AAR Corp (AIR) Reports Solid Revenue Growth Amidst Acquisition and Market Challenges

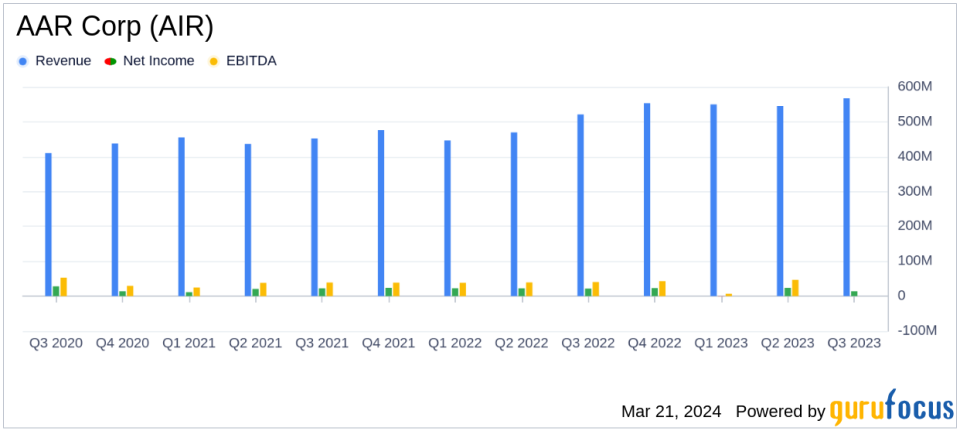

Revenue: Increased to $567.3 million, up 9% from the previous year.

Net Income: Reported at $14.0 million, or $0.39 per diluted share.

Adjusted Diluted EPS: Rose to $0.85 from $0.75 year-over-year.

Gross Profit Margin: Improved to 19.4% from 18.1% in the prior year quarter.

Commercial Sales: Grew by 18%, driven by Parts Supply and MRO services.

Acquisition: Completed the acquisition of Triumph Groups Product Support business for $725 million.

Net Debt: Stood at $207.8 million with a net leverage of 0.95x.

On March 21, 2024, AAR Corp (NYSE:AIR) released its 8-K filing, detailing the financial results for the third quarter of fiscal year 2024. The company, a leading provider of aviation services to commercial and government operators, MROs, and OEMs, reported a significant increase in revenue, gross profit margin, and adjusted diluted earnings per share (EPS) compared to the same quarter of the previous year.

AAR Corp (NYSE:AIR) operates in two segments: Aviation Services and Expeditionary Services. The Aviation Services segment, which generates the majority of revenue, saw a substantial 18% increase in sales to commercial customers, primarily driven by robust demand for Parts Supply offerings and MRO services. However, sales to government customers decreased by 7%. The company's strategic acquisition of Triumph Groups Product Support business is expected to scale repair capabilities and expand its footprint in the Asia-Pacific region.

Financial Performance and Challenges

The company's gross profit margin increased to 19.4%, reflecting the positive impact of operating efficiency on increased sales volumes. Selling, general, and administrative expenses were reported at $77.0 million, which included costs related to acquisition and amortization expenses, as well as investigation costs. Operating margins slightly decreased to 5.8% from 6.5% in the prior year quarter, while adjusted operating margin improved from 7.6% to 8.3%, indicating growth in commercial sales and improved profitability in Parts Supply and Repair & Engineering segments.

Net interest expense for the quarter was $11.3 million, compared to $3.5 million last year, including costs related to bridge financing for the acquisition. The average diluted share count increased, and the company repurchased 0.1 million shares for $5.1 million during the quarter, with $52.5 million remaining on its share repurchase program.

Cash flow provided by operating activities from continuing operations was $20.4 million, and as of February 29, 2024, the net debt was $207.8 million with a net leverage of 0.95x. AAR Corp (NYSE:AIR) is prioritizing debt repayment but remains open to evaluating share repurchases and other investment opportunities.

Outlook and Management Commentary

John M. Holmes, Chairman, President, and CEO of AAR Corp (NYSE:AIR), expressed pride in the company's ability to expand operating margins consistently over the last three years, despite an inflationary environment with rising labor costs. Holmes anticipates that the integration of the Product Support acquisition will further expand margins and accelerate growth.

We have expanded our operating margins every quarter for the last three years and our adjusted operating margins are now 50% higher than they were before COVID. We are especially proud to have made this progress in an inflationary environment where labor costs, in particular, have been rising. We believe as we grow our business and integrate the Product Support acquisition, our margins will continue to expand."

The company expects the acquisition to enhance its leadership positions in used serviceable material (USM), new parts distribution, airframe MRO, and component repair services, driving greater value for customers and shareholders. AAR Corp (NYSE:AIR) also plans to maintain a focus on cash generation and portfolio optimization to ensure a strong balance sheet for future investments.

For more detailed financial information and to listen to the conference call discussing these results, investors and analysts can access the call by registering at the provided link.

AAR Corp (NYSE:AIR) remains committed to delivering value through strategic growth, operational efficiency, and financial discipline, positioning itself to capitalize on the evolving demands of the aerospace and defense aftermarket industry.

Explore the complete 8-K earnings release (here) from AAR Corp for further details.

This article first appeared on GuruFocus.