A10 Networks Inc (ATEN) Navigates Market Challenges with Robust Q4 and Full-Year 2023 Results

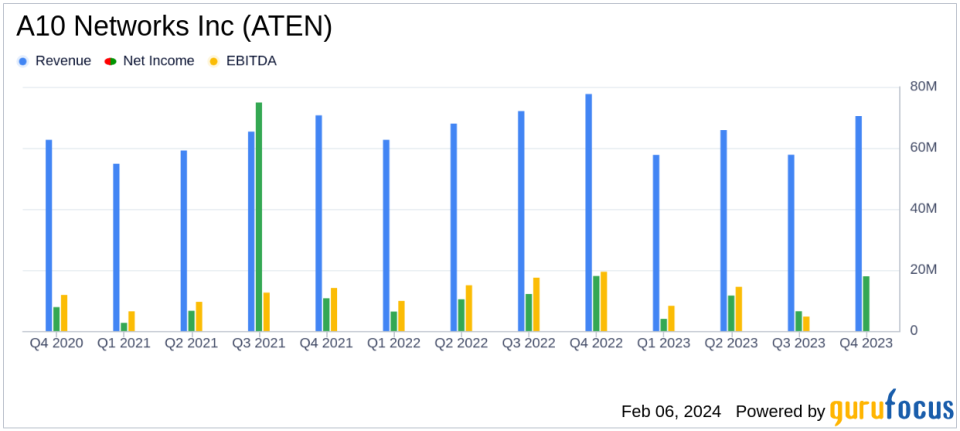

Revenue: Q4 revenue of $70.4 million, meeting guidance but down 9.3% YoY; full-year revenue reached $251.7 million, a 10.2% decrease.

Net Income: GAAP net income for Q4 stood at $17.9 million; non-GAAP net income was $18.5 million, slightly up from $18.4 million YoY.

Gross Margin: GAAP and non-GAAP gross margins remained strong at 81.1% and 81.8% for Q4, respectively.

Earnings Per Share (EPS): Q4 GAAP EPS at $0.24, consistent with the prior year; non-GAAP EPS rose to $0.25.

Share Buyback and Dividends: Repurchased 656,000 shares for $7.3 million; $49.7 million remains for buybacks, and a $0.06 per share dividend was declared.

Adjusted EBITDA Margin: Full-year Adjusted EBITDA margin improved to 28.3% from 26.8% in 2022.

A10 Networks Inc (NYSE:ATEN), a leading provider of cybersecurity and infrastructure solutions, released its 8-K filing on February 6, 2024, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. Despite a challenging market environment, particularly with North American service provider customers, ATEN achieved its revenue guidance and maintained strong profitability.

Company Overview

A10 Networks Inc is a provider of secure application solutions and services, enhancing cyber protection and digital responsiveness across dynamic IT and network infrastructures. With a portfolio that includes application delivery controllers, threat protection systems, and management and automation tools, ATEN primarily generates revenue from the Americas, complemented by Europe, the Middle East, Africa, and the Asia Pacific regions.

Financial Performance and Challenges

ATEN's Q4 revenue of $70.4 million was in line with guidance but represented a 9.3% decrease year-over-year (YoY), attributed to reduced capital expenditures from North American service provider customers. However, enterprise revenue saw a significant increase of 22.6% YoY, indicating a strategic shift towards enterprise customers. The company's full-year revenue was $251.7 million, down 10.2% YoY, with enterprise revenue growing by 8.6%.

The company's gross margin remained robust, with GAAP and non-GAAP gross margins for Q4 at 81.1% and 81.8%, respectively. This performance underscores ATEN's operational execution and ability to maintain target margins despite market volatility. GAAP net income for Q4 was $17.9 million, or $0.24 per diluted share, consistent with the previous year's performance. Non-GAAP net income slightly increased to $18.5 million, or $0.25 per diluted share, compared to $18.4 million, or $0.24 per diluted share, in Q4 of 2022.

Financial Achievements and Importance

ATEN's financial achievements in the face of market challenges highlight the company's resilience and effective business model. The maintenance of high gross margins and a strong Adjusted EBITDA margin of 28.3% for the full year, up from 26.8% in 2022, demonstrates the company's ability to manage costs and optimize operations. These margins are particularly important in the software industry, where they can reflect the scalability and efficiency of a company's business model.

In addition to its operational performance, ATEN continued its shareholder return program, repurchasing 656,000 shares and declaring a quarterly cash dividend of $0.06 per share. These actions signal confidence in the company's financial stability and commitment to delivering shareholder value.

Management Commentary

"Continued strong demand for our solutions and shift to focus on Enterprise customers partially mitigated broadly reported headwinds with Service Provider customers related to depressed capital expenditures and longer sales cycles," said Dhrupad Trivedi, President and CEO of A10 Networks. "We maintained our target gross margin level of 80 82% and EBITDA margin of 26 28% despite the revenue challenges, demonstrating our proven ability to allocate resources to the best strategic opportunities for future growth while driving operating efficiencies. We were able to deliver flat full year EPS on a constant-currency basis in spite of a challenging macro environment. Over the last three years, we have delivered Adjusted EBITDA growth of 14%. We expect to grow our non-GAAP EPS in 2024 compared to 2023, enabling us to continue investing in future innovative solutions and returning capital to shareholders."

Conclusion

ATEN's financial results for Q4 and the full year of 2023 reflect a company that is adept at navigating market headwinds while maintaining a strong profitability profile. The company's strategic focus on enterprise customers and operational efficiencies has allowed it to sustain high gross margins and a solid Adjusted EBITDA margin. As ATEN continues to execute on its business model and invest in innovation, it remains well-positioned for future growth and shareholder returns.

For a detailed understanding of A10 Networks Inc's financials, including the complete income statement, balance sheet, and cash flow statement, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from A10 Networks Inc for further details.

This article first appeared on GuruFocus.