6 Reasons to Bet on Hilltop Holdings (HTH) Stock Right Now

Hilltop Holdings Inc.’s HTH healthy balance sheet and business restructuring activities will likely aid the company’s growth in the near term. This, along with higher rates and decent loan demand, will support its top line.

The Zacks Consensus Estimate for HTH's 2023 and 2024 earnings has been revised 7.3% and 3.6% upward, respectively, over the past month. This shows that analysts are optimistic regarding the company’s earnings prospects. HTH currently sports a Zacks Rank #1 (Strong Buy).

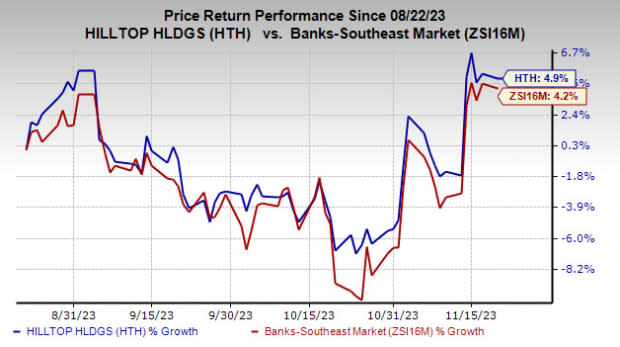

Over the past three months, the stock has gained 4.9% compared with the industry's growth of 4.2%.

Image Source: Zacks Investment Research

A few factors that make HTH stock a solid pick now are mentioned below:

Earnings Growth: In the last three to five years, the company witnessed earnings per share growth of nearly 1%. This momentum in earnings is expected to continue in the near term. The company’s earnings are projected to rise 1.3% in 2023.

Also, HTH has an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in three quarters and missed once in the trailing four quarters, the average beat being 32.03%.

Higher Net Interest Income: Hilltop Holdings is focused on improving its net interest income (NII), which is its primary revenue surce. The metric witnessed a compound annual growth rate (CAGR) of 1.3% over the four-year period ended 2022. Similarly, supported by higher interest rates, the company’s net interest margin (NIM) increased to 2.87% in 2022 from 2.57% in 2021. The uptrend for NII and NIM persisted in the first nine months of 2023.

With the Federal Reserve expected to keep interest rates high in the near term, NII and NIM are expected to somewhat improve although rising deposit costs will weigh on them.

Management expects NII to increase 2-5% in 2023. We project NII to rise 2.3% this year. While the metric is expected to decline marginally in 2024, it will likely increase 8.4% in 2025. Further, we anticipate NIM to be 3.07% in 2023, 2.95% in 2024 and 3.07% in 2025.

Manageable Debt Level: As of Sep 30, 2023, HTH had a total debt of $1.28 billion, and cash and due from banks worth $1.51 billion. The company maintains investment grade ratings of BBB+/Baa2, and a stable outlook from Fitch Ratings and Moody’s Investors Service, respectively. This renders the company favorable access to the debt market.

Also, Hilltop Holdings’s debt/equity ratio is zero compared with the industry average of 0.29, displaying no debt burden relative to the industry. Thus, the company's solid credit profile indicates that it will continue to meet debt obligations in the near term, even if the economic situation worsens.

Steady Capital Distribution: Hilltop Holdings pays quarterly dividends on a regular basis as its capital distribution is sustainable on a solid liquidity position. The company increased its quarterly dividend five times in the last five years, with an annualized dividend growth rate of 21%.

Business Restructuring Efforts: Hilltop Holdings has grown through business restructuring initiatives. In 2020, the company divested its insurance division – National Lloyds Corporation. Since the buyout of PlainsCapital in 2012, the company’s business has expanded tremendously through acquisitions with the consolidation of its position in Texas, Oklahoma, Georgia, Tennessee and Arizona.

These deals are not only accretive to earnings but have also helped the company to diversify its operations from core Property & Casualty insurance to a profitable banking operation. Management is looking for deals that are strategically fit for the business.

Reasonable Valuation: Hilltop Holdings’ stock looks undervalued right now with respect to its price-to-book (P/B) and price-to-sales (P/S) ratios. It has a P/B ratio of 0.95, lower than the industry average of 1.00. Moreover, the company’s P/S ratio of 1.32 is below the industry average of 1.81.

Other Bank Stocks Worth a Look

A couple of other top-ranked stocks from the banking space are Community Trust Bancorp CTBI and First Citizens BancShares FCNCA.

The Zacks Consensus Estimate for Community Trust’s current-year earnings has been revised 5% upward over the past 60 days. Its shares have gained 17% in the past three months. Currently, CTBI sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

First Citizens BancShares carries a Zacks Rank #2 (Buy) at present. Its earnings estimates for 2023 have been revised 3.7% upward over the past 30 days. In the past three months, FCNCA’s shares have rallied 7.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hilltop Holdings Inc. (HTH) : Free Stock Analysis Report

First Citizens BancShares, Inc. (FCNCA) : Free Stock Analysis Report

Community Trust Bancorp, Inc. (CTBI) : Free Stock Analysis Report