The 7 Best Defense Stocks to Buy Now: October 2023

Defense stocks are back in the spotlight amid rising global geopolitical tensions. The war in Russia and Ukraine was a testament to the rapidly evolving economic and political instability. Even as the economy faces many challenges, global aerospace and defense spending will continue to rise YOY. Several conflicts have emerged, including the recent Israel-Hamas war, leading to mass casualties. Investors are also concerned about China invading Taiwan, which could spark buy-side institutional demand for defense stock companies.

The global aerospace and defense industry was last valued at $795 billion and is projected to reach $1.076 Trillion by 2027. Industry growth will remain robust as spending increases for aircraft, missile defense systems, and weaponry. Additionally, PwC expects high double-digit growth for the defense industry into 2024 as supply chain constraints continue to alleviate.

Below are my top seven high-potential defense stocks to buy right now!

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Lockheed Martin (LMT)

Source: Ken Wolter / Shutterstock.com

Lockheed Martin (NYSE:LMT) is making a comeback in 2023 as geopolitical tensions rise. The stock is down roughly 7% YTD, as the defense industry has largely underperformed the broader market. However, Q4 2023 might be the turning point for the company after reporting its Q3 2023 financial results. Lockheed Martin saw modest topline growth in Q3 2023 of $16.9 billion. FCF was $2.5 billion, down from $2.7 billion in Q3 2022. During the quarter, EPS was slightly up to $6.73. However, operating cash flow fell to $2.9 billion.

The company’s long-term outlook remains strong as it continues to expand in domestic and international markets. CEO Jim Taiclet said the company “maintains a robust backlog of $156 billion”. In addition, on August 28th, Lockheed Martin was awarded a $765 Million contract with the Australian Defense Force as a strategic partner for AIR6500. This program will provide Australia with advanced integrated missile and air defense systems.

They reaffirmed their 2023 outlook and increased their share repurchase and quarterly dividend. Lockheed Martin projects FY2023 EPS in the $27.00 range. This represents growth of approximately 25%, a significant improvement from -5% in 2022. With the Israel-Hamas war intensifying, Lockheed Martin is the top defense stock to buy for 2023.

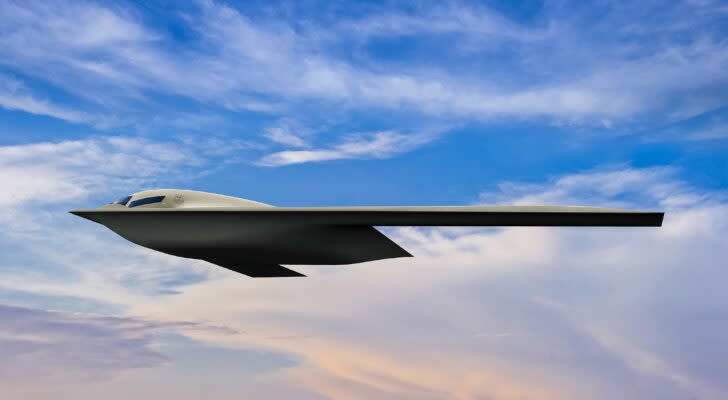

Northrop Grumman (NOC)

Source: ALAN RADECKI, Public domain, via Wikimedia Commons

Northrop Grumman (NYSE:NOC) is an aerospace and defense company based in the United States. They are one of the world’s largest weapons manufacturers, operating in the U.S., the Middle East, and Asia Pacific. The stock is up 12% in the last month as the Israel-Hamas war unraveled.

Northrop Gruman’s products are delivered to more than 25 countries worldwide. Their products include a wide range of advanced air, sea, land, and space systems. This includes their vast aircraft line, from the B-2 Spirit to their complex navigation, radar, and missile systems. In their most recent Q2 2023 financial results, Northrop Gruman saw strong sales growth of 9% YOY. However, operating income fell in the quarter due to contract-related legal matters.

Their long-term outlook remains strong despite the company’s worries about ongoing macroeconomic headwinds. During the second quarter of 2023, contract awards and backlogs increased by $10.9 billion and $19.8 billion, respectively. The awards were primarily for Space Systems, Aeronautic Systems, and Mission Systems. As aerospace and defense spending continues to accelerate, Northrop Gruman is one of the best high-potential defense stocks to buy.

General Dynamics (GD)

Source: Casimiro PT / Shutterstock.com

General Dynamics (NYSE:GD) is an American aerospace and defense company and the 6th largest defense contractor in the world. The company manufactures Gulfstream business jets, Abram tanks, Stryker fighter jets, submarines, and light tactical vehicles. They also offer a wide range of defense-related IT services and security systems.

Revenue for the FY 2022 was up a modest 2.4% to $39.40 billion. FCF and operating cash flow also grew in 2022, up 2.4% and 7.2%, respectively. However, their most recent quarter proved the company’s resilience despite supply chain headwinds. In Q2 2023, General Dynamics revenue grew to $10.2 billion, up 10.5% YOY. While revenue was up in the quarter, earnings per share (EPS) was slighter down.

General Dynamics continues to receive growing support from the U.S. Department of Defense. This includes two U.S. Navy contracts totaling $1.72 billion for Virginia-Class submarines and ship repair and maintenance in October. The company’s balance sheet remains strong, ready to capitalize on the opportunities ahead. They ended the quarter with a record backlog of $91.4 billion. General Dynamics should be kept on your radar if you’re looking for a premiere dividend growth stock to buy in 2023.

RTX Corporation (RTX)

Source: JHVEPhoto / Shutterstock.com

RTX Corporation (NYSE:RTX) is a U.S.-based multinational aerospace and defense company. They largely manufacture aircraft engines, missile defense systems, satellites, and drones. The company has three large subsidiaries: Collins Aerospace, Pratt and Whitney, and Raytheon.

RTX Corporation is currently one of the worst-performing defense stocks in 2023. In July 2023, the company’s subsidiary Pratt & Whitney announced a rare condition of powder metal for their PW1100 GTF engines. This will significantly cost the company and its customers, including a $3 billion pre-tax charge in Q3 2023. However, investors can still get excited about the company’s future growth prospects.

It’s worth noting that despite the company’s setback, the CEO Greg Hayes has reaffirmed their 2020-2025 sales outlook and margin expansions. This includes a full commitment to 2025 free cash flow of $7.5 billion. As well as $33-$35 billion returned to shareholders through the merger between Raytheon Technologies and United Technologies Corporation. With a forward P/E of 13.85, RTX Corporation is one of the best cheap defense stocks to buy for the long term.

Palantir (PLTR)

Source: Poetra.RH / Shutterstock.com

Palantir (NYSE:PLTR) is continuing to gain investor momentum as demand for their AI services accelerates. The company has been involved in artificial intelligence well before it became a hot topic. Palantir is known for its three platforms Gotham, Apollo, and Foundry.

Since Palantir’s IPO back in 2020, the stock has remained extremely volatile. However, the company is up 86% since inception. A number of positive growth catalysts are emerging that investors should be excited about. They have announced a number of strategic partnerships and new contract awards over the last few months. More recently, including a multi-year partnership with the U.S. Army to test and scale AI and ML capabilities.

Palantir’s revenue growth remains strong and demand for their products and services continues to accelerate. Additionally, CEO Alex Karp said Palantir will achieve its first full year of GAAP profitability in 2023. The company is making all the right moves and increased their FY 2023 guidance to $2.21 billion. With an SP 500 inclusion on the horizon, Palantir is a high growth defense stock that investors should not take their eyes off.

Heico Corp (HEI)

Source: Postmodern Studio / Shutterstock.com

Heico Corp (NYSE:HEI) is an aerospace and defense company that manufactures aircraft, commercial and defense satellites, and unmanned aerial systems. Over the last decade, Heico has delivered robust sales and EPS growth. Revenue for the FY 2022 grew to $2.20 billion, up 18% YOY. EPS also grew to $2.50 per share, up 15%, respectively.

While the company has a high P/E ratio, the company’s growth and margin are well above the industry average. With a market cap of a little less than $20 billion, Heico is still seeing high double-digit sales growth. The company has also made several beneficial acquisitions in the last five years, including the Wencor Group acquisition for $2.05 billion.

For fiscal Q3 2023, Heico saw strong sales growth of $722.9 Million, up 27% YOY. Net income increased to $102 Million, or $0.74 per share. Demand in the commercial aerospace market has contributed to the growth, with twelve consecutive quarters of sequential growth for their subsidiary, Flight Support Group. As they continue to consolidate end markets and invest in new and existing technologies, Heico is a no-brainer defense stock to buy.

CACI International (CACI)

Source: Casimiro PT / Shutterstock.com

CACI International (NYSE:CACI) is an under-the-radar defense stock that you’ve probably never heard of. They are a U.S. defense contractor that delivers a wide range of products and services for national security. The company’s P/E of 18.12 is attractive when compared to the industry average of 24.3.

CACI International’s products include advanced electronic warfare, electromagnetic pulse protection, and enterprise cloud security solutions. The company has seen strong revenue and EPS growth over the last decade. A majority of their growth has been funded through a series of accretive acquisitions.

Over the last decade, the company’s operating income has doubled, with EPS nearly tripling in the same period. The company continues its streak of new contract awards totaling more than $1 billion. This includes $125 Million from the U.S. Naval Air Warfare Center and $917 Million from the Air Force Research Laboratory. Furthermore, on August 22nd, the company announced a strategic partnership with Amazon AWS to accelerate cloud solutions for the U.S. government. This makes CACI International a great cheap defense stock to buy for 2023.

On the date of publication, Terel Miles did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

More From InvestorPlace

Musk’s “Project Omega” May Be Set to Mint New Millionaires. Here’s How to Get In.

The #1 AI Investment Might Be This Company You’ve Never Heard Of

The Rich Use This Income Secret (NOT Dividends) Far More Than Regular Investors

The post The 7 Best Defense Stocks to Buy Now: October 2023 appeared first on InvestorPlace.