AAR (AIR) Q3 Earnings Surpass Estimates, Sales Rise Y/Y

AAR Corp. AIR reported third-quarter fiscal 2024 adjusted earnings of 85 cents per share, which surpassed the Zacks Consensus Estimate of 84 cents by 1.2%. The bottom line improved 13.3% from the year-ago quarter’s level.

The company reported GAAP earnings per share (EPS) of 39 cents compared with 62 cents in the prior-year quarter.

Total Sales

In the quarter under review, AAR generated net sales of $567.3 million. The reported figure missed the Zacks Consensus Estimate of $568 million by 0.1% but increased 8.9% from $521.1 million recorded in the year-ago quarter.

The year-over-year improvement can be attributed to strong demand for AAR’s parts supply offerings, MRO services, and increased volumes in the company’s commercial programs activities.

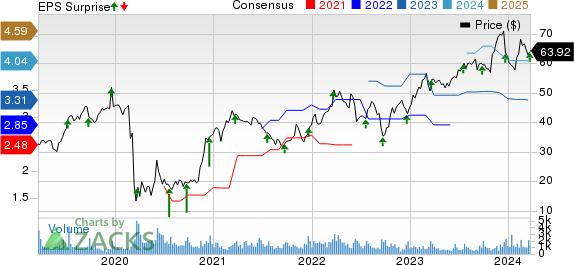

AAR Corp. Price, Consensus and EPS Surprise

AAR Corp. price-consensus-eps-surprise-chart | AAR Corp. Quote

Segment Details

In the fiscal third quarter, sales in the Parts Supply segment totaled $242.3 million, up 6.5% year over year.

Repair & engineering reported sales of $140.8 million, up 10% from the prior-year period’s level.

Integrated solutions sales came in at $165.5 million, up 15.3% from the year-ago period.

Expeditionary Services recorded sales of $18.7 million, down 15% from the year-ago quarter’s tally.

Operational Update

The company’s gross profit margin in the reported quarter increased 130 basis points to 19.4% from 18.1% in the prior-year quarter. The improvement was driven by the favorable impact of the company’s operating efficiency on increased sales volumes.

AIR’s adjusted operating margin increased from 7.6% to 8.3% in the fiscal third quarter, driven by commercial sales growth.

Selling, general and administrative expenses amounted to $77 million in the current quarter.

Net interest expense for the quarter totaled $11.3 million compared with $3.5 million in the year-ago period.

Financial Details

As of Feb 29, 2024, AAR’s cash and cash equivalents amounted to $69.2 million compared with $68.4 million as of May 31, 2023.

The company’s long-term debt was $274.7 million as of Feb 29, 2024, up from $269.7 million as of May 31, 2023.

Zacks Rank

AAR currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Defense Releases

Curtiss-Wright Corporation CW reported fourth-quarter adjusted earnings per share (EPS) of $3.16, which surpassed the Zacks Consensus Estimate of $2.92 by 8.2%. The bottom line improved 8.2% from the year-ago quarter’s level of $2.92.

In the quarter under review, the company’s net sales of $785.8 million went up 3.7% year over year. Also, the top line surpassed the Zacks Consensus Estimate of $737 million by 6.6%.

Kratos Defense & Security Solutions, Inc. KTOS reported fourth-quarter 2023 adjusted earnings of 12 cents per share, up 50% from 8 cents reported in the prior-year quarter. The bottom line also surpassed the Zacks Consensus Estimate by 50%.

Total revenues were $273.8 million, which surpassed the Zacks Consensus Estimate of $252 million by 8.6%. The figure also increased 9.8% from $249.3 million recorded in the year-ago quarter.

Teledyne Technologies Inc. TDY reported fourth-quarter 2023 adjusted earnings of $5.44 per share, which beat the Zacks Consensus Estimate of $5.06 by 7.5%. The bottom line also improved 10.1% from $4.94 recorded in the year-ago quarter.

Total sales were $1,425 million, which missed the Zacks Consensus Estimate of $1,445.6 million by 1.4%. The top line, however, grew 0.5% from $1,418.2 million reported in the year-ago quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AAR Corp. (AIR) : Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

Curtiss-Wright Corporation (CW) : Free Stock Analysis Report

Kratos Defense & Security Solutions, Inc. (KTOS) : Free Stock Analysis Report