908 Devices Inc (MASS) Reports Growth Amidst Industry Headwinds

Revenue Growth: Q4 revenue up 23% year-over-year, full year increase of 7%.

Handheld Devices: Handheld revenue surged by 57% in Q4 and 28% for the full year.

Gross Margin: Maintained at 51% for Q4, though full year margin declined to 50% from 56%.

Net Loss Improvement: Q4 net loss narrowed to $7.4 million from $9.8 million year-over-year.

2024 Revenue Outlook: Anticipates revenue between $52.0 million and $54.0 million, a 4-8% growth.

On March 5, 2024, 908 Devices Inc (NASDAQ:MASS) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its innovative handheld and desktop mass spectrometry devices, reported a significant increase in revenue, primarily driven by the growth in sales of its handheld devices.

908 Devices Inc (NASDAQ:MASS) is at the forefront of the medical devices industry, providing cutting-edge solutions for chemical and biochemical analysis. The company's products are essential in various fields, including life sciences research, bioprocessing, and forensics, offering rapid and actionable insights at the point-of-need.

Financial Performance and Challenges

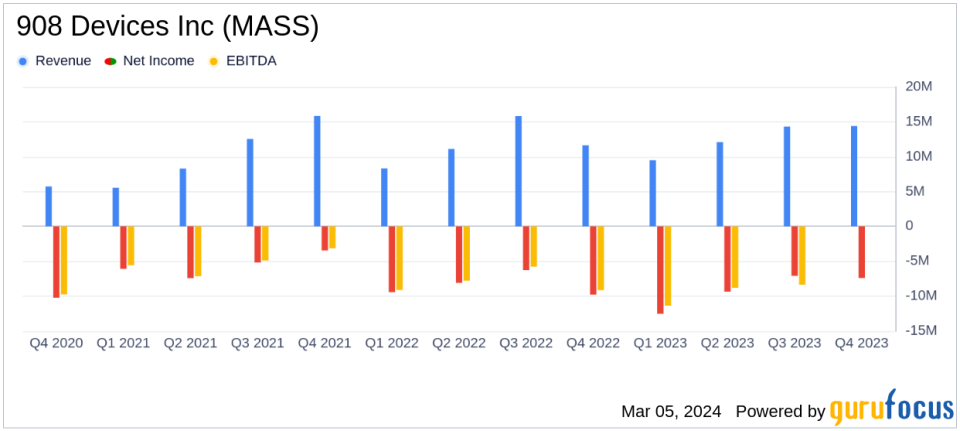

The company's fourth-quarter revenue saw a 23% increase to $14.4 million compared to the previous year, with handheld device revenue growing by an impressive 57%. The full year's revenue also rose by 7% to $50.2 million. Despite these gains, the company faced challenges in the life science instrumentation and bioprocessing industries, which led to a decrease in desktop and contract revenues.

908 Devices Inc (NASDAQ:MASS) managed to maintain a gross margin of 51% for the fourth quarter, consistent with the prior year. However, the full-year gross margin decreased to 50% from 56%, indicating cost pressures or a change in the sales mix. Operating expenses slightly increased due to higher stock-based compensation and commission expenses, although the company achieved some savings in general operating costs.

The net loss for the fourth quarter improved, narrowing to $7.4 million from $9.8 million in the prior year. For the full year, the net loss widened to $36.4 million from $33.6 million. The net loss per share for 2023 was $1.13, compared to $1.07 for the previous year.

Financial Achievements and Importance

908 Devices Inc (NASDAQ:MASS)'s ability to grow its handheld segment in a challenging market is a testament to the company's innovation and market demand for its products. The growth in the installed base of devices to 2,853, with 139 devices placed in the fourth quarter, is significant for future recurring revenue, which represented 33% of total revenues in the quarter. The company's cash position remains strong with $145.7 million in cash, cash equivalents, and marketable securities, and no debt outstanding, which is crucial for sustaining operations and investing in growth.

Key Financial Metrics

Understanding the key financial metrics is essential for investors. Here are some important figures from the earnings report:

Revenue | Q4 2023 | Full Year 2023 |

|---|---|---|

Product Revenue | $11.4 million | $40.2 million |

Service Revenue | $2.9 million | $9.6 million |

Contract Revenue | $1.2 million | $2.3 million |

Total Revenue | $14.4 million | $50.2 million |

Gross Profit | $7.3 million | $25.3 million |

Net Loss | $(7.4 million) | $(36.4 million) |

These metrics are important as they provide insights into the company's sales performance, cost management, and overall financial health. The gross profit and net loss figures, in particular, help investors understand the company's profitability and operational efficiency.

Analysis and Outlook

CEO Kevin J. Knopp commented on the company's performance, stating:

"We made solid progress in 2023 towards our objectives... Despite near-term headwinds... we launched two additional desktop devices in the Process Analytical Technology (PAT) space, positioning us for accelerated growth as conditions improve."

The company's focus on expanding market presence and efficient cash management is crucial for its journey towards profitability. With the guidance for 2024 projecting revenue growth of 4% to 8%, 908 Devices Inc (NASDAQ:MASS) is cautiously optimistic about its future performance.

For investors and potential GuruFocus.com members, the financial results of 908 Devices Inc (NASDAQ:MASS) indicate a company that is navigating industry challenges while capitalizing on the growth opportunities of its handheld device segment. The company's strategic positioning and solid financial footing make it a noteworthy consideration for those interested in the medical devices sector.

Explore the complete 8-K earnings release (here) from 908 Devices Inc for further details.

This article first appeared on GuruFocus.