6 Low Price-Earnings Stocks Paying a High Dividend Yield

According to the GuruFocus All-in-One Screener as of July 16, the following guru-held companies have high dividend yields and are trading with low price-earnings ratios.

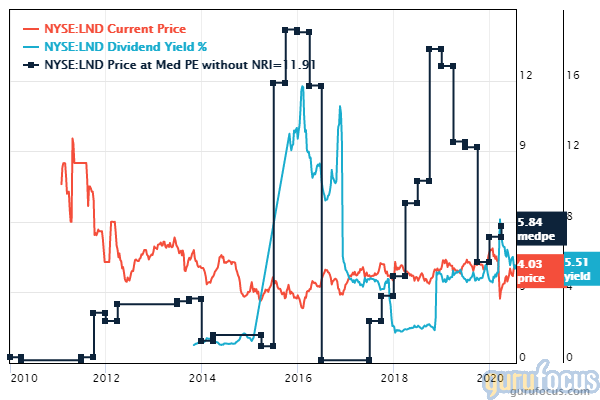

Brasilagro

Brasilagro - Cia Bras de Prop Agricolas's (LND) dividend yield is 5.5% and the payout ratio is 0.40. Over the past 52 weeks, the stock price has decreased 0.59%. Shares are trading with a price-book ratio of 1.14 and a price-earnings ratio of 10.42. The company's average yield was 3.21% over the past 10 years.

The operator of rural properties in Brazil has a market cap of $239 million. The return on equity of 12.89% and return on assets of 8.08% are outperforming 75% of companies in the consumer packaged goods industry. The cash-debt ratio of 0.13 is below the industry median of 0.41.

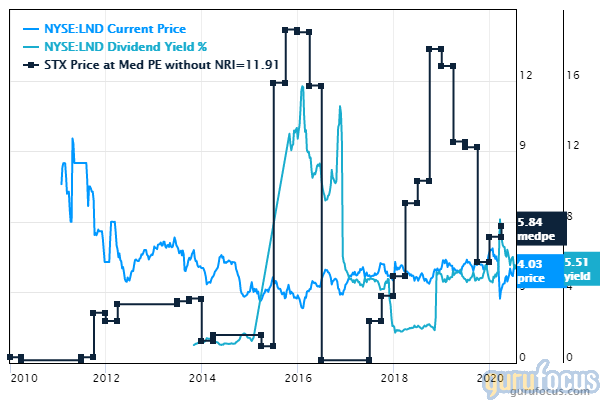

Seagate

Seagate Technology PLC's (STX) dividend yield is 5.36% with a payout ratio of 0.39. The stock has gained 4.91% compared to a year ago. Shares are trading with a price-earnings ratio of 7.20 and a price-book ratio of 6.92. The company's average yield was 4.23% over the past 10 years.

The supplier of hard disk drives has a $12.38 billion market cap. The return on equity of 98.51% and return on assets of 20.7% are outperforming 99% of competitors. The cash-debt ratio of 0.39 is underperforming 77% of competitors.

Jeff Ubben is the company's largest guru shareholder with 12.30% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 2.31% and Pioneer Investments (Trades, Portfolio) with 0.77%.

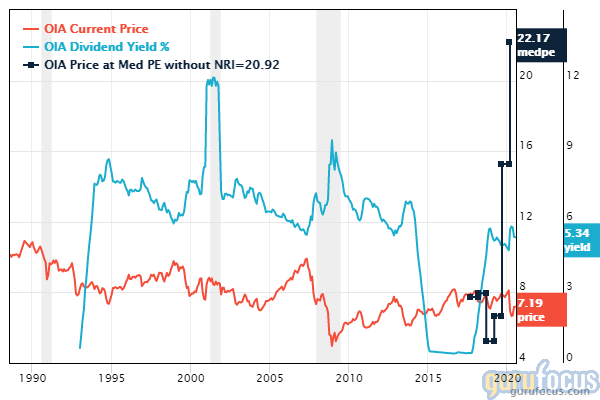

Invesco

Invesco Muni Income Opps Trust's (OIA) dividend yield is 5.29% with a payout ratio of 0.36. Over the past 52 weeks, the stock has declined 1.93%. Shares are trading with a price-book ratio of 0.89 and a price-earnings ratio of 6.77.

The closed-end investment company has a market cap of $341 million. GuruFocus rated its profitability 1 out of 10. The return on equity of 13.83% and return on assets of 10.45% are outperforming 100% of competitors. Its financial strength is rated 4 out of 10. The equity-asset ratio of 0.76 is below the industry median of 0.86.

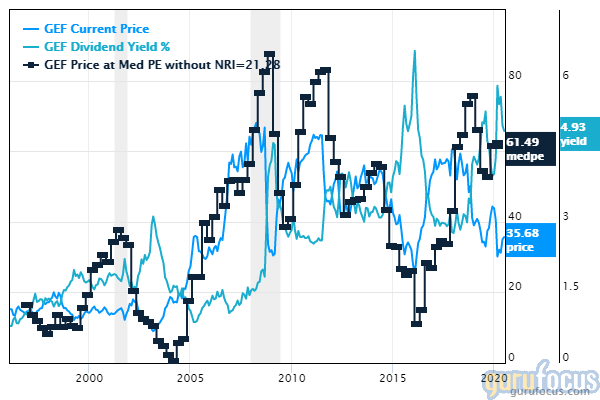

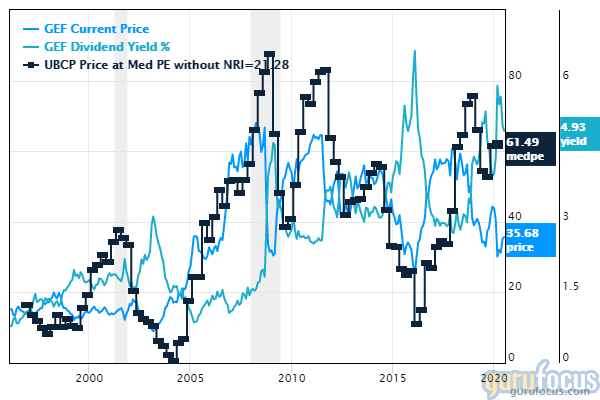

Greif

Greif Inc.'s (GEF) dividend yield is 4.93% with a payout ratio of 0.61. Over the past 52 weeks, the stock has increased 9.38% and shares are trading with a price-book ratio of 1.96 and a price-earnings ratio of 12.35. The company's average yield was 3.32% over the past 10 years.

The producer of industrial packaging products has a market cap of $1.8 billion and a GuruFocus profitability rating of 7 out of 10. The return on equity of 15.34% and return on assets of 3.09% are outperforming 50% of competitors. Its financial strength is rated 3 out of 10 with a cash-debt ratio of 0.02.

Mario Gabelli (Trades, Portfolio)'s GAMCO Investors is the company's largest guru shareholder with 1.32% of outstanding shares, followed by Jeremy Grantham (Trades, Portfolio) with 0.48%.

United Bancorp

United Bancorp Inc.'s (UBCP) dividend yield is 4.93% and the payout ratio is 0.47. Over the past 52 weeks, the stock has increased 3.96%. Shares are trading with a price-earnings ratio of 9.56 and a price-book ratio of 1.04.

The bank holding company has a market cap of $65 million. GuruFocus rated its profitability 4 out of 10. The return on equity of 10.98% and return on assets of 1.01% are outperforming 60% of competitors. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.38 is below the industry median of 1.13.

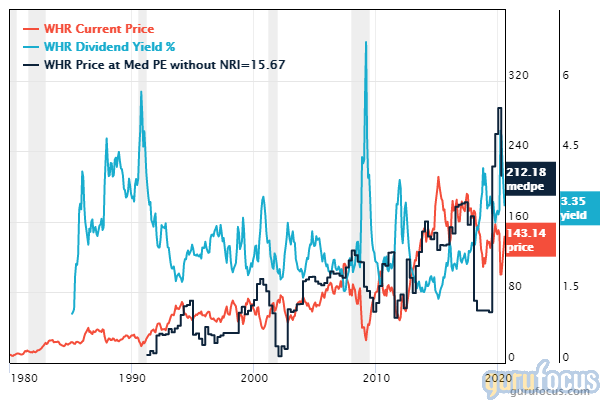

Whirlpool

Whirlpool Corp.'s (WHR) dividend yield is 3.33% with a payout ratio of 0.35. Over the past 52 weeks, the stock has increased 2.81% and the shares are trading with a price-book ratio of 2.9 and a price-earnings ratio of 10.57. The company's average yield was 2.25% over the past 10 years.

The manufacturer and marketer of home appliances has a market cap of $8.8 billion and a GuruFocus profitability rating of 7 out of 10. The return on equity of 29.16% and return on assets of 4.49% are outperforming 60% of competitors. Its financial strength is rated 5 out of 10, with a cash-debt ratio of 0.37 and an equity-asset ratio of 0.16.

With 11.68% of outstanding shares, PRIMECAP Management (Trades, Portfolio) is the company's largest guru shareholder, followed by Barrow, Hanley, Mewhinney & Strauss with 1.81% and Tom Gayner (Trades, Portfolio) with 0.43%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Guru Stocks Projected to Expand Earnings

5 Predictable Stocks With a Margin of Safety

5 Health Care Stocks Trading With Low Price-Earnings Ratios

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.