7 Tech Stocks Under $20 to Snap Up Before the Surge

The tech sector has been on a tear in 2023 largely due to the emergence of generative artificial intelligence (AI) and all that it promises. The upswing in valuation has largely benefited a handful of mega-cap stocks including Nvidia (NASDAQ:NVDA), Microsoft (NASDAQ:MSFT) and other members of the magnificent seven.

That said, $20 remains more than enough money with which to purchase strong tech stocks. Many seem unconcerned about Fitch’s downgrade of the U.S. credit rating with some, like Jamie Dimon calling it ridiculous. That suggests the stock market can continue to rise. Mega cap tech has led the upswing in 2023 so it’s logical to consider diversifying into inexpensive tech at this point.

Here are seven tech stocks under $20 to buy before their prices rise.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Upwork (UPWK)

Source: Sundry Photography / Shutterstock.com

Upwork’s (NASDAQ:UPWK) online freelancer marketplace has a lot going for it as the labor market continues to evolve rapidly. Traditional employment is becoming less and less common. The result is that Upwork continues to grow overall while the firm’s fundamentals continue to improve. The stock recently exploded upward following Q2 earnings.

Of course, it would have been better to have invested prior to Aug. 2. UPWK shares spiked from $10 to $14 on that date. However, that doesn’t mean Upwork isn’t worth investing in currently.

For one, I expect stock price targets to get adjusted upward in the coming months. UPWK is fully priced based on its current ratings. I think those prices will move upward following the strong Q2 results.

Upwork’s first-half and second-quarter revenues grew steadily. That’s a strong indication that the gig economy is as strong as ever. What’s even better in relation to Upwork is the fact that it is improving on an operational basis very rapidly. In the first 6 months of the year, the firm posted a net gain of $13.76 million. A year ago that figure stood at $48.56 million in the red. It’s quite a turnaround, especially among tech stocks under $20.

Palantir (PLTR)

Source: Poetra.RH / Shutterstock.com

Palantir (NYSE:PLTR) has emerged as another stock that’s part of the AI conversation. It is among the best-known analytics firms that serve the government and defense department through its Gotham and Foundry products. The software platforms have taken across government and the emergence of AI has opened a new dimension for the company’s future prospects.

Before getting into that I’ll simply note that Palantir has consistently outperformed based on its recent earnings history. Many pundits had dismissed the firm as an also-ran SPAC and the firm had a particularly difficult 2022. However, Palantir posted its first-ever GAAP profit in Q4 2022. That temporarily spiked prices which fell thereafter. The firm’s association with AI and government has since sent share rapidly upward again.

Investors should recognize that Palantir trades at around $18 currently. It is not likely to remain one of the tech stocks under $20. It traded in the mid-$20s for most of 2021 so its very possible that it can continue to rise during the second half of the year. The firm is carving out a niche as the AI provider to the DoD. That’s a huge plus moving forward.

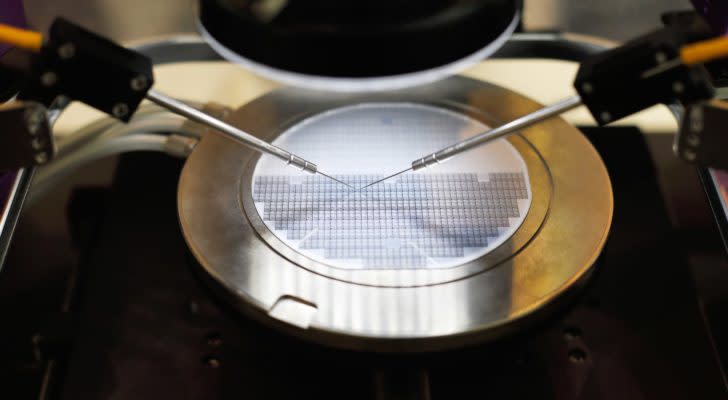

TTM Technologies (TTMI)

Source: Shutterstock

TTM Technologies (NASDAQ:TTMI) is a relatively inexpensive chip stock that offers an interesting mix of factors for investors from a fundamental perspective.

The component maker in the semiconductor industry contracted in both the second quarter and the first half based on sales. The firm also contracted based on earnings but only based on the past 6 month period when income fell by 38.2% to $27.79 million. Here’s the kicker. Net income actually increased nearly six-fold in Q2 2023 jumping to $6.82 million from just over $1 million a year earlier. That implies that TTM Technologies is adapting quickly to an increasingly difficult operational landscape.

The company operates fabrication plants globally with more than 75% of operations in North America and manufacturing in China as well. From that perspective, TTM Technologies is geographically diversified. That could make it attractive in a fast-moving chip sector that undergoes rapid changes and cyclical fluctuations that require quick responses and shifting priorities. The firm’s diverse manufacturing base may then make it more attractive in the future.

PubMatic (PUBM)

Source: Tada Images / Shutterstock.com

PubMatic (NASDAQ:PUBM) is a digital advertising stock that may not be in the category of tech stocks under $20 for much longer. It has risen from $13 to above $19 thus far in 2023.

Investors remain bullish on PubMatic because, despite the many concerning signs about the economy, there’s a sense that things are improving. Inflation does remain high and Fitch did downgrade U.S. creditworthiness recently. Yet, despite all of that, there’s an overwhelming positivity that a soft landing remains the worst-case scenario moving forward.

That is a positive for PubMatic’s prospects to sell digital advertising. If the economy can avoid the disaster that was previously expected, then advertisers will spend more money trying to attract sales through PubMatic. And that outcome continues to pervade headlines at this point.

PubMatic’s sales didn’t suffer during the first quarter instead growing slightly. Costs increased markedly leading to losses. Any future indication of improving operations should help to push PUBM shares higher again.

Infosys (INFY)

Source: AjayTvm / Shutterstock.com

Infosys (NYSE:INFY) is an IT stock representing a firm located in India, home to a massive population and a strong tech community. The firm provides outsourced consulting and IT services but has essentially stagnated in 2023.

Its business grew modestly based both on top-line and bottom-line results in the second quarter. The bad news is that it simply didn’t grow much. The positive news is that it didn’t see rapid declines leading to net losses. That can’t be said for so many other smaller tech firms this year. Rate hikes and other factors have taken a strong toll on small tech. The fact that Infosys has escaped relatively unscathed is the reason to buy it.

India is gaining a lot of attention for many reasons. Its geopolitical importance has become very evident. Major tech firms are tapping India as a manufacturing base of the future. It all suggests that domestic firms including Infosys have a bright future.

Snap (SNAP)

Source: BigTunaOnline / Shutterstock

Snap (NYSE:SNAP) stock can rise rapidly in the future. The parent firm of Snapchat mostly disappointed during the second quarter as social media ad spend continues to have trouble.

Sales fell by 4% during the second quarter. Snap’s 7% contraction in the first quarter was the first time ever for the company as a publicly-listed entity. That trajectory is definitely concerning and logically points to the idea that investors should avoid SNAP shares.

However, there’s a contrarian narrative to follow for Snap. Daily active users increased by 14% to 397 million in the second quarter. So Snap clearly has a growing audience to which it can sell. That’s a strong benefit overall. When and if advertisers decide that Snapchat is a worthwhile social media channel the recipe for growth is there.

Additionally, Snap’s losses improved in the second quarter narrowing by 10% to $377 million. The firm has a long road ahead of it but it still makes more than $1 billion in sales per quarter.

Grab Holdings (GRAB)

Source: Nor Sham Soyod / Shutterstock.com

Grab Holdings (NASDAQ:GRAB) is a company offering food delivery, transportation and financial services through its app. The stock is worth considering as it serves a burgeoning Southeast Asian market poised for growth. Further, Grab’s management anticipates that its operations will rapidly improve throughout this year and that losses will dissipate.

The growth narrative underpinning Grab is very straightforward. Revenues increased by 130% in the first quarter, reaching $525 million. As appealing as that growth is, the company also produced a $250 million loss during the period.

That loss, though, is open to interpretation. It narrowed by 43% on a year-over-year basis. That’s a very clear step in the right direction. That progress led the firm to slash its EBITDA loss forecast for the remainder of 2023 by $80 to $90 million. Grab continues to anticipate breakeven EBITDA figures by Q4 of this year. That alone is a reasonable argument in favor of purchasing Grab shares which currently trade for less than $4. Share prices have the potential to grow a lot over the next few years if the firm reaches breakeven metrics beyond EBITDA alone.

On the date of publication, Alex Sirois did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Alex Sirois is a freelance contributor to InvestorPlace whose personal stock investing style is focused on long-term, buy-and-hold, wealth-building stock picks. Having worked in several industries from e-commerce to translation to education and utilizing his MBA from George Washington University, he brings a diverse set of skills through which he filters his writing.

More From InvestorPlace

ChatGPT IPO Could Shock the World, Make This Move Before the Announcement

Musk’s “Project Omega” May Be Set to Mint New Millionaires. Here’s How to Get In.

The Rich Use This Income Secret (NOT Dividends) Far More Than Regular Investors

The post 7 Tech Stocks Under $20 to Snap Up Before the Surge appeared first on InvestorPlace.