8x8 (NASDAQ:EGHT) Reports Sales Below Analyst Estimates In Q3 Earnings

Business communications software company 8x8 (NYSE:EGHT) missed analysts' expectations in Q3 FY2024, with revenue down 1.8% year on year to $181 million. Next quarter's revenue guidance of $178.5 million also underwhelmed, coming in 3.8% below analysts' estimates. It made a non-GAAP profit of $0.12 per share, improving from its profit of $0.07 per share in the same quarter last year.

Is now the time to buy 8x8? Find out by accessing our full research report, it's free.

8x8 (EGHT) Q3 FY2024 Highlights:

Market Capitalization: $434.9 million

Revenue: $181 million vs analyst estimates of $183.4 million (1.3% miss)

EPS (non-GAAP): $0.12 vs analyst estimates of $0.10 (20.9% beat)

Revenue Guidance for Q4 2024 is $178.5 million at the midpoint, below analyst estimates of $185.6 million (full year revenue guidance also below)

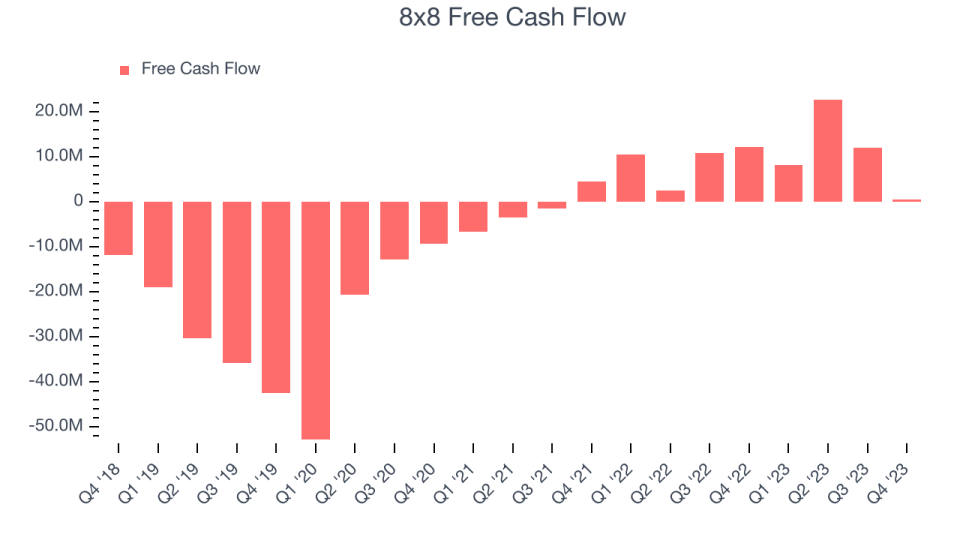

Free Cash Flow of $639,000, down 94.7% from the previous quarter

Gross Margin (GAAP): 69%, in line with the same quarter last year

“I am pleased to report that we met our guidance ranges for service revenue and total revenue and exceeded our guidance range for non-GAAP operating margin in the third quarter,” said Samuel Wilson, Chief Executive Officer of 8x8,

Founded in 1987, 8x8 (NYSE:EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

Sales Growth

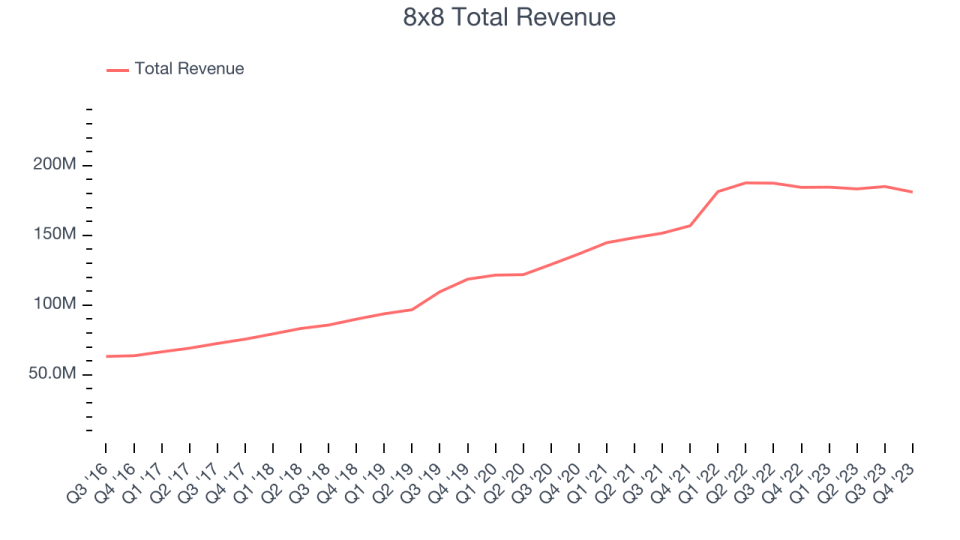

As you can see below, 8x8's revenue growth has been unremarkable over the last two years, growing from $156.9 million in Q3 FY2022 to $181 million this quarter.

This quarter, 8x8's revenue was down 1.8% year on year, which might disappointment some shareholders.

Next quarter, 8x8 is guiding for a 3.3% year-on-year revenue decline to $178.5 million, a further deceleration from the 1.7% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 2.1% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. 8x8's free cash flow came in at $639,000 in Q3, down 94.8% year on year.

8x8 has generated $43.76 million in free cash flow over the last 12 months, a decent 5.9% of revenue. This FCF margin stems from its asset-lite business model and gives it a decent amount of cash to reinvest in its business.

Key Takeaways from 8x8's Q3 Results

This was a tough quarter. The company's full-year revenue guidance was below expectations and its revenue guidance for next quarter and the full year both missed Wall Street's estimates. A bright spot was a beat on profit that led to a non-GAAP EPS beat. However, underperformance on revenue guidance is driving the stock performance. Overall, the results could have been better. The company is down 3% on the results and currently trades at $3.26 per share.

8x8 may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.