5 Top-Ranked Cathie Wood Stocks to Buy Right Now

Cathie Wood is well-known for investing in “Disruptive Innovation” through her ARK Invest family of exchange-traded funds (ETFs) that manage roughly $14 billion worth of assets. The term Disruptive Innovation means “any situation in which an industry is shaken up and previously successful incumbents stumble,” and the term’s origin can be found in a 1995 Harvard Business Review article.

Wood’s recipe of success has been investments in large-cap as well as small-cap companies primarily offering disruptive technologies, including AI, blockchain, robotics, clean energy and genome sequencing. Wood believes that over a five-year horizon, disruptive technology providers will outperform the market.

Wood has also been active in investing in cryptocurrency-oriented stocks. Coinbase has been one of her top holdings and currently accounts for 10.37% of Ark Innovation ETF (ARKK).

Cathie Wood’s investment strategy did wonders in 2023, with ARKK gaining more than 70%, Ark Next Generation Internet ETF more than 100% and Ark Fintech Innovation ETF more than 90%.

The momentum is expected to continue in 2024, given chances of faster rate cuts by the U.S. Federal Reserve and increasing chances of a soft landing, a scenario in which inflation cools off to the Fed’s targeted inflation rate without a recession.

Our Picks

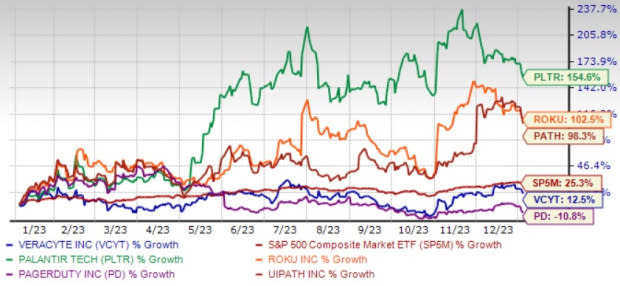

We have picked Palantir Technologies PLTR, Veracyte VCYT, PagerDuty PD, Roku ROKU and UiPath PATH from Cathie Wood’s ark.

These stocks have a favorable combination of a Growth Score of A or B and a Zacks Rank #1 (Strong Buy) or #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Per the Zacks proprietary methodology, stocks with this favorable combination offer good investment opportunities.

Image Source: Zacks Investment Research

Let’s take an in-depth look.

Palantir is well-known for its advanced data integration and analysis platform. It rides on a diversified end-market with increasing adoption among the government, financial and healthcare sectors.

In third-quarter 2023, PLTR closed 80 deals of $1 million or more across 30 industries, 29 deals of $5 million or more across 16 industries and 12 deals of $10 million or more across 11 industries.

Palantir currently flaunts a Zacks Rank #1 and a Growth Score of A. The Zacks Consensus Estimate for 2024 earnings has improved 1.6% over the past 60 days to $4.53 per share. PLTR shares have returned 154.6% in the past year.

Another Zacks Rank #1 stock, Veracyte has a Growth Score of A. The company is benefiting from strong demand for its testing solutions, including Decipher Prostate tests and Afirma.

VCYT has been investing in its San Diego lab to enhance capacity and efficiency. In third-quarter 2023, it reported roughly 15,500 Decipher Prostate tests and 13,500 Afirma tests.

Veracyte also added more than 65 new accounts in the quarter, including some large health systems and competitive wins, thereby reflecting portfolio strength.

The consensus mark for Veracyte’s 2024 loss has narrowed to 15 cents per share over the past 60 days from a loss of 31 cents per share. VCYT shares have returned 12.5% in the trailing 12-months.

PagerDuty currently carries a Zacks Rank #2 and a Growth Score of A. It is benefiting from strong demand for its operations cloud. PD’s expanding generative AI portfolio is expected to help in expanding clientele.

In third-quarter fiscal 2024, annual recurring revenue (ARR) increased 13% year over year to $439 million. Customers spending more than $100,000 in ARR grew 10% year over year to 778.

PagerDuty’s shares have lost 10.8% in the trailing 12-months. The Zacks Consensus Estimate for its fiscal 2025 earnings has improved 17.9% over the past 60 days to 79 cents per share.

Roku shares have returned 102.5% in the past year. It currently has a Zacks Rank #2 and a Growth Score of B.

Roku benefits from increased user engagement on The Roku Channel and the popularity of the Roku TV program. The launch of third-party streaming channels, including Peacock, Disney+ and HBO Max, is aiding user growth.

The consensus mark for fiscal 2025 earnings has increased 14.3% to $3.20 per share over the past 60 days.

UiPath currently has a Zacks Rank #2 and a Growth Score of B. It is riding on the strong adoption of end-to-end automation platforms, particularly in federal, financial services and healthcare verticals. PATH’s focus on driving operational efficiency is aiding margin expansion.

UiPath’s expanding clientele has been a growth catalyst. In third-quarter fiscal 2024, customers with $1 million or more in ARR grew 31% year over year to 264, while customers with $100,000 or more in ARR increased to 1,974.

UiPath shares have surged 98.3% in the trailing 12-months. The consensus mark for fiscal 2025 earnings has jumped 11.1% over the past 60 days to 50 cents per share.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UiPath, Inc. (PATH) : Free Stock Analysis Report

Veracyte, Inc. (VCYT) : Free Stock Analysis Report

Roku, Inc. (ROKU) : Free Stock Analysis Report

PagerDuty (PD) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report