5 Textile - Apparel Stocks to Watch Despite Industry Headwinds

Persistent inflationary pressure and supply-chain disruptions have been a concern for several Zacks Textile - Apparel industry players. Escalated SG&A expenses are also hurting many companies in the space. In addition, reduced discretionary spending due to an overall inflationary landscape has been a concern.

Nevertheless, brand enhancement techniques, including innovations along with efforts to enhance store and digital operations keep lululemon Athletica Inc. LULU, Ralph Lauren Corporation RL, Crocs, Inc. CROX, Guess?, Inc. GES and G-III Apparel Group, Ltd. GIII well-positioned.

About the Industry

The Zacks Textile - Apparel industry includes companies and lifestyle brands that manufacture, design, distribute, source, market and sell apparel, footwear and accessories for men and women. These include fashion apparel like dresses, pants, skirts, shorts, shirts, jackets, blouses and knitwear and intimate apparel like underwear and shapewear. The industry also comprises companies offering apparel for a healthy lifestyle and athletic activities, such as yoga, running and training, to name a few. Some companies also deal with fitness-related accessories like gloves, bags, headwear and sports masks. The industry participants operate through direct-to-consumer (brick-and-mortar and online), wholesale and licensing distribution channels. Most players operate through stores and digital networks in the United States and internationally.

3 Trends Shaping the Future of the Textile - Apparel Industry

Escalated Costs: Players in the Textile-apparel space are encountering escalated input cost inflation, persistently weighing on their profits. Companies continue to battle supply-chain hurdles stemming from port congestions, increasing freight prices and wide-scale shortages of materials. Textile-apparel players have been witnessing higher SG&A costs as well. Elevated marketing expenses and increased investments toward enhancing store and digital operations have spiked SG&A costs. These factors pose threats to companies’ margins. Moreover, the impact of lower demand due to inflation, rising interest rates and reduced discretionary spending is a significant concern for the payers.

International Exposure Poses Risks: Due to a vast international presence, the same company es are exposed to volatile foreign currency movements. Political unrest, like turmoil related to the current geopolitical events and related sanctions, restrictions or other responses, could also dent companies’ performance.

Brand-Enhancing Endeavors: Efforts to bolster brands via marketing strategies, licensing deals, buyouts and alliances will likely keep supporting textile-apparel players. New product launches are also an essential part of their growth. These companies regularly enhance products through innovation to remain competitive and tap evolving consumer preferences. Textile-apparel players are focused on investments to enhance the in-store experience. Consumers’ growing inclination toward online shopping has put e-commerce at the forefront for players in the textile-apparel industry.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Textile – Apparel industry is housed within the broader Zacks Consumer Discretionary sector. The industry currently carries a Zacks Industry Rank #191, which places it in the bottom 24% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all member stocks, indicates dim near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries results from a negative aggregate earnings outlook for the constituent companies. Looking at the aggregate earnings estimate revisions, analysts are gradually becoming less confident about this group’s earnings growth potential. Since the beginning of April 2023, the industry’s earnings estimate for the current financial year has fallen 7.6%.

Let’s look at the industry’s performance and current valuation.

Industry vs. Broader Market

The Zacks Textile - Apparel industry has underperformed the broader Zacks Consumer Discretionary sector as well as the S&P 500 composite in the past year.

The industry has declined 3.7% during this period against the broader sector’s growth of 3.5%. Meanwhile, the S&P 500 has rallied 9.7% in the same period.

One-Year Price Performance

Industry's Current Valuation

On the basis of forward 12-month price-to-earnings (P/E), commonly used for valuing consumer discretionary stocks, the industry is currently trading at 11.83X compared with the S&P 500’s 19.24X and the sector’s 17.24X.

Over the last five years, the industry has traded as high as 29.58X, as low as 9.73X and at the median of 17.25X, as the chart below shows.

Price-to-Earnings Ratio (Past 5 Years)

5 Textile - Apparel Stocks to Keep a Close Eye On

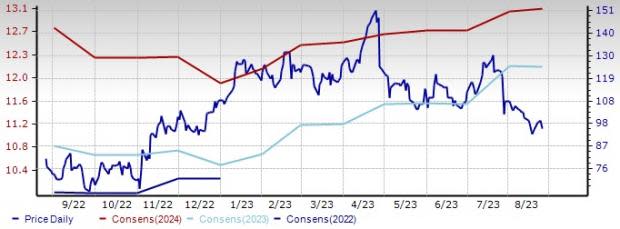

Crocs: The designer, developer, manufacturer, marketer and distributor of casual lifestyle footwear and accessories currently carries a Zacks Rank #2 (Buy). Crocs has been benefiting from continued consumer demand for new clogs and sandals and continued momentum in Crocs and HEYDUDE brands. Focusing on product innovation and effective marketing has been working well for the company. CROX has been on track with expanding digital and omnichannel capabilities. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Crocs’ current fiscal year earnings per share (EPS) has climbed 4.8% in the past 30 days to $12.14. The stock has rallied 23.3% in the past year.

Price and Consensus: CROX

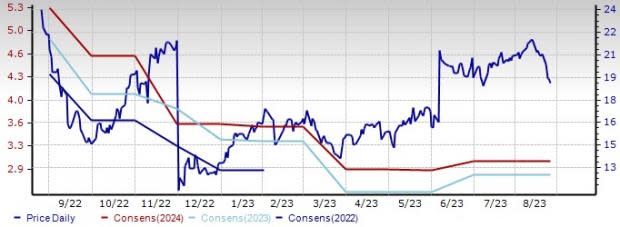

Guess?: The Zacks Rank #2 company designs, markets, distributes and licenses lifestyle collections of apparel and accessories. Guess? has been benefiting from its solid digital business. Management has been progressing with its customer-centric initiatives, including omnichannel capabilities, advanced data analytics and customer segmentation. Guess?’s commitment to six key strategies has been yielding well. These include organization and culture, functional capacities, brand relevance with three main consumer groups (heritage, Millennials and Generation Z customers), customer focus, product brilliance and international footprint. The Zacks Consensus Estimate for Guess?’s current fiscal-year EPS has remained unchanged in the past 30 days at $2.81. GES’s stock has gained 20.4% in the past year.

Price and Consensus: GES

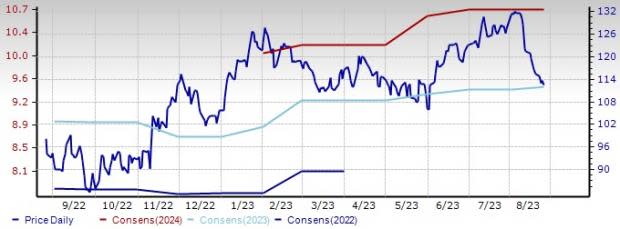

G-III Apparel: The company designs, sources and markets women's and men's apparel. G-III Apparel accelerated its digital growth and strives to become the best omnichannel organization. The Zacks Rank #3 (Hold) company undertakes several strategies, including acquisitions and licensing of well-known brands, to expand its product portfolio and make itself a diversified apparel and accessories company. G-III Apparel has numerous growth opportunities, including the Spring 2024 repositioning the expansion of the Donna Karan label and a new long-term license for the Nautica brand.

The Zacks Consensus Estimate for GIII’s current fiscal-year EPS has remained unchanged in the past 30 days at $2.86. Shares of G-III Apparel have declined 20.2% in the past year.

Price and Consensus: GIII

Ralph Lauren: The designer, marketer and distributor of premium lifestyle products carries a Zacks Rank of 3. Ralph Lauren’s strategy of product elevation, personalized and targeted promotion, disciplined inventory management, favorable channel and geographic mix, and ramping up its targeting and personalization efforts is likely to support long-term AUR growth. The company is making significant progress in expanding digital and omnichannel capabilities.

The Zacks Consensus Estimate for Ralph Lauren’s current fiscal-year EPS has moved up by 0.4% over the past 30 days to $9.47. Shares of RL have jumped 19.5% in the past year.

Price and Consensus: RL

lululemon: The yoga-inspired athletic apparel company carries a Zacks Rank #3. lululemon has been benefiting from continued business momentum. The company is focused on investments to enhance the in-store experience. It is leveraging its stores to facilitate omni-channel capabilities, including the buy online pickup in store and ship-from-store. LULU’s Power of Three ×2 growth strategy based on three key growth drivers, including product innovation, guest experience and market expansion, is impressive.

The Zacks Consensus Estimate for lululemon’s current fiscal year EPS has moved up by a penny in the past 30 days to $11.93. LULU’s stock has increased 15.7% in the past year.

Price and Consensus: LULU

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report