6 Stocks Young Warren Buffett Would Buy in 2017

- By James Li

Six technology and health care companies made both the Undervalued Predictable Screener and the Buffett-Munger Screener as of May 4: Anika Therapeutics Inc. (ANIK), NIC Inc. (EGOV), Express Scripts Holding Co. (ESRX), F5 Networks Inc. (FFIV), CGI Group Inc. (GIB) and Novo Nordisk A/S (NVO). As these companies offer good growth and value potential, gurus are buying shares in these companies.

Warning! GuruFocus has detected 3 Warning Sign with FAST. Click here to check it out.

The intrinsic value of ANIK

The Buffett-Munger investing strategy

Berkshire Hathaway Inc. (BRK-A) (BRK-B) CEO Warren Buffett (Trades, Portfolio) invests in companies that meet his four-criterion investing approach. Such companies have high business predictability, durable competitive advantages, comfortable interest coverage and low price-earnings (P/E) to growth (PEG) ratios.

The Buffett-Munger model portfolio gained 178.85% since its inception Dec. 31, 2008, outperforming the Standard & Poor's 500 index benchmark by approximately 14.50%. Figure 1 lists the annual returns of the portfolio compared to the benchmark.

Figure 1

As illustrated in Figure 1, the Buffett-Munger strategy outperformed the benchmark in five of the past eight years: 2009, 2010, 2011, 2012 and 2016. The portfolio performance is driven predominantly by technology and health care companies, which include Novo Nordisk, Cigna Corp. (CI) and Universal Health Services Inc. (UHS). The companies gained 13.86%, 19.09% and 14.44% since the day each company was added to the Buffett-Munger model portfolio.

Anika Therapeutics

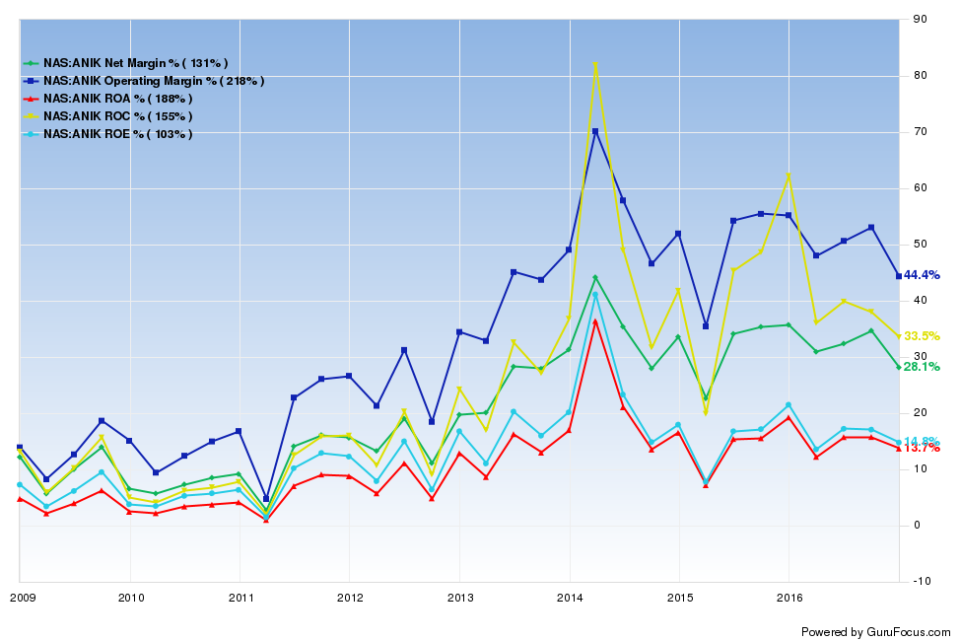

Anika Therapeutics, an integrated orthopedic medicines company, maintained its place in Buffett's top companies for May 2017. The Bedford, Massachusetts biotech company has four good signs including expanding operating margins and consistent per-share revenue growth. Anika's operating margin currently outperforms 96% of global competitors.

The global, integrated orthopedic medicines company reported solid first-quarter results in 2017 including a year-over-year consolidated revenue growth of 5%. Revenues for Monovisc increased 24% year over year, driven by global expansion of the product. The increase in revenues for Monovisc and Orthovisc, two of Anika's major joint health products, contributed to a 3% year-over-year increase in Worldwide Orthobiologics revenues and a 12% year-over-year increase in International Orthobiologics.

Anika maintained a profitability rank of 8 and a predictability rank of four stars, implying sustainable growth potential during the upcoming months. The company also has solid gross margins, which consistently increased during the past 15 years. Finally, the company has no debt and a perfect financial strength rank of 10.

Anika's PEG ratio is currently 0.89, which is close to a 10-year low of 0.29. As the company offers strong growth and value potential, Ken Fisher (Trades, Portfolio) increased his Anika position 18.43% during first-quarter 2017.

NIC

Like Anika, NIC also debuted on Buffett's watch list during first-quarter 2017. The digital "eGovernment" services company has a predictability rank of 4.5 stars, implying consistent revenue and earnings growth during the past 10 years.

NIC reported a record $77.2 million during first-quarter 2017, a 5% year-over-year increase from the prior-year quarter. Higher motor vehicle inspections, property tax filings and miscellaneous interactive government services contributed to the increase in company revenues, which in turn led to historically high operating margins.

As the company has no debt and strong Altman Z-scores, NIC's financial strength ranks 9 out of 10. While the company has a PEG ratio of 1.73, NIC's price-book (P/B) and price-sales (P/S) ratios are near a 52-week low.

Express Scripts

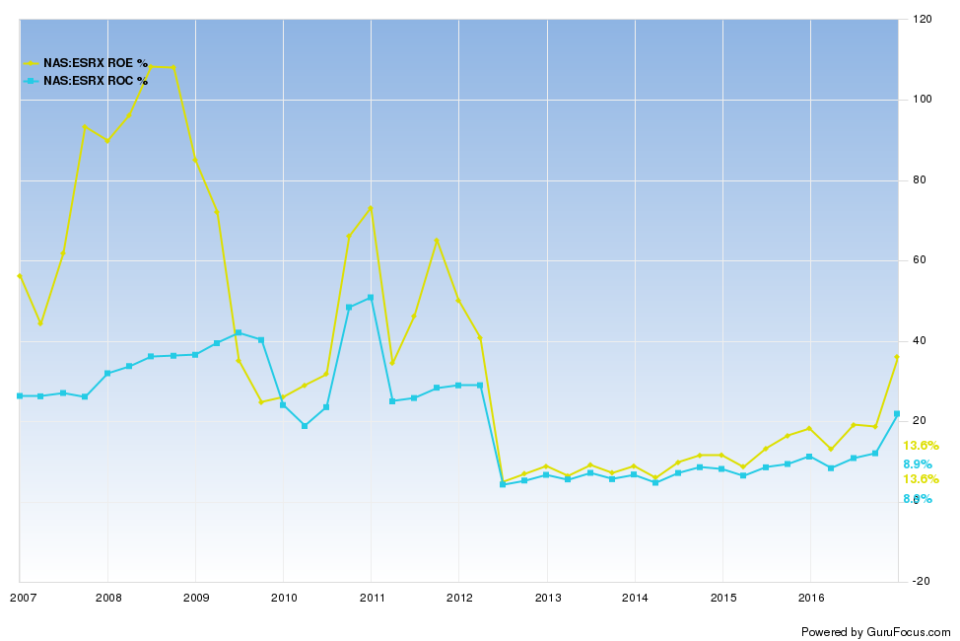

Express Scripts Holding, a major pharmacy benefit management company, offers good growth and value potential through seven positive investing signs. The company's Piotroski F-score ranks a perfect nine and its business predictability ranks a solid four stars out of five.

Despite having a modest financial strength rank of 5, Express Scripts still has a profitability rank of 8. The company provided a high full-year 2017 adjusted earnings guidance range of $6.90 to $7.04, that would outperform 2016 adjusted earnings by an estimated 9%. Express Scripts has a net margin close to a 10-year high and a return on equity that outperforms 86% of global health plans companies.

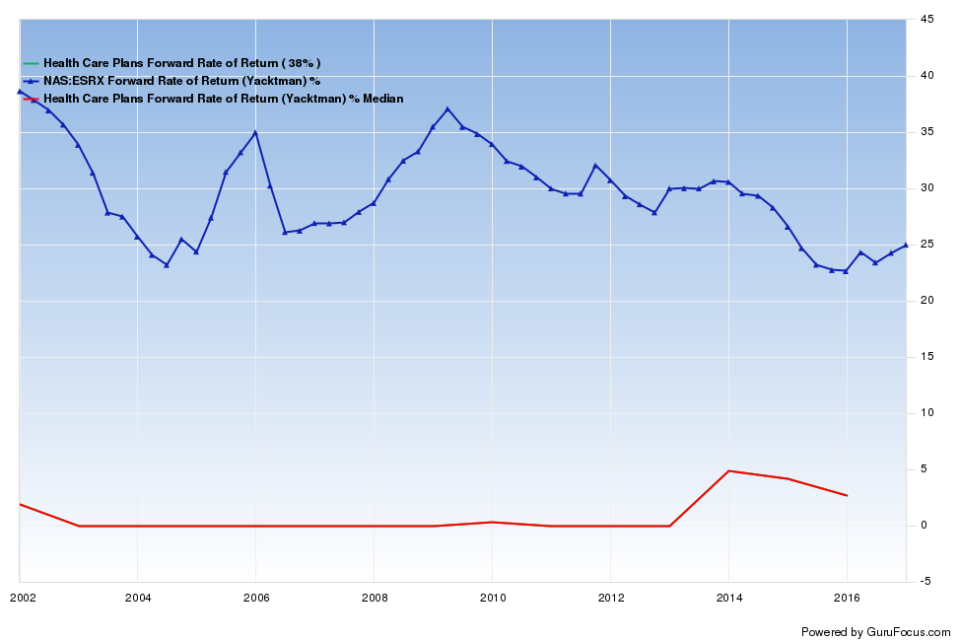

Express Scripts' share price of $61.79 is close to a three-year low, suggesting possible undervaluation. The company's P/E ratio is near a 10-year low, and its PEG ratio of 0.68 ranks higher than 79% of competitors. Additionally, Express Scripts currently trades near its 10-year minimum P/S valuation.

During first-quarter 2017, Donald Yacktman (Trades, Portfolio), founder of Yacktman Asset Management, invested in about 15,000 shares in Express Scripts as the company offers a 25.97% forward rate of return. This rate of return outperforms 73% of global competitors.

F5 Networks, CGI Group and Novo Nordisk

F5 Networks, CGI Group and Novo Nordisk have been featured in the Undervalued Predictable Screener and/or the Buffett-Munger Screener since 2016 based on model portfolio information. The former two are in the Top 25 Undervalued Predictable Companies portfolio while Novo Nordisk is in the Top 25 Buffett-Munger portfolio. Figure 2 summarizes the annual returns of the two model portfolios compared to the S&P 500 benchmark.

Figure 2

The Undervalued Predictable Companies model portfolio returned 218.07% since its inception Dec. 31, 2008, outperforming the Buffett-Munger portfolio by approximately 40% and the S&P 500 by approximately 54%. F5 Networks, which maintained a four-star predictability rank, gained 32.62% from January 2016 to May 2017.

Conclusions and see also

Buffett only likes a specific set of companies: a simple business that he understands with predictable/proven earnings, high economic moat and available at a reasonable price. Such companies are "good companies at fair prices."

Premium members have access to all value screeners, including the All-in-One Guru Screener that allows you to generate custom screens. The premium plus membership gives further access, including the backtesting feature and the Manual of Stocks for all U.S. companies. If you are not a member, we invite you to compare our membership levels and sign up for a free seven-day trial.

Disclosure: The author has no positions in the stocks mentioned in this article.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with FAST. Click here to check it out.

The intrinsic value of ANIK