Will Aaron's (AAN) Gain From GenNext Stores, Digital Presence?

The Aaron’s Company, Inc. AAN has been focused on strengthening its digital presence and is on track with the GenNext strategy to bolster its performance. Acquisitions played important roles in aiding its growth. Moreover, the company maintained its commitment to strategic expansion and cost-efficiency efforts, mainly complemented by the generation of substantial free cash flow.

However, Aaron’s has been witnessing high inflation and other challenging economic conditions, which continue to impact its customers. Management expects to continue being affected by high inflation and other macroeconomic factors throughout 2023.

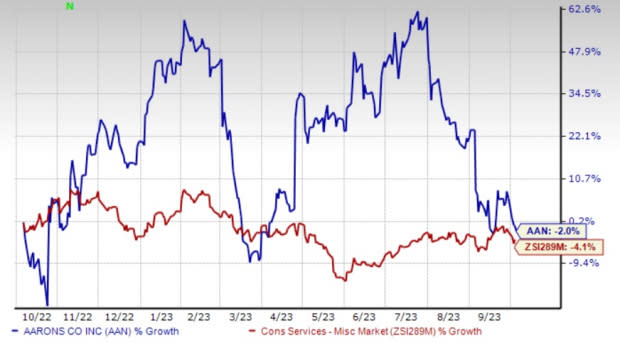

Given the mixed sentiments, shares of this Zacks Rank #3 (Hold) company have lost 2% in the past year compared with the industry’s decline of 4.1%.

Image Source: Zacks Investment Research

The GenNext Initiative

Aaron’s remains on track with its GenNext strategy, which focuses on a comprehensive overhaul of the traditional in-store experience. The GenNext program is multi-layered, involving the revitalization of existing stores and the strategic establishment of new retail havens.

The reimagined GenNext retail stores feature augmented showrooms and ingeniously re-engineered layouts, complemented by refreshed and vibrant signage. This transformative journey is further complemented by seamless technology-enabled shopping and checkout processes, designed to facilitate a shift in the shopping experience.

The GenNext initiative, which was originally launched in 2018, has received positive customer feedback since then. The initiative includes new and remodeled stores. To date, Aaron's has converted or opened 32 GenNext stores, bringing the total to 243 company-operated GenNext stores.

At the end of the second quarter, these stores accounted for approximately 29% of lease revenues in retail sales. That compares to just more than 17% in the prior-year quarter.

Notably, Aaron's has set a goal of reaching 50 GenNext stores by the end of the year, and it is currently making strides to stay on course to achieve this objective.

Digital Momentum

Aaron’s has been witnessing strength in its e-commerce platform, driven by increased website traffic and a higher conversion rate. Some notable efforts undertaken by the company to bolster digital performance are increased investments in digital marketing, improved shopping experience, same-day and next-day delivery facilities, personalization of products, and a broader assortment, including the latest product categories.

Moreover, the company’s express delivery program has contributed substantially to improving online performance. Driven by these actions, e-commerce lease revenues were up 5.5%, accounting for 17.9% of the total lease revenues, in second-quarter 2023.

BrandsMart Buyout

Aaron’s latest acquisition of the appliance and electronics retailer, BrandsMart, has enabled it to offer high-quality furniture, appliances, electronics, and other home goods on affordable lease and retail purchase options to its customers. In second-quarter 2022, Aaron’s included BrandsMart revenues for the first time since its buyout.

For the BrandsMart segment, revenues were $143.8 million in the second quarter of 2023, driven by strength in small appliances and housewares, and e-commerce. The company is optimistic about the segment’s performance in the near term. The buyout is likely to strengthen Aaron’s market position and help expand the customer base.

Hurdles on the Way

Weak lease revenues and fees, and drab retail sales have been hurting the company’s quarterly performance. This led to a consolidated revenue decline of 13.1% in the second quarter.

Also, continued inflationary and other economic pressures affecting customers' income have been deterrents. Both segments are expected to continue experiencing softness in customer demand in its core product categories, including appliances, furniture and electronics, in the second half of the year.

Consequently, management anticipates 2023 revenues to be $2.12-$2.22 billion compared with the earlier stated $2.15-$2.25 billion. The lowered revenue outlook is mainly due to a decrease in early purchased options and drab retail sales at the Aaron's business in the second quarter, which is likely to continue throughout the year.

Key Picks

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely GIII Apparel Group GIII, Guess GES and SP Plus SP.

GIII Apparel currently sports a Zacks Rank #1 (Strong Buy). Shares of GIII have rallied 48.9% in the past year. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GIII Apparel’s current financial year’s sales and earnings per share suggests growth of 2.4% and 14.7%, respectively, from the year-ago period’s reported figures. GIII has a trailing four-quarter earnings surprise of 526.6%, on average.

Guess has a trailing four-quarter earnings surprise of 43.4%, on average. It sports a Zacks Rank of 1 at present. Shares of GES have risen 31.4% in the past year.

The Zacks Consensus Estimate for Guess’ current financial-year sales and earnings suggests growth of 3.4% and 9.9%, respectively, from the year-ago period's reported figures.

SP Plus has a trailing four-quarter earnings surprise of 2.82%, on average. It currently carries a Zacks Rank #2 (Buy). Shares of SP have rallied 55.2% in the past year.

The Zacks Consensus Estimate for SP’s current financial-year sales and earnings suggests growth of 12.3% and 6.5%, respectively, from the year-ago period's reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Aaron's Company, Inc. (AAN) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report

SP Plus Corporation (SP) : Free Stock Analysis Report