‘Expect at Least 60% Upside,’ Says Morgan Stanley About These 2 Buy-Rated Stocks

While August brought with it a pullback following the market’s strong performance so far this year, the past few sessions have seen momentum build again.

The good news, according to Andrew Slimmon, managing director and senior portfolio manager at Morgan Stanley Investment Management, is that the market’s advance is set to continue.

Boosted by the Q3 earnings season, Slimmon sees the S&P 500 nearing the 5,000 mark by the end of the year, which would not only represent an 11% increase from current levels, but would amount to a new record, beating the 4,818 notched at the start of 2022.

“Year-over-year quarterly earnings are going to inflect from negative to positive after Q3,” Slimmon has said. “Historically, this is greeted positively by equities.”

Meanwhile, the stock experts at Morgan Stanley also have an idea which stocks are going to do well against this positive backdrop. They are pointing investors toward a pair of equities they see positioned to meaningfully outperform – they see both generating returns of at least 60% in the months ahead.

To also get an idea for what the rest of the Street has in mind for these names, we ran these tickers through the TipRanks database – a platform that tracks and measures the performance of anyone giving financial advice online. Here’s what we found.

Despegar.com Corporation (DESP)

To get started, we’ll look at one of Latin America’s most experienced travel agencies. Despegar.com is recognized across the region, and recommended by satisfied travelers. The company operates in 20 countries, providing a full range of travel services and products, including airline tickets, travel packages, hotels, vacation rentals, and more. Despegar has served more than 17 million customers as a one-stop marketplace for every traveler’s vacation planning.

Some numbers show the scale that Despegar operates on. The company can link travelers to more than 800 airlines, 1260 car rental agencies, 7,700 leisure activities, and 660,000 accommodations across Latin America. Services are offered under two brands, Despegar, the flagship brand, and Decolar in Brazil.

Earlier this month, Despegar reported its 2Q23 numbers, and despite being its seasonally weakest quarter, generated record revenue of $165.5 million, amounting to a 23.1% year-over-year increase while beating expectations by $6.73 million. Likewise, EPS of $0.25 came in ahead of the forecast, by 1 cent. Additionally, with travel demand continuing to recover in Latin America, the company delivered gross Bookings of $1.3 billion in the quarter. Looking ahead, Despegar reiterated its expectation for 2023 revenue between $640 million to $700 million, compared to consensus at $669.48 million.

Laying out the Morgan Stanley case for further growth here, and charting a solid path for investors to follow, analyst Andrew Ruben has good things to say about this stock. He writes, “We see cyclical, secular, and company-specific drivers supporting revenue growth for Despegar… We look for Despegar to grow revenue +25% y/y in 2023E and at a +12% 2022-2027E CAGR… We think Despegar has room to gain share — as a pure-play on the LatAm market, benefitting from network effects in a region with a high degree of hotel and airline fragmentation. Despegar ranked favorably in our detailed channel check of 15 Brazil/Mexico travel platforms, spanning 12 metrics across payments, ease-of-use, recommendations, and personalization tools.”

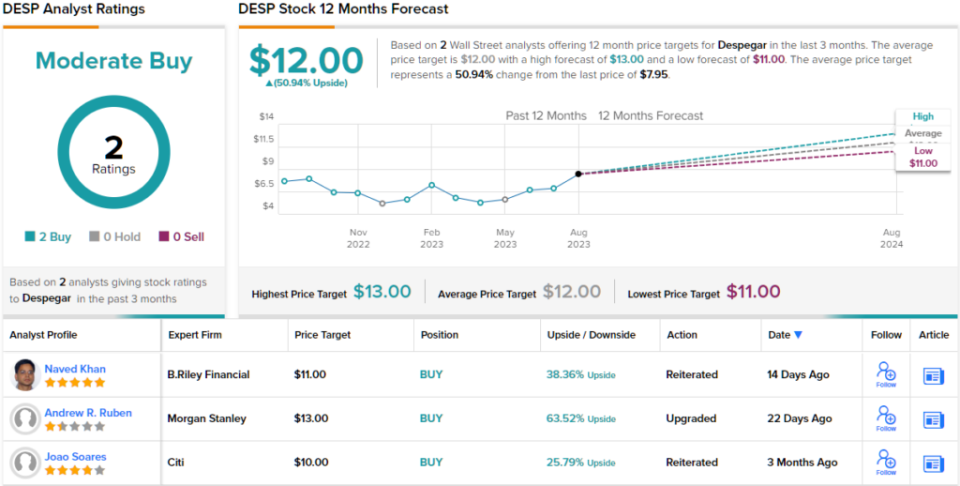

These comments inform Ruben’s Overweight (i.e. Buy) rating on the shares, while his $13 price target implies a 12-month gain of 63%. (To watch Ruben’s track record, click here)

Overall, this stock has picked up only 2 analyst reviews recently, although both are positive, giving it a Moderate Buy consensus rating. The $12 average price target and $7.95 trading price together suggest ~51% one-year upside potential. (See DESP stock forecast)

Pharvaris N.V. (PHVS)

From the travel industry, we’ll shift gears and move over to biopharmaceuticals. Pharvaris is a clinical-stage biopharma firm working on new treatments for hereditary angioderma (HAE), a serious skin disease characterized by severe outbreaks of extreme swelling. The company’s focus is on bradykinin B2-receptor antagonists, a novel drug class, orally dosed, with application in preventing and treating attacks of HAE.

Pharvaris is developing deucrictibant, a novel small molecule therapeutic agent that the company is studying for its potential as a safe, effective, and convenient treatment for all sub-types of HAE. Pharvaris is formulating the drug to be used as both a prophylactic treatment and an on-demand treatment for the relief of acute disease symptoms.

Currently, Pharvaris has several pipeline research tracks into deucrictibant. The two of most immediate interest are PHVS416 and PHVS719.

The first of these, -416, was until recently the subject of an FDA clinical hold. This was partially lifted this past June, after regulatory review of the preplanned interim analysis of the ongoing 26-week nonclinical study. The hold was lifted on its IND (investigational new drug) application, for the drug as an on-demand treatment for acute attacks of HAE.

The firm’s IND for -416 remains subject to an additional hold from the FDA, as a prophylactic treatment for HAE, but the company expects to submit additional data by year’s end, aiming to have that hold lifted as well. While this hold affects the CHAPTER-1 Phase 2 study in the US, the study is a global clinical trial – and has proceeded outside of the US. The company announced earlier this month that CHAPTER-1 had completed enrollment. The company expects to announce top-line data from the CHAPTER-1 study by the end of 2023.

Also of note is PHVS719. This is an extended release capsule, designed for once-daily dosing and use as a prophylactic treatment HAE. The drug is currently undergoing a Phase 1 trial in healthy volunteers, testing the safety and tolerability profile of the drug formulation.

This biopharma researcher caught the eye of Morgan Stanley’s Maxwell Skor. The analyst emphasizes that the company’s leading product continues to show a sound safety profile, and writes of the stock, “We believe Pharvaris is positioned to deliver the first oral therapy for the on-demand treatment of hereditary angioedema (HAE) supported by positive Ph2 RAPIDe-1 data and the FDA lifting their clinical hold. The decision to lift the clinical hold for on-demand treatment suggests growing confidence in the safety profile of deucrictibant and alignment on the requested nonclinical study design. We see a viable market opportunity with on-demand and short-term prophylactic treatment, while building confidence in the Ph2 CHAPTER-1 prophylactic readout (YE23) based on a de-risked mechanism-ofaction (MoA) and trial design.”

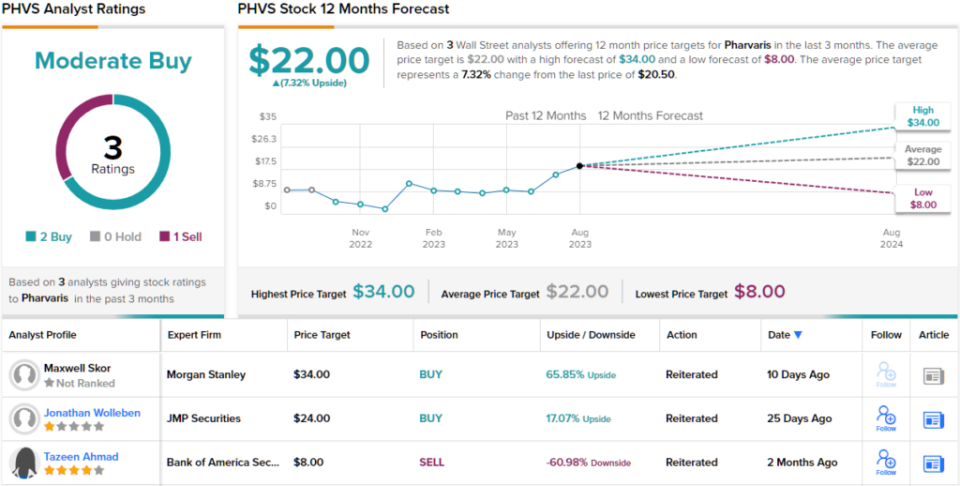

Looking forward, Skor goes on to rate Pharvaris’ shares as Overweight (a Buy) while his price target, set at $34, implies the stock will gain ~66% on the one-year horizon.

All in all, PHVS has picked up 3 recent analyst reviews, which are split into 2 Buys and one Sell – for a Moderate Buy consensus view. The $22 average price target suggests a 7% upside potential for the coming year. (See Pharvaris stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.