Aaron's (AAN) Thrives With Strategic Shifts Amid Challenges

The Aaron's Company, Inc. AAN maintained its commitment to strategic expansion and cost-efficiency efforts, mainly complemented by the generation of substantial free cash flow.

Notably, the company’s lease portfolio exceeded expectations, demonstrating resilience in second-quarter 2023. In the face of a persistently difficult demand landscape for high-value consumer durables, Aaron's adeptly navigated the market, showcasing the efficacy of its proactive approach and commitment to financial strength.

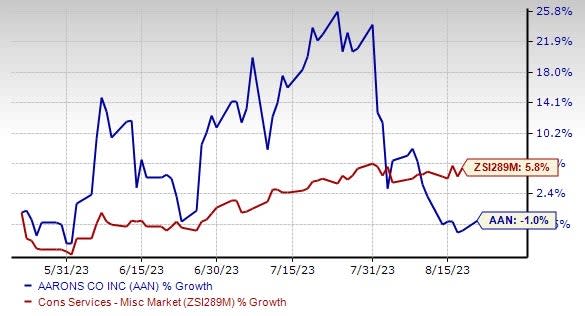

However, Aaron’s has been witnessing high inflation and other challenging economic conditions that continue to impact its customers. Shares of this Zacks Rank #3 (Hold) company have declined 1% in the past three months against the industry’s growth of 5.8%.

Image Source: Zacks Investment Research

Let’s Introspect

Amid the challenging economic landscape, Aaron's has achieved promising outcomes by observing changes in customer behavior and implementing strategic measures to cut costs. One of the key contributors to Aaron's success has been its impressive performance in the e-commerce channel.

Aaron's has made significant efforts in the e-commerce domain by investing more in digital marketing, enhancing the online shopping experience, offering expedited delivery options, personalizing product offerings and expanding the range of products available on its platform. The express delivery program has also contributed to this growth.

Another development for Aaron's is the acquisition of BrandsMart, a retailer specializing in appliances and electronics. This acquisition enabled Aaron's to provide its customers with access to high-quality furniture, electronics, home appliances, and other goods through both lease and retail purchase options.

The strategic move has not only strengthened Aaron's position in the market but has also contributed to an expansion of its customer base. The company's optimism about the performance of this segment is evident from its plans to open a BrandsMart store by the fourth quarter of 2023.

Aaron's has also been effectively executing its GenNext strategy, which focuses on next-generation store formats. The GenNext store strategy serves as a prominent illustration, consistently generating substantial financial benefits through the transformation of the customer experience within the physical stores and the redefinition of the operational model.

By the end of the second quarter of 2023, Aaron's established 230 GenNext locations. This strategy has proven successful in attracting a younger audience and expanding the company's overall reach.

Wrapping Up

The company cut its revenue outlook due to lower early purchased options and drab retail sales at the Aaron's business in second-quarter 2023, which is likely to continue throughout the year.

For 2023, the company anticipates revenues of $2.12-$2.22 billion versus $2.15-$2.25 billion predicted earlier. Adjusted EBITDA (excluding stock-based compensation) is projected to be $140-$160 million.

AAN envisions adjusted earnings per share (EPS) of $1.00-$1.40 for the year. Earnings per share are expected to be 55-80 cents compared with the earlier stated 70-95 cents.

Red-Hot Stocks to Consider

Here we have highlighted three better-ranked stocks, namely Skechers U.S.A., Inc. SKX, American Eagle Outfitters Inc. AEO and Crocs, Inc. CROX.

Skechers designs, develops, markets and distributes footwear. It currently sports a Zacks Rank #1 (Strong Buy). The expected EPS growth rate for three to five years is 28.3%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Skechers’ current financial-year sales and earnings suggests growth of 8.5% and 41.2%, respectively, from the year-ago reported figures. SKX has a trailing four-quarter earnings surprise of 39.1%, on average.

American Eagle is a specialty retailer of casual apparel, accessories and footwear. The company currently has a Zacks Rank #2 (Buy). The expected EPS growth rate for three to five years is 9.6%.

The Zacks Consensus Estimate for American Eagle’s current fiscal-year earnings suggests growth of 8.3% from the year-ago reported number. AEO has a trailing four-quarter earnings surprise of 9.2%, on average.

Crocs is one of the leading footwear brands with a focus on comfort and style. It currently has a Zacks Rank #2. CROX delivered an earnings surprise of 20.5% in the last reported quarter.

The Zacks Consensus Estimate for Crocs’ current financial-year sales and earnings suggests growth of 12.9% and 11.2%, respectively, from the year-ago reported numbers. CROX has a trailing four-quarter earnings surprise of 19.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

The Aaron's Company, Inc. (AAN) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report