7 Chinese Net-Nets for China's 70th Anniversary

In light of the People's Republic of China's 70th anniversary, seven Ben Graham net-nets that trade on the Chinese stock exchanges with positive operating cash flow over the trailing 12 months are Zhejiang Guangsha Co. Ltd. (SHSE:600052), Shanghai Wayne Enterprise Co. Ltd. (SHSE:600641), Beijing Gehua CATV Network Co. Ltd. (SHSE:600037), Anhui Xinhua Media Co. Ltd. (SHSE:601801), Changchunjingkai Group Co. Ltd. (SHSE:600215), Shenzhen Jasic Technology Co. Ltd. (SZSE:300193) and Jiangsu Sanfangxiang Industry Co. Ltd. (SHSE:600370).

China stock market remains undervalued on its 70th anniversary

On Oct. 1, 1949, Chairman Mao Zedong proclaimed from the top of the Tiananmen Gate in Beijing that the People's Republic of China had been founded.

Berkshire Hathaway Inc. (BRK.A)(BRK.B) CEO Warren Buffett (Trades, Portfolio)'s favorite market indicator suggests an undervalued Chinese stock market. As of Tuesday, the ratio of China's total market cap to gross domestic product is approximately 40%, close to its minimum value of 35%. Based on this market level, the implied contribution to the expected annual return is 16.76% assuming a reversion to the mean level of 142%.

The Net-Net Screen reported 511 net-nets in the Asia region, suggesting possible undervaluation for Asian markets in general. Graham defined a net-net as a company whose share price is less than its net current asset value or its net-net working capital. Graham defined the former as the difference between current assets and total liabilities and the latter as the sum of cash and cash equivalents, 75% of accounts receivable and 50% of total inventories less total liabilities.

Graham also required that companies have positive operating cash flow over the past 12 months and no meaningful debt compared to the company's cash position. The "Father of Value Investing" set a safe threshold of five for the company's interest coverage ratio, which equals operating income divided by interest expense.

Zhejiang Guangsha

Zhejiang Guangsha develops, sells and leases real estate properties around China. GuruFocus ranks the company's financial strength 8.6 out of 10 on several positive investing signs, which include a strong Piotroski F-score of 7, a solid Altman Z-score of 9.07 and an equity-to-asset ratio that outperforms 94.23% of global competitors.

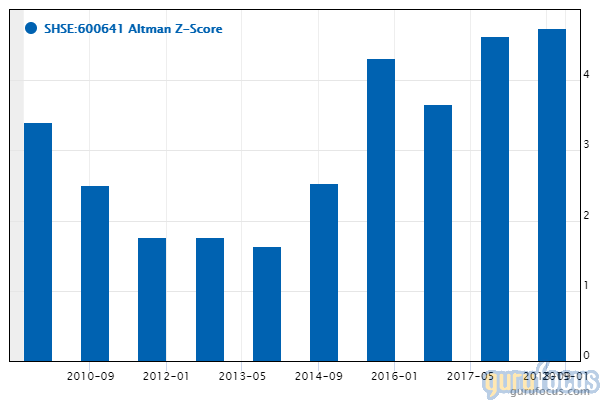

Shanghai Wayne Enterprise

Shanghai Wayne Enterprise engages in real estate, property leasing and management. GuruFocus ranks the company's financial strength 7.8 out of 10 and profitability 8 out of 10 on several positive investing signs, which include a strong Altman Z-score of 9.36, expanding operating margins and a cash-to-debt ratio that outperforms 89.86% of global competitors.

Beijing Gehua CATV Network

Beijing Gehua CATV Network engages in the development, maintenance and transmission of radio and television programs. GuruFocus ranks the company's financial strength 7.6 out of 10: Even though it has a poor Piotroski F-score of 4, Beijing Gehua's cash-to-debt and equity-to-asset ratios are outperforming over 85% of global competitors.

Anhui Xinhua Media

Anhui Xinhua Media distributes publications, audio and video publishing, digital advertising, media and investment management related to entertainment. GuruFocus ranks the company's financial strength 8.7 out of 10 on several positive signs, which include a strong Piotroski F-score of 7, a solid Altman Z-score of 4.44 and a cash-to-debt ratio that outperforms 83.59% of global competitors.

Changchunjingkai

Changchunjingkai operates four business segments: real estate development, thermal, infrastructure development and services. GuruFocus ranks the company's financial strength 8.8 out of 10 on several positive investing signs, which include a strong Piotroski F-score of 7, a solid Altman Z-score of 7.56 and an equity-to-asset ratio that outperforms 94.23% of global competitors.

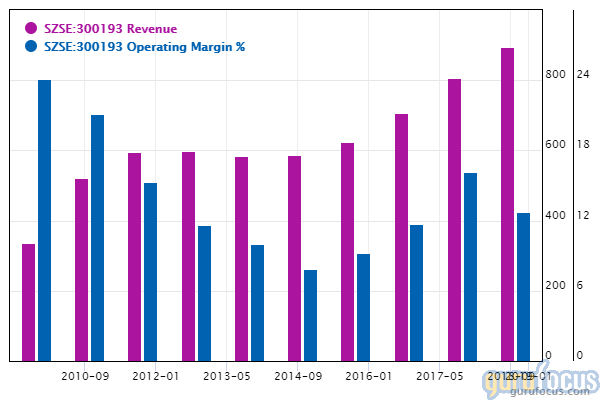

Shenzhen Jasic Technology

Shenzhen Jasic Technology engages in the research, development, production and sale of general inverter welding machines. GuruFocus ranks the company's financial strength 8.8 out of 10 and profitability 8 out of 10 on several positive investing signs, which include expanding profit margins, consistent revenue growth, a strong Altman Z-score of 8.88 and a cash-to-debt ratio that outperforms 91.47% of global competitors.

Jiangsu Sanfangxiang

Jiangsu Sanfangxiang produces and distributes polyester, chemical fiber, textile and public engineering services of thermoelectricity. GuruFocus ranks the company's financial strength 8.6 out of 10 on several positive investing signs, which include a strong Piotroski F-score of 7, a solid Altman Z-score of 8.68 and a cash-to-debt ratio that outperforms 90.66% of global competitors.

Disclosure: No positions.

Read more here:

4 High-Quality US Stocks as Trade War Fears Are Rekindled

3 Recreation Companies With High Financial Strength

6 Undervalued-Predictable Chinese Companies

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.