AAON Inc (AAON) Reports Record Sales and Earnings for Q4 2023

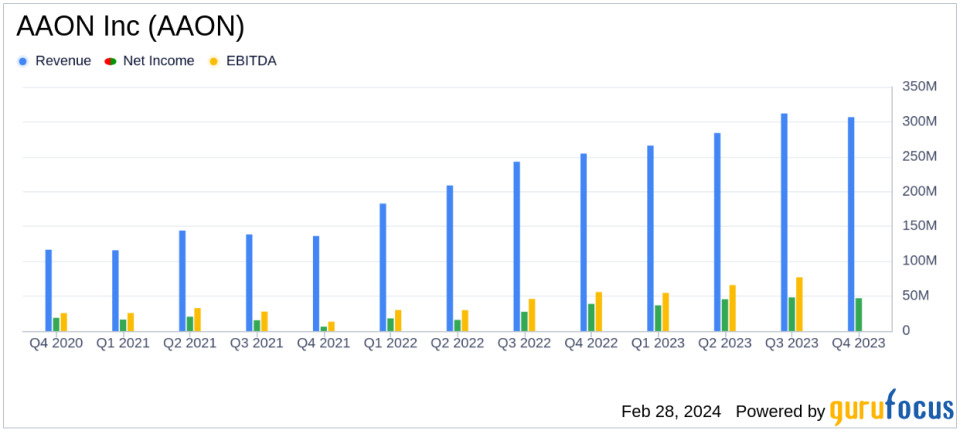

Net Sales: Increased 20.4% to $306.6 million in Q4 2023 compared to Q4 2022.

Gross Profit: Rose 42.3% to $111.7 million, with gross margin improving to 36.4%.

Operating Income: Grew 37.1% to $63.9 million, reflecting a higher operating margin of 20.8%.

Net Income: Increased 21.0% to $47.0 million, with earnings per diluted share up 19.1% to $0.56.

EBITDA: Improved by 37.1% to $77.0 million, with an EBITDA margin of 25.1%.

Backlog: Ended the quarter at $510.0 million, up 4.0% from the previous quarter but down 6.9% year-over-year.

Balance Sheet: Remains strong with a current ratio of 3.2 and a leverage ratio of 0.15.

On February 28, 2024, AAON Inc (NASDAQ:AAON), a leading manufacturer of air-conditioning and heating equipment, announced its financial results for the fourth quarter of 2023 through its 8-K filing. The company, known for its premium HVAC solutions, reported a year of record sales, EBITDA, and earnings, according to CEO Gary Fields. Despite what is typically a softer period for the company, AAON achieved comparable sales and earnings to the third quarter, which was a record quarter in itself.

AAON's products, which cater to the commercial and industrial new construction and replacement markets in North America, saw a significant increase in sales in the fourth quarter of 2023. The company's net sales rose by 20.4% to a record $306.6 million from $254.6 million in the fourth quarter of 2022. This growth was attributed to a healthy backlog entering the quarter and improved operational efficiencies, leading to an organic volume growth of approximately 9.3%.

The company's gross profit for the quarter increased by 42.3% to $111.7 million, or 36.4% of sales, compared to the same period a year ago. The increase in gross profit margin from 30.8% in the previous year's quarter to 36.4% reflects productivity gains and incremental pricing. Earnings per diluted share in the fourth quarter of 2023 increased by 19.1% to $0.56 from $0.47 in the fourth quarter of 2022.

AAON's financial achievements are particularly important in the construction industry, where margins can be tight and efficiency gains are crucial for profitability. The company's ability to improve its gross profit margin significantly over the year demonstrates its competitive edge and operational excellence.

Key financial metrics from the income statement, balance sheet, and cash flow statement highlight the company's robust financial position. The balance sheet remains strong with a current ratio of 3.2 and a leverage ratio of 0.15, indicating AAON's solid liquidity and low debt levels. The company's backlog, although slightly down year-over-year, showed a sequential increase, suggesting a healthy demand for AAON's products.

CEO Gary Fields commented on the outlook for 2024, expressing cautious optimism despite signs of slowing in the nonresidential construction sector and uncertainties surrounding the new refrigerant transition. He emphasized AAON's advanced position in new refrigerant equipment and cold climate air-source heat pumps, which are expected to help the company continue taking market share.

"As we progress through the early months of 2024, we are cautiously optimistic with the outlook for the current year. While increasingly there are signs of slowing in the nonresidential construction sector, along with uncertainties surrounding the new refrigerant transition, we continue to anticipate sales and earnings growth for the year, albeit at slower growth rates than recent years," said Fields.

CFO Rebecca Thompson highlighted the company's strong cash flows from operating activities, which grew year-over-year by 189.0% in the fourth quarter and 159.1% for the full year of 2023, outpacing earnings growth. She also noted the opportunities to enhance earnings to cash flow conversion rates in 2024.

AAON's performance in the fourth quarter of 2023 underscores its resilience and adaptability in a challenging market. The company's focus on operational efficiency and product innovation positions it well for continued success in the coming year.

For more detailed information and analysis on AAON Inc (NASDAQ:AAON)'s financial results, investors and interested parties are encouraged to visit the company's website and attend the conference call and webcast scheduled for February 28, 2024, at 5:15 P.M. ET.

Explore the complete 8-K earnings release (here) from AAON Inc for further details.

This article first appeared on GuruFocus.