividend of 33 cents a share on Oct 19, 2023. GBCI has a dividend yield of 4.6%.

Over the past five years, GBCI has increased its dividend eight times. Its payout ratio now sits at 53% of earnings. Check Glacier Bancorp's dividend history here.

Glacier Bancorp, Inc. Dividend Yield (TTM)

Glacier Bancorp, Inc. dividend-yield-ttm | Glacier Bancorp, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accenture PLC (ACN) : Free Stock Analysis Report

Honeywell International Inc. (HON) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Glacier Bancorp, Inc. (GBCI) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report