6 Reasons Why OFG Bancorp (OFG) Stock is Worth Betting on

Given its strong fundamentals and decent growth prospects, it seems wise to add OFG Bancorp OFG stock to your portfolio now. The company is well-poised to benefit from solid loan and deposit balances, high-interest rates and a strong balance sheet.

Analysts seem optimistic regarding the company’s earnings growth potential. Over the past two months, the Zacks Consensus Estimate for OFG’s earnings has been revised 7.8% and 6.9% upward for 2023 and 2024, respectively. The stock presently carries a Zacks Rank #2 (Buy).

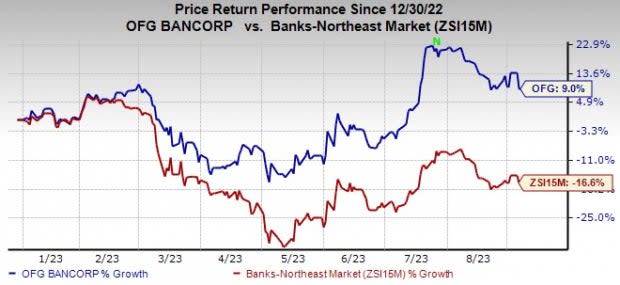

Shares of the company have rallied 9% this year against the industry’s 16.6% fall.

Image Source: Zacks Investment Research

Some factors that make OFG Bancorp an attractive choice right now.

Earnings Growth: In the last three-five years, OFG witnessed earnings growth of 26.7%, higher than the industry average of 12.3%. The trend is expected to continue in the near term, with earnings anticipated to rise 8.7% this year.

The company has an impressive earnings surprise history. Its earnings surpassed the Zack Consensus Estimate in each of the trailing four quarters, with an average beat of 7.33%.

Revenue Strength: The company’s revenues witnessed a CAGR of 9.9% over the five-year period ended 2022. The improvement was driven by solid loan and deposit balance and efforts to bolster fee income. Further, since 2022, higher interest rates have aided OFG’s top line.

Given the decent loan demand and rise in fee income, the company’s revenues will likely trend upward. The top line is expected to rise 11.2% in 2023 and 1% next year.

Steady Capital Distributions: OFG Bancorp has been paying quarterly dividends regularly. Also, over the last five years, the company has hiked dividends six times, with payout growing 33.39% over the same time frame. OFG's payout ratio currently stands at 24% of earnings.

The company has a share repurchase program in place. In January 2022, it announced a new share buyback plan, authorizing up to $100 million worth of shares. Under this program, authorization worth $19.4 million remained available as of Jun 30, 2023. Given the earnings strength, OFG Bancorp’s capital distribution plan seems sustainable.

Favorable Valuation: OFG stock has a Value Score of B. Our research shows that stocks with a Value Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best upside potential.

Strong Leverage: OFG Bancorp’s debt/equity ratio is 0.21 compared with the industry average of 0.39, displaying no debt burden relative to the industry. It highlights the company's financial stability, even in an unstable economic environment.

Superior Return on Equity (ROE): OFG has an ROE of 16.92%, which is higher than the industry’s ROE of 11.81%. This reflects that the company reinvests its cash more efficiently than its peers.

Other Banks Worth a Look

A couple of other top-ranked stocks from the banking space are Sierra Bancorp BSRR and First Internet Bancorp INBK.

Sierra Bancorp currently carries a Zacks Rank #2. Earnings estimates for 2023 have been revised 9.7% north in the past 60 days. In the past three months, BSRR’s shares have rallied 13.9%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings estimates for First Internet Bancorp have been revised 14.3% north for 2023 over the past 60 days. Shares of INBK have surged 29% in the past three months. Currently, the company carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sierra Bancorp (BSRR) : Free Stock Analysis Report

OFG Bancorp (OFG) : Free Stock Analysis Report

First Internet Bancorp (INBK) : Free Stock Analysis Report