6 Stocks Killing Gurus' Returns

Although gurus hold positions in the following companies, their share prices and returns have suffered declines recently. These are the worst-performing stocks over the past six months that have a long-term presence in multiple gurus' portfolios.

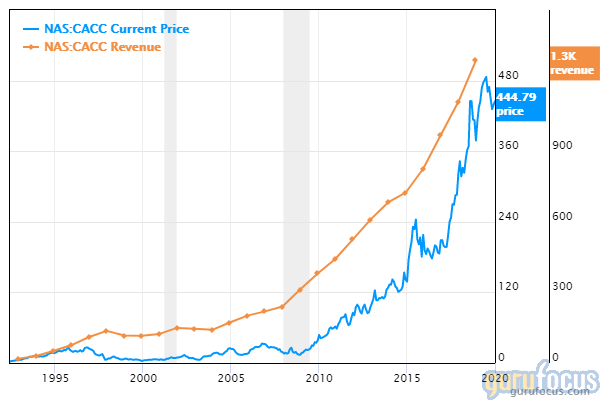

Credit Acceptance

Shares of Credit Acceptance Corp. (NASDAQ:CACC) declined 7.84% over the past six months. The stock is held by four gurus.

The company's largest guru shareholder is Ruane Cunniff (Trades, Portfolio) & Goldfarb with 5.74% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.19%, Jeremy Grantham (Trades, Portfolio) with 0.23% and Lee Ainslie (Trades, Portfolio) with 0.05%.

The consumer finance company has a market cap of $8.53 billion. The stock was trading with a price-earnings ratio of 13.41. As of Jan. 30, the share price of $460 was 11% below the 52-week high and 17.78% above the 52-week low.

Over the past decade, share prices have risen 752%. The return on equity of 30.47% and return on assets of 9.73% are outperforming 92% of companies in the credit services industry.

Sarepta Therapeutics

Shares of Sarepta Therapeutics Inc. (NASDAQ:SPRT) declined 25.27% over the past six months. Five gurus hold the stock.

With 5.30% of outstanding shares, Frank Sands (Trades, Portfolio) is the largest guru shareholder of the company, followed by Steven Cohen (Trades, Portfolio) with 0.93% and Simons' firm with 0.47%.

The medical research and drug development company has a market cap of $8.79 billion. The stock was trading with a price-book ratio of 8.36 as of Jan. 30, and the share price of $118 was 55.83% below the 52-week high and 15.29% above the 52-week low.

Shares have climbed 1,174% over the past decade. The return on equity of -60.63% and return on assets of -37.64% are underperforming 59% of companies in the biotechnology industry.

Centrais Eletricas Brasileiras

Centrais Eletricas Brasileiras SA (NYSE:EBR) declined 9.27% over the past six months. The stock is held by two gurus, of which Simons' firm is the largest with 0.07% of outstanding shares followed by Pioneer Investments (Trades, Portfolio) with 0.03%.

The company has a market cap of $8.31 billion. The stock was trading with a price-book ratio of 0.82 as of Jan. 30, the share price of $9.11 was 21% below the 52-week high and 24.51% above the 52-week low.

Over the past decade, the stock has declined 56.86%. The return on equity of 37.9% and return on assets of 11.87% are outperforming 95% of companies in the utilities - regulated industry.

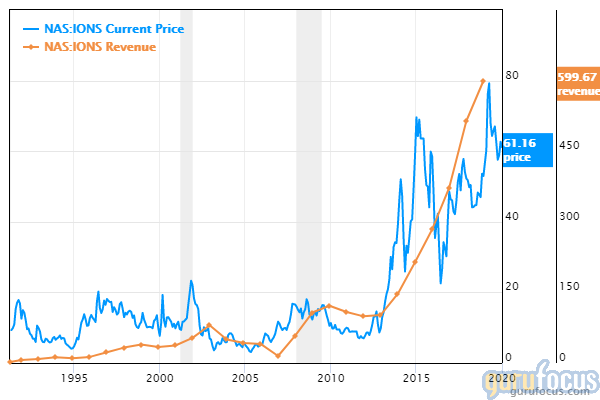

Ionis Pharmaceuticals

Shares of Ionis Pharmaceuticals Inc. (NASDAQ:IONS) declined 7.57% over the past six months. Four gurus hold the stock.

With 1.29% of outstanding shares, Simons' firm the largest guru shareholder of the company, followed by the Vanguard Health Care Fund (Trades, Portfolio) with 1.21% and Joel Greenblatt (Trades, Portfolio) with 0.14%.

The company, which develops antisense technology to discover and develop novel drugs, has a $8.31 billion market cap. The stock was trading with a price-book ratio of 6.21. As of Jan. 30, the share price of $59.30 was 31.75% below the 52-week high and 10.78% above the 52-week low.

Over the past decade, the stock has climbed 429%. The return on equity of 39.13% and return on assets of 15.89% are outperforming 95% of companies in the biotechnology industry.

Westlake Chemical

Shares of Westlake Chemical Corp. (NYSE:WLK) declined 6.61% over the past six months through Jan. 30. The stock is held by five gurus.

The chemical company's largest guru shareholder is Ainslie with 2.54% of outstanding shares, followed by Michael Price (Trades, Portfolio) with 0.07% and Chuck Royce (Trades, Portfolio) with 0.03%.

The petrochemical producer has a market cap of $8.19 billion. The stock was trading with a price-earnings ratio of 17.58. As of Jan. 30, the share price of $63.70 was 21.17% below the 52-week high and 14.44% above the 52-week low.

Over the past decade, shares have risen 522%. The return on equity of 8.25% and return on assets of 3.88% are outperforming 50% of companies in the chemicals industry.

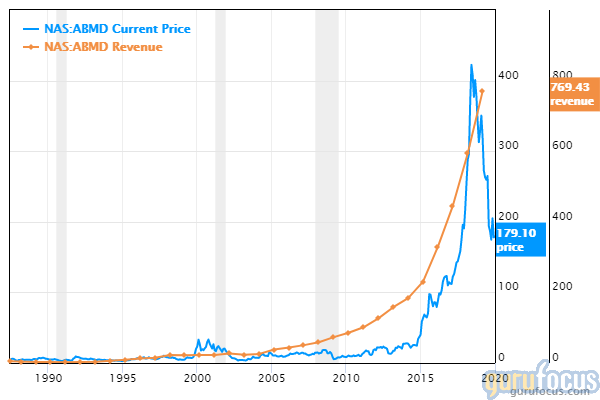

Abiomed

Shares of Abiomed Inc. (NASDAQ:ABMD) declined 33.45% over the past six months. Five gurus hold the stock. With 6.85% of outstanding shares, PRIMECAP Management (Trades, Portfolio) is the largest guru shareholder of the company.

The company, which provides mechanical circulatory support devices, has an $8.19 billion market cap. The stock was trading with a price-book ratio of 8.46. As of Jan. 30, the share price of $184 was 50.19% below the 52-week high and 17.05% above the 52-week low.

Over the past decade, the stock has climbed 2,191%. The return on equity of 24.13% and return on assets of 21.45% are outperforming 91% of companies in the medical devices and instruments industry.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Guru Stocks Boosting Book Value

5 Energy Stocks Gurus Are Buying

Parnassus Endeavor Fund Exits Biogen, Trims Regeneron

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.