AAR Corp. (AIR) Q4 Earnings Beat Estimates, Sales Rise Y/Y

AAR Corp. AIR reported fourth-quarter fiscal 2023 adjusted earnings of 83 cents per share, which surpassed the Zacks Consensus Estimate of 77 cents by 7.8%. Earnings surged 15% from the year-ago quarter.

The company reported GAAP earnings per share (EPS) of 66 cents, flat with the prior-year quarter.

For the full-year fiscal 2023, AAR reported adjusted earnings of $2.86 per share, up 20% from $2.38 in fiscal 2022. The reported figure beat the Zacks Consensus Estimate of $2.85 per share by 0.4%.

Total Sales

In the quarter under review, AAR generated net sales worth $553.3 million. The reported figure surpassed the Zacks Consensus Estimate by 4.5% and increased 16.5% from the $474.9 million recorded in the year-ago quarter.

For fiscal 2023, AAR reported net sales of $1.99 billion, which beat the Zacks Consensus Estimate by 1%. The reported figure also increased 9.3% from the $1.82 billion recorded in fiscal 2022.

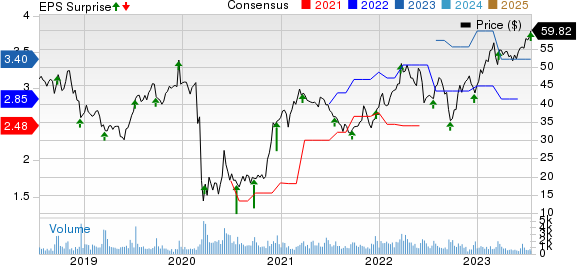

AAR Corp. Price, Consensus and EPS Surprise

AAR Corp. price-consensus-eps-surprise-chart | AAR Corp. Quote

Segment Details

In the fiscal fourth quarter, sales in the Aviation Services segment totaled $529.9 million, up 17% year over year.

Expeditionary Services recorded sales of $23.4 million, up 0.9% from $23.2 million in the year-ago quarter.

Operational Update

The adjusted gross profit margin in the reported quarter improved to 19.5% from 18.6% in the prior-year quarter. The margin expansion was a result of the favorable impacts of the company’s efforts to reduce costs and increase operational efficiency.

SG&A expenses rose 24.4% to $70.8 million in the fiscal fourth quarter. The adjusted operating margin expanded to 7.8% from 7% in the prior-year quarter, driven by growth in commercial sales. AIR incurred net interest expenses of $4.7 million in the fiscal fourth quarter compared with $0.6 million in the year-ago quarter.

Financial Details

As of May 31, 2023, AAR’s cash and cash equivalents amounted to $68.4 million compared with $53.5 million as of May 31, 2022.

The company reported long-term debt of $269.7 million as of May 31, 2023, up from $98.9 million as of May 31, 2022.

Zacks Rank

AAR currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A Recent Defense Release

Lockheed Martin LMT: It reported second-quarter 2023 adjusted earnings of $6.73 per share, which surpassed the Zacks Consensus Estimate of $6.43 by 4.7%. The bottom line also improved 6.5% from the year-ago quarter's figure.

Net sales amounted to $16.69 billion in the reported quarter, which surpassed the Zacks Consensus Estimate of $15.86 billion by 5.3%. The top line rose 8.1% from $15.45 billion in the year-ago quarter.

Upcoming Defense Releases

Curtiss-Wright Corporation CW: The company is scheduled to report its second-quarter earnings on Aug 2, 2023. The Zacks Consensus Estimate for CW’s 2023 earnings calls for a growth rate of 8.5% from the prior-year reported figure.

The Zacks Consensus Estimate for Curtiss-Wright’s 2023 sales implies a growth rate of 5.5% from the prior-year reported figure. CW delivered an earnings surprise of 8.51% in the last reported quarter.

Hexcel Corporation HXL: It is slated to report its second-quarter earnings on Jul 24, 2023. The Zacks Consensus Estimate for HXL’s 2023 earnings suggests a growth rate of 46.9% from the prior-year reported figure.

The Zacks Consensus Estimate for Hexcel’s 2023 sales implies a growth rate of 13.9% from the prior-year reported figure. HXL delivered an earnings surprise of 28.21% in the last reported quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

AAR Corp. (AIR) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Curtiss-Wright Corporation (CW) : Free Stock Analysis Report