5 Top Stocks Set to Beat Q3 Earnings Estimates on Monday

We are in the middle of the third-quarter 2023 earnings season. So far, the results are better than expected. The season started with weak expectations as the market’s benchmark — the S&P 500 Index — is likely to witness the fourth consecutive quarter of earnings decline.

As of Oct 25, 146 companies have reported results. Total earnings of these companies are up 8.6% year over year on 4.8% higher revenues, with 80.1% beating EPS estimates and 61.6% beating revenue estimates. For third-quarter 2023, total earnings of the S&P 500 companies are currently expected to be down -0.3% year over year on 1% higher revenues.

However, our current projection has shown that this reporting cycle is expected to be the last period of declining earnings for the S&P 500 Index, with positive growth resuming from the fourth quarter. In this regard, the guidance given by management will be of utmost importance.

Our Top Picks

We have narrowed our search to five stocks that are set to declare third-quarter earnings on Monday. Each of our picks carries a Zacks Rank #2 (Buy) and has a positive Earnings ESP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings release. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

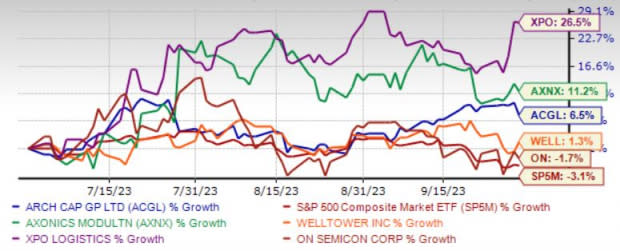

The chart below shows the price performance of our five picks in the last quarter.

Image Source: Zacks Investment Research

XPO Inc. XPO is a provider of asset-based less-than-truckload transportation with proprietary technology which moves goods efficiently. XPO provides freight transportation services in the United States, rest of North America, France, the United Kingdom, rest of Europe, and internationally. XPO operates in two segments, North American LTL and European Transportation.

XPO has an Earnings ESP of +3.29%. The Zacks Consensus Estimate for current-year earnings has improved 1.2% over the last 30 days. XPO recorded earnings surprises in the last four reported quarters, with an average beat of 16.9%. The company is set to release earnings results on Oct 30, before the opening bell.

ON Semiconductor Corp. ON is benefiting from solid momentum across automotive and industrial end-markets. Its broad-based strength across industrial, computing, consumer and automotive end-markets for both silicon carbide and insulated-gate bipolar transistor-based products, remains a positive.

Moreover, ON is winning market share in the automotive segment thanks to its silicon carbide dominance as well as intelligent power and sensing solution. ON’s EliteSIC silicon carbide modules increase the efficiency and lower the weight of the traction inverters, extending the electric vehicle range and improving performance.

ON Semiconductor has an Earnings ESP of +1.00%. The Zacks Consensus Estimate for current-year earnings has improved 0.6% over the last 60 days. ON recorded earnings surprises in the last four reported quarters, with an average beat of 8.7%. The company is set to release earnings results on Oct 30, before the opening bell.

Welltower Inc. WELL is well-poised to benefit from its diversified portfolio of healthcare real estate assets. Continued strength in its seniors housing operating portfolio, aided by favorable demographic trends, healthy demand-supply fundamentals and robust and accretive capital deployment activity, are the near-term positives.

WELL recently amped up its current-year normalized funds from operations (FFO) per share guidance to $3.51-$3.60 from $3.48-$3.59. We expect the metric to exhibit year-over-year growth of 14.9% in 2023. Furthermore, WELL’s portfolio-restructuring efforts and a solid balance sheet augur well.

Welltower has an Earnings ESP of +0.75%. It has an expected earnings growth rate of 6.3% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 30 days.

WELL recorded earnings surprises in the last four reported quarters, with an average beat of 2.3%. The company is set to release earnings results on Oct 26, after the closing bell.

Arch Capital Group Ltd. ACGL boasts a strong product portfolio and has been maintaining an exemplary record of premium growth. Premiums should benefit ACGL from new business opportunities; rate increases, growth in existing accounts and growth in Australian single-premium mortgage insurance.

This apart, Arch Capital has been diversifying its Mortgage Insurance business via strategic acquisitions that complement the strength in the specialty insurance and reinsurance businesses. A solid capital position shields ACGL from market volatility. It effectively deploys capital to pursue growth initiatives. Strategic buyouts strengthen the portfolio of Arch Capital and offer geographic diversification.

Arch Capital has an Earnings ESP of +1.37%. It has an expected earnings growth rate of 42.5% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.7% over the last 30 days.

ACGL recorded earnings surprises in the last four reported quarters, with an average beat of 26.8%. The company is set to release earnings results on Oct 30, after the closing bell.

Axonics Inc. AXNX is focused on the development and commercialization of a novel implantable SNM system for patients with urinary and bowel dysfunction and disrupting the SNM market. AXNX is primarily engaged in the development and commercialization of novel products for the treatment of bladder and bowel dysfunction.

Axonics has an Earnings ESP of +227.27%. It has an expected earnings growth rate of 74.2% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 8.3% over the last 30 days.

AXNX recorded earnings surprises in three out of the last four reported quarters, with an average beat of 37.8%. The company is set to release earnings results on Oct 30, after the closing bell.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

XPO, Inc. (XPO) : Free Stock Analysis Report

ON Semiconductor Corporation (ON) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

Axonics Inc. (AXNX) : Free Stock Analysis Report